When it comes to building wealth, real estate and stocks have been locked in an age-old battle.

Both investment options have successfully created fortunes for investors, though they offer different paths to wealth. Real estate soldiers can point to people like Donald Trump, Donald Bren, and Stephen Ross as examples of those who became billionaires through real estate. At the same time, the stock market warriors can tout names like Warren Buffett, Ray Dalio, and Peter Lynch.

This battle is especially relevant in a place like the UAE, home to one of the hottest real estate markets in the world – Dubai, with its tax advantages as one of its pull factors. Investors want to know if they should stick to the local property market or buy stocks on platforms like Sarwa.

Of course, many non-financial factors like the desire to invest in a real asset rather than a financial asset, the sense of personal fulfilment that comes from owning a property, and the joy of using one’s creativity to reshape a property go into this discussion, which makes it hard to reduce it to a battle about numbers.

However, for investors seeking to build wealth, the financial aspect cannot be ignored. For them, examining real estate vs. stocks historical returns is a very important factor that determines where they would invest.

In this article, we will evaluate real estate vs stock market returns over various time horizons, so you can better decide which side you’re on. We’ll cover:

- Real estate vs stocks historical returns

- Property vs shares: A brief overview of the pros and cons

- Real estate investment trusts: How to combine real estate and stock investing

Do you want to learn more about how to successfully invest in the stock market? Sign up for Sarwa’s Fully Invested newsletter for regular educational content that will make you a better investor.

1. Real estate vs stocks historical returns

Many studies have tried to compare the returns of real estate and stocks to determine which is the better investment.

(Disclaimer: Past performance is no guarantee of future gains.)

Real estate vs stocks historical returns over the past 97, 50, and 10 years

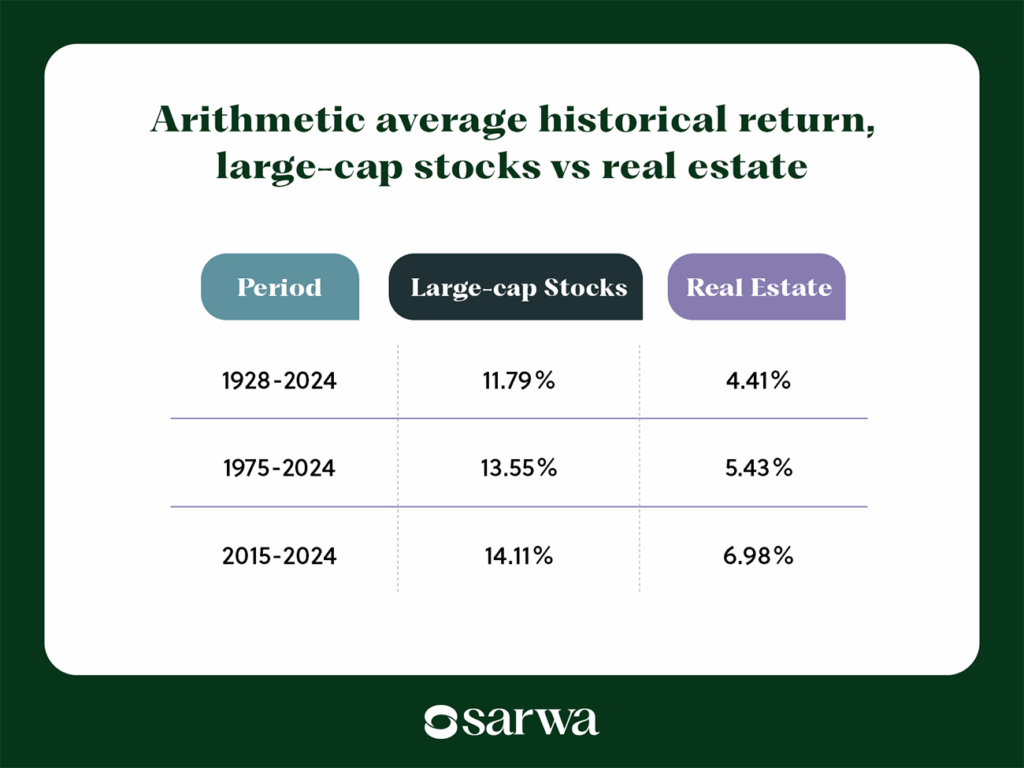

One of the most comprehensive studies was done by Aswath Damodaran, a professor of Finance at New York University. He compared the annual returns of large-cap US stocks, small-cap US stocks, short-term US Treasury bills, US Treasury bonds, US corporate bonds, real estate, and gold.

