When we talk about Sarwa to our investors, they often warn us: “be careful, you’re going to have to spend a lot of time educating the market on investing”.

That’s exactly right, and we’re going to have fun doing it!!

You’ve probably seen by now our educational series (the Sarwa Scoop). If you haven’t, be sure to check it out – we cover topics such as the importance of starting early, compound interest, ETFs, diversification and the importance of managing your emotions when investing.

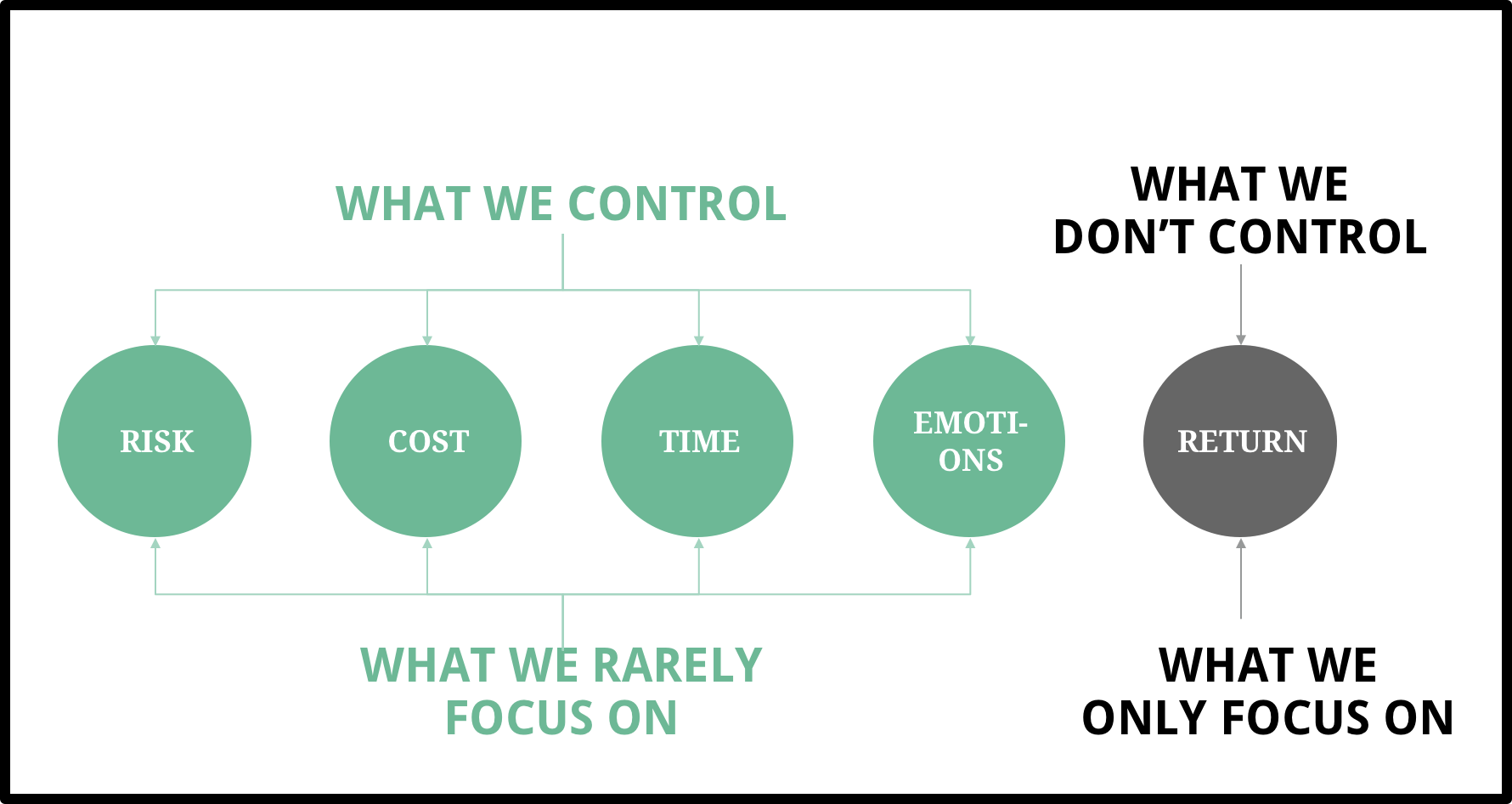

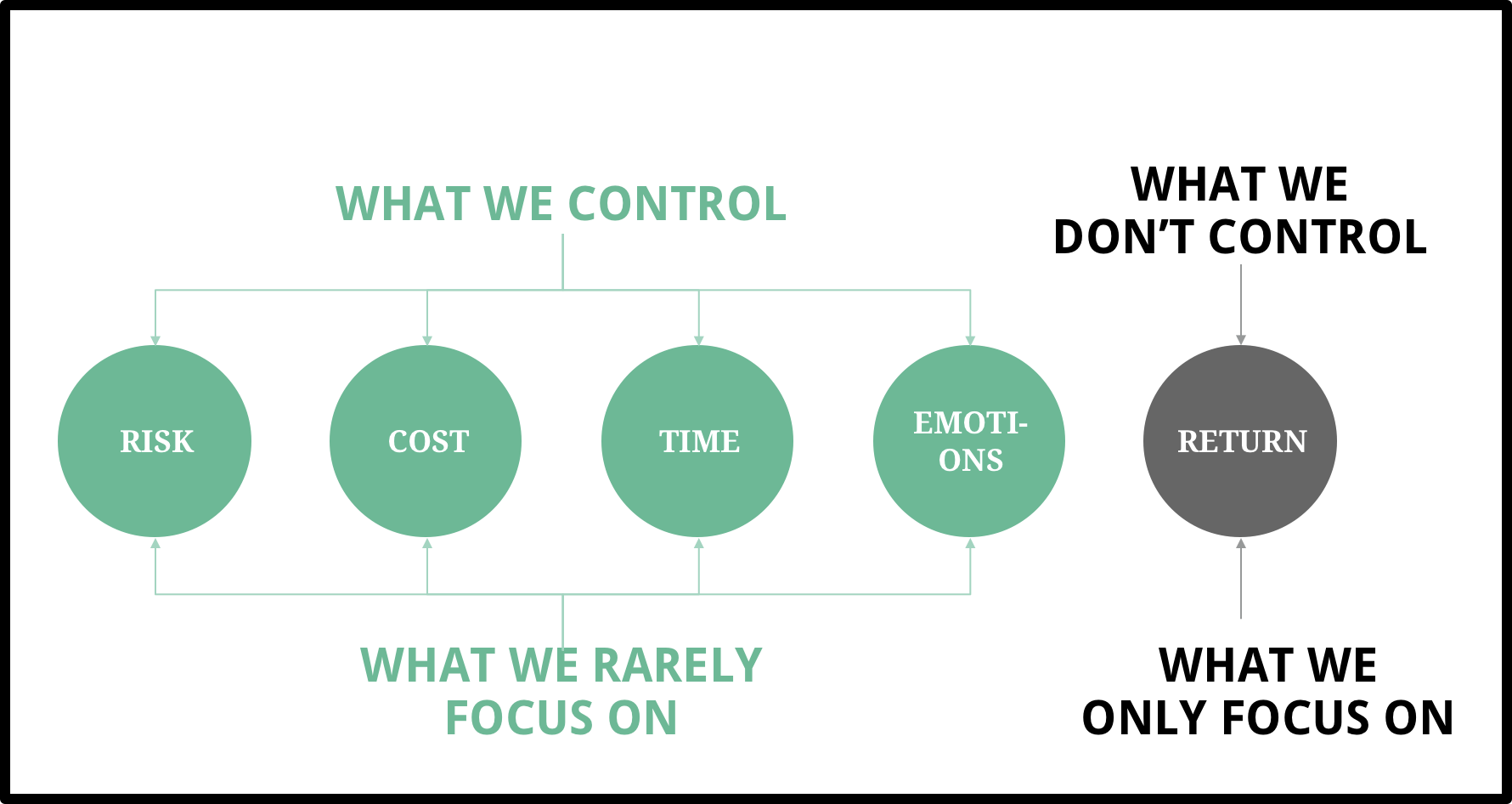

Remember this chart? Learn this and you’ll become an expert investor overnight:

To get the point across, we’ve staffed our client support team accordingly to constantly remind our community of these 4 principles while we chat with them.

Allow us to introduce:

The Patient Sloth

“If investing is entertaining, if you are having fun, you are probably not making any money. Good investing is boring.” – George Soros

Also..

“Successful investing takes time, discipline and patience. No matter how great the talent or effort, some things just take time: You can’t produce a baby in one month by getting nine women pregnant.” – Warren Buffet

You get it: To build great wealth, the best thing you can do is to start investing as soon as possible, have a long-term horizon and take advantage of compound interest.

The Spotted Cheetah

Cheetahs are known to calculate their every move.

Based on the level of risk you’re comfortable with, Sarwa recommends an optimized portfolio that fits your profile. This is a free portfolio recommendation available right after registering on our website. We take into account your investment knowledge, desired risk and other important factors such as your goals and the duration of your investment.

Our goal is to help you plan and prepare financially so that you save time and have peace of mind knowing your money is working for you – regardless of your risk profile, whether you’re a conservative, balanced or growth investor (ultra-conservative? We’ve got you covered as well).

