The coronavirus is causing panic in global financial markets. But should it be a worry for your financial future? Keeping calm at times like these can pay big dividends in the future.

Yes it’s true: the coronavirus is impacting almost every aspect of our lives. Financial markets are slumping as the virus spreads.

But how worried should investors be? And what can they do to make sure that their portfolios avoid the worst of the virus’ fallout?

Coronavirus hits markets hard

Coronavirus has dominated headlines in recent weeks as it has spread to every continent on earth (bar Antarctica). The health of everyone around the world is of most concern, but it’s also troubling for global financial markets. News this week that the virus had gained a foothold in America, home to the world’s largest economy, has spooked some investors.

All of the world’s major stock markets have fallen on fears that the virus will halt supply chains and bring the global economy to a slow down. The stock price of a wide range of companies – from airlines to travel operators, technology companies to high street retailers – have dropped.

To panic or not to panic

But is panic necessary? Should you be worried about your investments?

In truth, times like these are unsettling but it’s hard to know right now what the future holds as the full severity of the virus isn’t yet known. But investors hate uncertainty, hence, they are well within their rights to be worried about what the virus could do to financial markets.

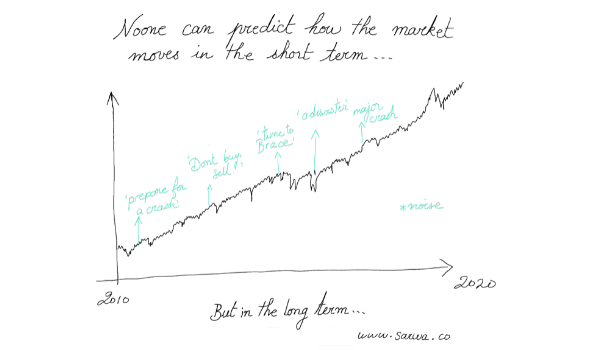

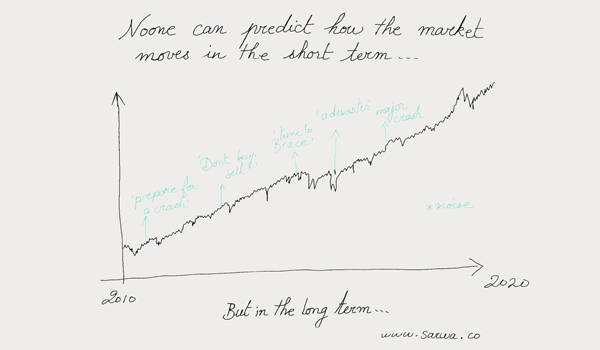

However, as history has proven, there is no need to panic. Sure, markets are volatile, but that doesn’t mean we’re set for a crisis. Markets can swing down when events like these strike but they tend to recover. For example, during the Sars outbreak the MSCI China index fell by nearly 9% before bouncing by more than 30%. It’s likely we’ll see the same volatile swings now.

Reasons to be reassured

We know it’s hard not to panic. We’re human after all and emotion usually plays a part in everything we do, even investing. But here are 3 reasons not to change your strategy and stick to your plan:

- Markets have fallen from a very high point

Sure, we don’t yet know how far markets will fall, but we do know that only a matter of months ago, the world’s stock markets were at record highs. Hence, if you’ve been invested over a long period, this pullback will only erode short term gains. Most of the gains you made over the long term remain intact. Considering how stocks began 2020 at record highs, the recent moves may have been welcomed by some investors. There’s no denying that we’re currently in the longest bull-run for stocks in modern history, so some investors would have been expecting a significant correction like this at some point.

- History shows that the panic is worse than the fall

Investors are looking to history to find what effect previous global medical emergencies had on markets. The good news is, it doesn’t look too bad. JPMorgan carried out a study that assessed the impact of past outbreaks, such as Sars, swine flu, Ebola and Zika. In each of those cases, they found an initial sharp decline quickly gave way to a recovery. So it’s not necessarily true that this initial drop in prices will be with us for the long haul.

- If you’re diversified, you have little to worry about

It’s natural to feel panic at times like these, even if you’ve already made some profit and read a little economic history. But your best defence in times like these is basic portfolio theory. It’s called diversification. Making sure that your portfolio is diversified across asset classes and geographies is the best defence for anyone worried about market volatility. That approach would hold you in good stead going forward, robustly defending your investments. We believe wholeheartedly in diversification at Sarwa. Here’s why.

Keep calm and invest on

Above all, we are wishing our friends and partners throughout the globe good health in the weeks ahead. We wish everyone well as the epidemic continues to progress, and we hope the virus’ peak is reached sooner rather than later.

Hopefully, this article has put your mind a little more at ease. As you know, smart investing is a long term occupation that requires patience and control over your emotions. We know it’s hard in volatile times like these when markets wildly fluctuate, but smart investors know they have to stick to a plan.

It’s also worth remembering that when the market falls, there is a chance to buy high quality investments, such as blue chip stocks, cheap. Therefore, downturns like these can be looked upon as an opportunity rather than a threat.

If you’d like to discuss your investments or any element of the coronavirus, get in touch with us. We’d be delighted to chat.

Ready to invest in your future?