The annual return of large-cap stocks was calculated based on the S&P 500 Index while that of real estate was done based on the home price data provided by Robert Shiller (which has now morphed into the Case-Shiller index).

One important caveat before we examine the results is that while the return of the S&P 500 reported by Damodaran includes dividend payments, the data reported for real estate does not include cash flow from rental income (only price appreciation).

With that clarification out of the way, we can present the data below:

The arithmetic average historical return is the average annual return of the assets. It is the return per year added up and divided by the number of years. It is a quick snapshot of the average performance without taking the compounding effect into account.

As seen above, the S&P 500 outperformed US real estate over the past 97, 50, and 10 years.

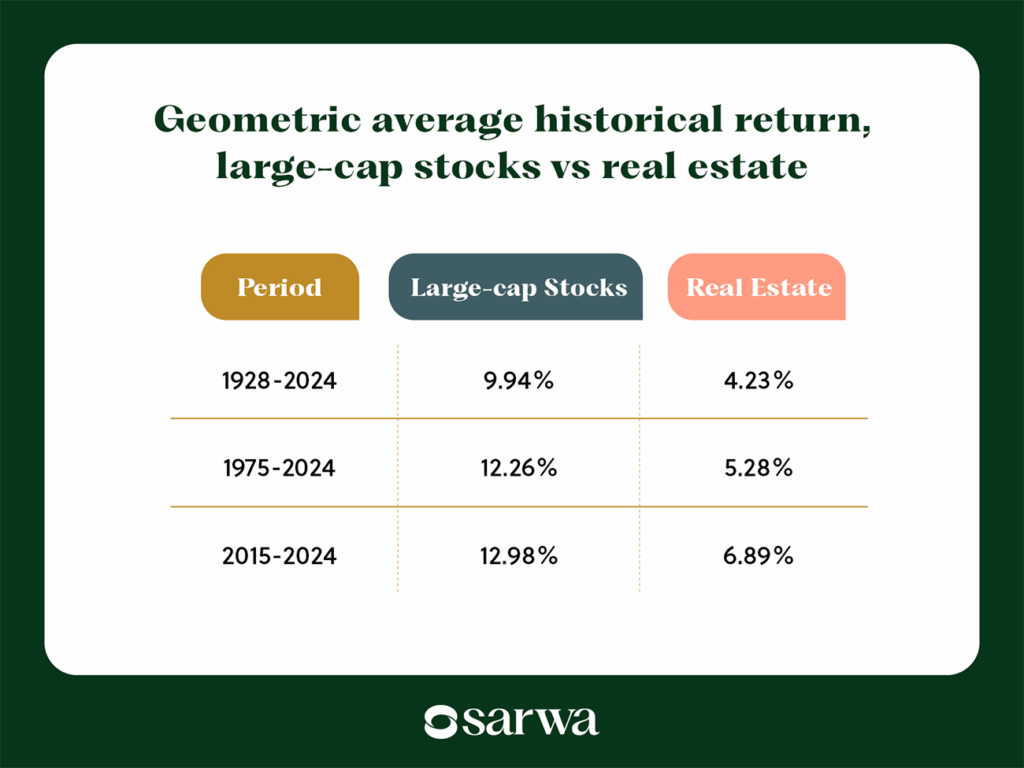

The geometric average historical return is the compounded annual return. Because it accounts for the effect of compounding, many consider it a more reliable measure of the performance of long-term investments.

Note that the S&P 500 also outperformed real estate over the past 97, 50, and 10 years.

Stocks vs US housing market over the past 32 years

The S&P 500 has delivered an average annual return of 10.39% (including dividends), or 7.99% when adjusted for inflation, between 1992 and 2024, according to Investopedia. Over the same period, the US housing market provided a 5.5% rate of return.

