Young investors that work towards early retirement see a great opportunity when the stock market drops. After all, market crashes allow them to buy more of the stocks on sale. When markets recover, and they stay invested throughout, they can win big.

Let’s take a moment to see how this played throughout the market’s history: The worst market crash even recorded, and a more recent example of the 2008 crisis.

How did the great depression of 1929 – where market plummeted by 90%! – impact long term investors?

Studies show that staying invested through this period has yield great returns. How so? If we account for the dividends reinvesting and the Consumer Price Index, the US market ended up recovering in just over 4.5 years in a real sense, post inflation/deflation. Deflation and dividend yields significantly improved investor returns during this economic recession.

Companies give cash back to investors when they are in profit – in the form of dividends. In 1930, unemployment soared and businesses were struggling with revenues – profits were shrinking but companies kept paying dividends.

Assume Company X paid a dividend of five cents a share in 1928. If the company’s stock traded at $1, this would give a dividend yield of 5 percent ( The dividend yield is a percentage of dividends compared to the price of the actual share). During The Great Depression, company X sales dropped. To survive, they reduce their dividend payout. Let’s assume they dropped it from 5 to 2 cents a share. If company X stock price dropped from $1 a share down to 20 cents a share, the company’s dividend yield would have risen to 10%.

The price of shares during that period dropped faster and further than the reduced dividends. The yields increased. Investors were getting more value for their money. When the stock prices dropped, the money they were getting allowed them to purchase more quantity of shares which will catapult their profits.

Let’s look into actual values.

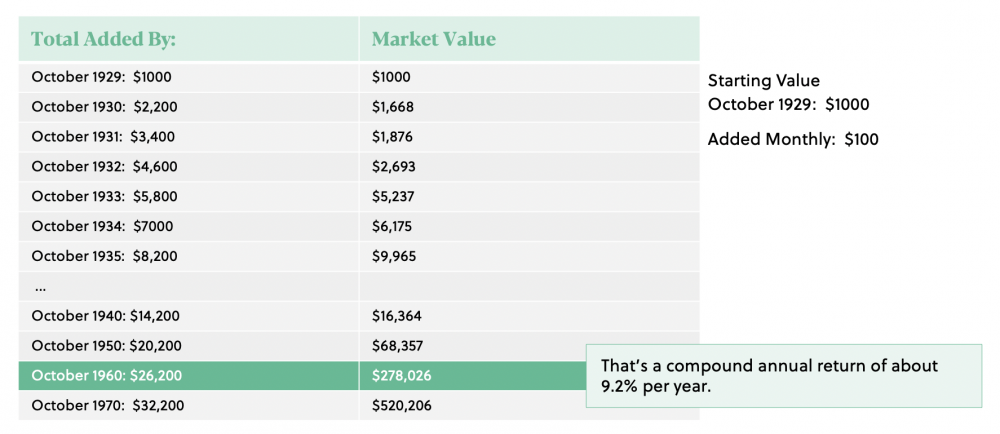

Let’s say you started to invest in October 1929 with $1000 and you continue to add 100$ a month to that lump sum. By October 1930, you would have added a total of $2,200. Due to market movements at the time, the value of your portfolio would have been $1,668. Your heart would want you to “Protect Your Money Now and pull out while you can!” – your head is conflicted. Here’s what would have happened if you kept adding money.

After six years, you would have invested a total of $8,200 and by October 1935, your portfolio would be worth $9,965. That’s not all. Goods and services cost less in 1935 than they did in 1929 so the buying power of this money (the real return) would have been even greater!

In a 30 years period, your worth is $278,026 – that is a compounding return of 9.2%. What if we added $10,000 as a lump sum and drip feed 100$ each month? Nominal returns will be drastically high.

A more recent example: The 2008 financial crisis.

A vanguard study shows that a $1,000 invested in a balanced portfolio during the pre-crisis peak of 2007 – just few months before the stock market dropped by around 50% from peak – would have doubled in value 10 years later. This is an extreme example of just one lump sum without any other contribution. Typically investors tend to have regular contributions.

According to Vanguard, The U.S. market delivered an outstanding annualized average return of 19% since March 2009 (the crisis-era low) after the meltdown of –47% in the six months prior to that. Those returns put the average annual return for the full ten-year period at 11%, better than the comparable return of 9% for two decades prior to the crisis.

When the market drops, young investors celebrate.

Zooming out on the market movement across its history gives us perspective.

Some might even think of a short term market drop as an opportunity to collect cheap stocks. Many thought that October 1929 was the worst possible time to invest into the market. Historical data shows otherwise.

If you are a young investor, have a stable source of income and your emergency fund figured out, investing now might be the best thing you can do. When a market crash comes – it does not come for free – there is always scary scenarios that come with that. But from an investment perspective, the market is not scary.

Don’t get tricked by how the market is performing this month of this year. It distracts you from capitalizing on this and making money long term. Warren

With the pandemic, if you are investing

Main take aways:

| 1. Deflation and dividend re-investing can significantly improve investor returns during economic recessions. |

| 2. Investing regularly during the market downturn can juice up your long-term returns. |

| 3. ‘Price is what you pay. value is what you get,’ according to Warren Buffett. ‘Whether we’re talking about socks or stocks, I like buying quality merchandise when it is marked down.’ |

Ready to invest in your future?