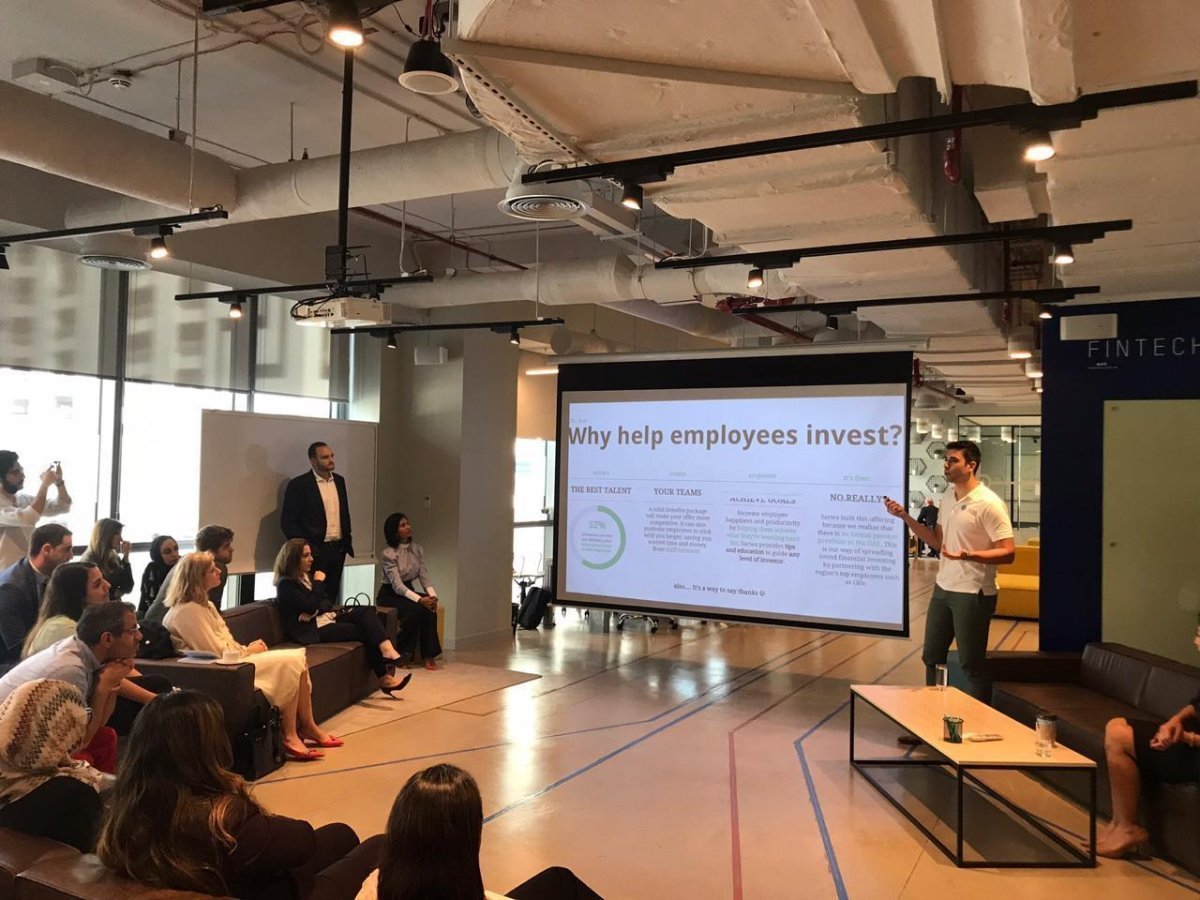

Team Sarwa welcomed a full house of Human Resources and Talent Acquisition professionals at the DIFC Fintech Hive for the launch of Sarwa for Work, Sarwa’s dedicated program to promote employee financial health at the workplace.

We had a diverse crowd, drawing from HR/Talent leads across some of the world’s largest multinationals, banks and regional conglomerates including SAP, RAKBank and Majid Al Futtaim.

Our Sarwa Correspondent, Natasha D’Souza welcomed the audience and gave a quick lay of the land in terms of why financial fitness matters to Sarwa but why it matters to businesses across the board. “Sarwa believes financial intelligence is critical to an individual’s overall success. As those of you leading and managing HR functions will know, the individual success of your people is important to you. Only when people are growing and thriving in their lives, can they bring themselves completely to their work,” shared Natasha

Natasha explained that the financial concerns of employees are playing a more prominent part in workplace stress and the problem isn’t set to go away in these economically turbulent times, with Forbes counting financial fitness as one of the top seven employee wellness opportunities in 2019.

Money is one of the foremost causes of employee stress, she explained and shared some telling numbers. In the UAE, a 2017 Global Benefits survey by Willis Towers Watson revealed that:

- Sixty-four percent of UAE employees consider money a major concern, moreso over the last two to three years

- Over one third of UAE employees have no savings

- 59% of UAE employees say they worry about their future financial status, compared with 52% and 45% of employees in developed and developing countries, respectively.

Tarek Sultani, Middle East Group Director and Studio Lead of Fjord took the audience through Fjord’s top business and tech trends for 2019. Fjord is a global design and innovation consultancy that believes in design for human impact. Tarek highlighted that the overarching theme for this year is “the search for value and relevance.” He explained : “People are instinctively seeking for silence amidst the digital noise. To engage with wary consumers, the onus is on brands and companies to be inclusive and authentic in their messaging and consistently share value.”

A short panel discussion followed, exploring the link between productivity and wellness, in particular employee financial health. Moderated by Sarwa CEO and Co-Founder Mark Chahwan, panelists included Maha Zaatari, Managing Director of Great Place to Work Middle East; Muhammad Chbib, serial entrepreneur and former CEO of tajawal; and Nelly Boustany, HR Director-MENA and Director of the Digital HR Experience-EMEA for SAP.

Here are some of the soundbytes that especially resonated with the audience:

“Be a human leader, not just a transactional one. When someone on your team has marital issues or is facing a financial hardship, guess what? It is affecting their performance and ultimately your business. Business is personal, so get personal.” ~Muhammad Chbib

“At SAP, we have increasingly begun focussing on the importance of mindfulness as it’s a bridge between well-being and productivity. We periodically conduct “zen cafes” where employees can learn about and engage in mindfulness sessions and it has helped my region perform at a high level, bringing greater profitability and revenue growth.” ~Nelly Boustany

“Sarwa realises that not all employees are ready to invest. We are committed to making investing accessible and that means meeting people where they are and helping them acquire financial savvy. They may be held back by significant debt or a poor savings habit, which is why we tailor our employee engagement efforts, offering coaching where needed. Employees value this advice because it makes them feel that their company is investing in their long-term betterment, by making them more educated investors.” ~Mark Chahwan

The panelists unanimously agreed that when companies focus on employees’ health and financial well-being, it results in increased productivity, a competitive edge in the marketplace, and a better ability to attract and retain employees, especially in a transient and fragmented talent market like the UAE.

Danny Jabbour, Head of Wealth Advisory rounded out the morning with a brief overview of the Four Rules of Investing and shared some of the feedback the team had already received from hosting “Lunch and Learns” at Fetchr, Twitter and Facebook, among others.

We were excited to see so many of our guest freely mingling post–launch to continue the conversation, with many welcoming the opportunity for a focussed deep-dive on employee financial health.

Thank you to our speakers and panelists for their brilliant insights, our audience for their engagement and great questions and to Blast Catering for the healthy, sumptuous breakfast!

For more about Sarwa for Work and to book a Lunch and Learn at your office, please visit: https://www.sarwa.co/lunch

Ready to invest in your future?