Stocks vs US housing market: Total returns

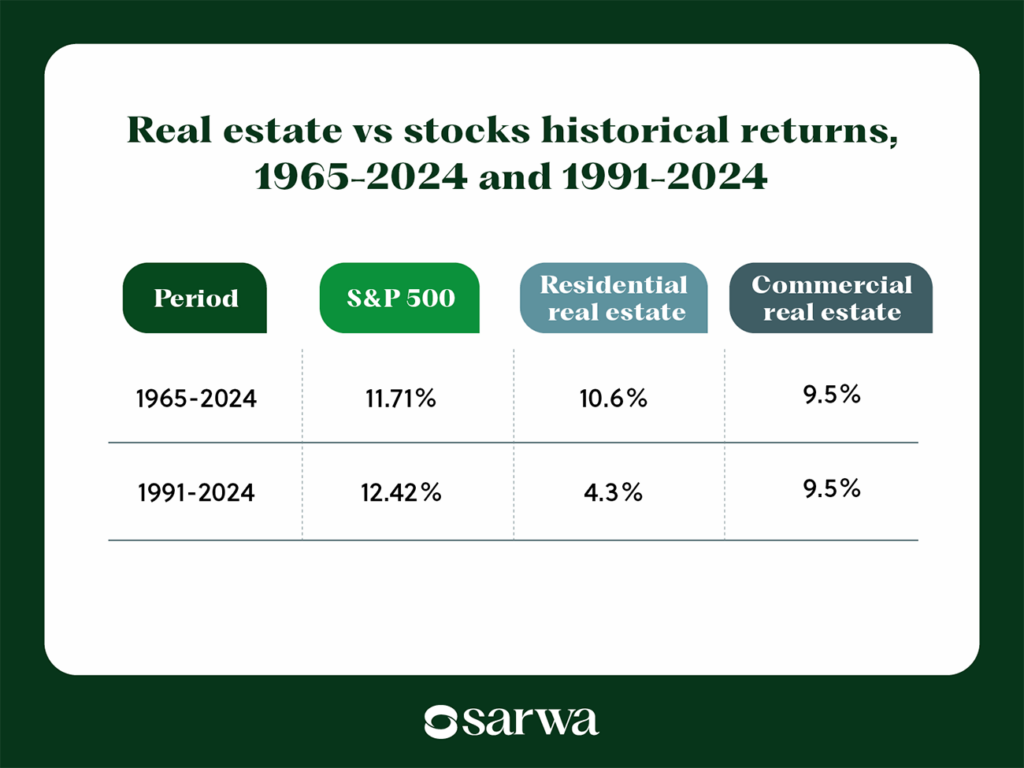

The two studies above have understated real estate returns by focusing only on price appreciation. A study by The Luxury Playbook, a Business and Economy magazine, has tried to remedy this.

Based on the data sources they explored, they estimated average annual returns as follows:

- S&P 500 (1978-2024): 12.25%

- S&P 500 (2012-2024): 14.66%

- Residential real estate (1965-2024): 10.6%

- Commercial real estate (1965-2024): 9.5%

- Residential real estate (1991-2024): 4.3%

- Commercial real estate (1991-2024): 9.5%

Since these figures are not directly comparable (different time periods), we calculated average annual returns (arithmetic) for stocks between 1965 and 2024 as well as 1991 and 2024 based on figures provided by Professor Damodaran. With that, we can now compare the total returns of stocks with those of real estate:

Again, the S&P 500 has outperformed both residential and commercial real estate over the past 60 and 24 years.

Real estate vs stock market returns: The UAE perspective

We don’t have extensive studies comparing real estate and stock market returns over multiple years in the UAE as we have seen in the US. What is more popular are studies focusing on just a single year.

Property prices in prime areas in Dubai grew by 14% in 2023, according to Ghada Benitez, a Certified International Property Specialist and Licensed Realtor. Also, she estimated that the rental yields in these areas were between 6-8%. This brings the total return to 20-22%.

However, data from Macro Trends and Slick Charts, two financial data websites, show that the S&P 500 delivered a price return (excluding dividend payment) of 24.23% and a total return (price return plus dividends) of 26.29% in 2023.