Our investment committee comes from some of the largest institutions in financial services (e.g. the ex-chairman of JP Morgan Chase Switzerland). Our wealth advisory team and live chat support group are also here to help you every step of the way.

We pick the ETFs for you, we recommend an asset allocation and we do the things you don’t have to worry about to ensure your money is working for you.

The All-Season Squirrel

Squirrels don’t hibernate in the winter. Instead they rely on caches of acorns and other nuts that they accumulate earlier in the year.

Sarwa wouldn’t be a robo-advisor if we did not use a metaphor comparing savings to acorns and squirrels. You should always pay yourself first and do that regularly. Fortunately, the UAE is tax efficient, so use that to your advantage to tax yourself – you will thank yourself later.

The Elephant in the Room

“Huge institutional investors, viewed as a group, have long underperformed the unsophisticated index-fund investor who simply sits tight for decades. A major reason has been fees: Many institutions pay substantial sums to consultants who, in turn, recommend high-fee managers. And that is a fool’s game.” – Warren Buffet

So allow us to address the elephant in the room: many financial advisors in the region have been charging high fees for their expert advice, and promising you the moon.

At Sarwa, we want you to understand that compounding works both ways: these fees eat away considerably at your returns.

Hidden fees, commissions, exit fees…

It is important to know how much money you are paying. As the chart shows, investors tend to focus on returns when the fees they are paying are just as important, especially when these fees lack transparency and are not disclosed.

This is why we charge a low fee (also because we can – we are a tech company after all). Our philosophy is ‘full transparency’ when it comes to fees and our approach to investing.

At Sarwa, we pride ourselves on transparent, low-cost pricing. It’s similar to an Audible or Anghami/Spotify subscription.

If you open a $ 10,000 Sarwa account, you would pay approximately $7 a month for our simple advisory fee of 0.85% per year. That’s a cup of coffee!

Ready to invest in your future?