Thus, even if we stick with prime areas in Dubai (with total returns between 20% and 22%), the S&P 500 outperformed them in 2023.

However, not everyone will purchase properties in prime areas. Therefore, an estimate of returns that covers prime and non-prime markets is more useful.

A 2024 article comparing UAE and UK real estate markets published by Next Level Real Estate, a real estate company, provides relevant data in this case. They noted that the average annual price appreciation in Dubai and Abu Dhabi real estate markets is 3-4% while the average rental yields are 6-8% in Dubai and 5-7% in Abu Dhabi.

This will give us a total return between 8% and 12%, which is far lower than the 25.02% total return provided by the S&P 500 in 2024.

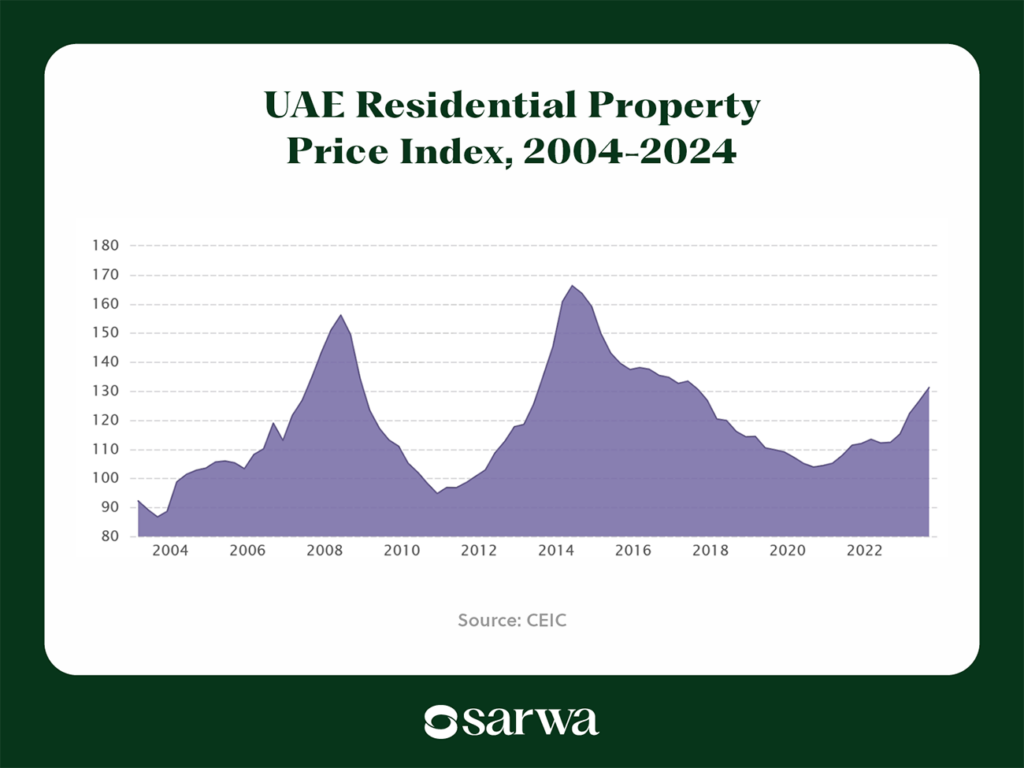

Furthermore, multi-year data provided by CEIC, a resource for global economic data, shows that the UAE residential property price index grew by a compounded annual growth rate (CAGR) of 1.82% between 2004 and 2024.

Source: CEIC

If we stick to a 6-8% rental yield, that brings us to an average total return of 7.82 – 9.82% for the UAE residential real estate market between 2004 and 2024. During this same period, the S&P 500 produced an average total return of 11.70%.

It seems then that what we noticed in the US also holds in the UAE: stocks seem to be a better investment than real estate.

2. Property vs shares: A brief overview of the pros and cons

However, while many investors will call the battle decided based on historical returns, some will want to consider other relevant factors (risk tolerance, time horizon, and financial goals, etc) before deciding on an investment strategy.

For example, real estate investment often provides a leverage advantage where investors can purchase a property by making a down payment (usually 20%) and financing the rest with debt (mortgage).

“Practically speaking, it’s also important to remember that many real estate investors use a lot of leverage to purchase property, which can dramatically magnify their return on equity,” according to US News. (Though one has to also consider the mortgage interest that will be paid in the future).

Thus, in addition to returns, you should consider the other pros and cons associated with real estate investing:

Pros of stock investing

Below are the reasons many investors will consider stocks a better investment than real estate:

- Liquidity: Stock markets are very liquid, which makes it easy to open or close trading positions in seconds or minutes.

One advantage of liquidity is that you can quickly enter and exit positions without significant price changes. Another advantage is that liquidity makes price discovery easier – you can know the value of your investment and what you can sell it for.

- Diversification: With the introduction of fractional investing, you can take positions in several stocks without requiring a huge capital outlay. If you can’t buy a share of a stock, you can purchase a fraction of it. With just $100, for example, you can create a diversified portfolio of five ($20 each) or ten different stocks ($10 each).

- Lower fees: The growth in financial technology in recent years has significantly reduced the commissions payable when buying or selling stocks. Investors can further reduce transaction fees by buying index funds or ETFs (which are cheaper than mutual funds) instead of individual stocks.

Cons of stock investing

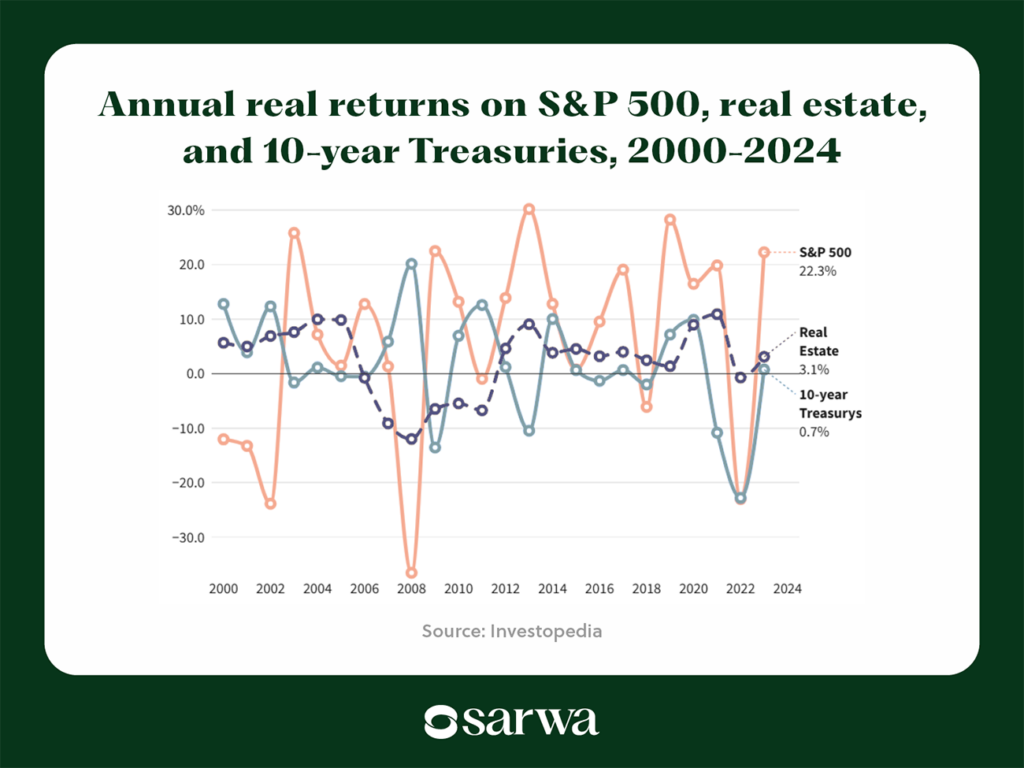

- Volatility: Stock prices are more volatile than real estate prices (and the prices of most asset classes). This can be seen in the chart below (which shows the annual returns of the S&P 500, real estate, and the 10-year Treasury bond between 2000 and 2024):

Source: Investopedia

Notice that the fluctuations between the highest returns and the lowest returns and between returns in one year and the next are larger with stocks than real estate. In other words, the prices of stocks are more prone to large swings.

- Prone to speculation: Given the high liquidity of stocks, they are prone to price speculation. Market sentiment, news, and trends can result in speculative activities.

Stock investors are especially subject to making investment decisions based on what Warren Buffett calls the fear-and-greed cycle, which makes them more prone to losing money.

Pros of real estate investing

- Leverage: As we have seen, the use of leverage can magnify the returns of a real estate transaction. Though leverage is also available with stocks, its nature makes the use of leverage riskier, especially for beginner investors.

- Ownership of a tangible asset: A stock is a financial asset while real estate is a physical asset that can be seen and touched. Some investors, depending on their background, see the tangibility of real estate as an advantage.

- Inflation hedge: Since house prices rise with inflation, investors see real estate as a good hedge against inflation.

- Price stability: Compared to stocks, real estate prices are more stable, especially during economic downturns.

- Tax benefits: In the UAE, there is no income tax on rental income, capital gains tax on sale of properties, and property taxes on continuing ownership of a property. Residential property transactions are also VAT-exempt.

Cons of real estate investing

Is investing in real estate safe? Here are four reasons to be cautious:

- Inaccessibility: Not everyone has the kind of capital needed to purchase a property. Even with a mortgage, the down payment required for a property purchase can still be a lot for many people.

How much do you need to invest in property in Dubai? “The minimum investment to buy residential property in Dubai starts from AED 600k – 900K,” according to Primo Capital, a real estate firm. Twenty-percent of this is still AED120k-180k, which is exorbitant for many.

Another point is in regards to the time to invest in real estate. It takes time to strike a deal and if it’s rental property, that’s extra time commitment for property management or more fees (if you hire a property manager).

- Harder to diversify: Given that it is costly to purchase a single property, diversifying across multiple properties (as a way to increase risk-adjusted returns) is difficult. This is unlike stock investing where $100 can get you 5 or 10 stocks because of fractional investing.

- High fees: For every real estate transaction you will incur property taxes, insurance fees, maintenance and property upkeep fees, broker fees, agent fees, and other miscellaneous fees that would reduce your net profits. All of these fees can add up to 6-10% of the property value.

- Illiquidity: Because it takes time to invest in real estate, many properties remain unsold for weeks and months. One disadvantage of this is that the property’s price can fall while the seller is waiting for a buyer. If the seller has an urgent need for money, they might have to sell at a discount.

3. Real estate investment trusts: How to combine real estate and stock investing

One way to get exposure to the real estate market without its cons is through real estate investment trusts (REITs). REITs are stocks of real estate companies that buy and sell properties (equity REITs) and those that finance mortgages (mortgage REITs).

REITs can also be bought and sold on the stock exchange market which makes them more liquid than purchasing properties.

Similarly, you can purchase a fraction of a share of a REIT or even purchase multiple REITs in the form of exchange-traded funds (ETFs). This makes REITs more accessible and more amenable to diversification (you can diversify across multiple REITs with just a few hundred dollars).

Interestingly, the seemingly overwhelming victory of stocks over real estate based on historical returns does not hold when we compare stocks to REITs instead.

For example, between 1972 and 2019, REITs’ average annual return of 11.8% (measured by the FTSE NAREIT All Equity REITs Index) exceeded that of the S&P 500 (10.6%), according to MorningStar, a financial services firm.

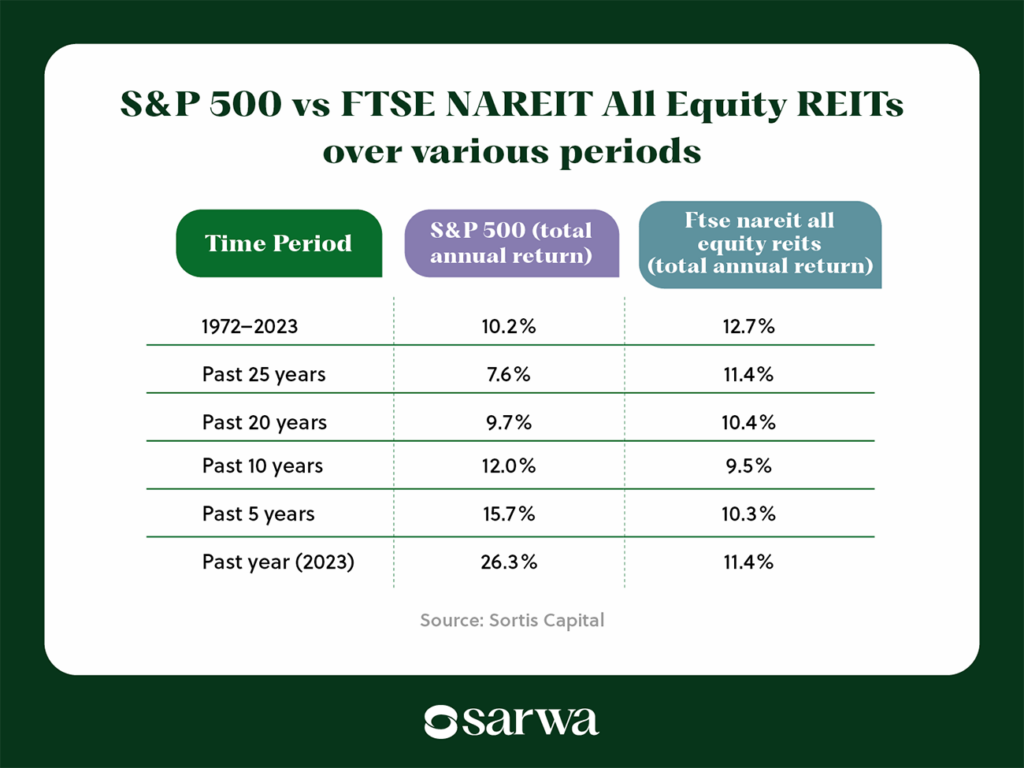

Furthermore, a 2024 study by Sortis Capital, a financial services firm, shows that the competition between stocks and REITs has been close historically.

Source: Sortis Capital

As the chart shows, REITs led stocks over the past 50, 25, and 20 years while stocks have claimed the lead over the past 10 and 5 years. Stocks also maintained the lead in 2023.

It seems then that REITs are one of the ways to invest in real estate that can provide comparable returns to stock market investments.

For investors whose utmost concern is returns, this settles the issue. However, as we mentioned above, various non-financial factors (the sense of personal fulfillment that comes from owning a property, for example) can make some investors prefer real estate to stocks and even REITs. Nevertheless, nothing stops such investors from investing in stocks and REITs in addition to real estate.

For more on the non-financial factors involved in the real estate vs stocks debate, read “Renting vs. Owning a Home in the UAE: What’s the Best Choice in 2025?”

If you are in the UAE, you can invest in both US stocks and REITs through Sarwa. You can also enjoy the benefits of broader diversification by including them in your investment portfolio in the form of ETFs. Sarwa Trade also allows you to get exposure to the UAE stock market through a UAE ETF that covers listed stocks in the Emirates.

With Sarwa, you will enjoy fractional trading, secure trading (with 256-bit encryption), low commissions, low entry barriers (you can start with as little as $1), instant deposits, and free AED transfers to your brokerage account.

Are you ready to build a fortune in the stock market? Sign up for Sarwa Trade to purchase stocks and REITs and grow your wealth over time.

Takeaways

- Over multiple timeframes, the S&P 500 has delivered higher returns than real estate in both the U.S. and UAE, even when accounting for total returns (including rental income and dividends).

- While stocks provide better historical returns, real estate has advantages such as leverage (using debt to magnify returns), inflation hedging, and ownership of a tangible asset. However, it also comes with challenges like illiquidity, high fees, and difficulty in diversification.

- Real estate investment trusts (REITs) provide an alternative way to invest in real estate while maintaining liquidity and diversification benefits.

- Deciding whether or not to buy a home is a personal choice. Sometimes the benefits aren’t easily quantifiable, but it’s always good to know/understand the data for you to make an informed decision.