Learning investing for beginners can seem a difficult task, especially if you don’t have any previous knowledge or guidelines for how to begin your journey to wealth building.

Today’s internet makes things more complicated. While new investors are usually motivated to get started after watching the success YouTube stories of those who have built great wealth before them, beginners are often at a loss on how to go about finding their own success for a long period of time.

This lack of know-how at a beginning stage can be dangerous.

Consequently, many new investors end up falling for investment scams or using investment strategies that resemble speculating rather than investing. And in a world where investment products are all over the place, failure to access and use the right information can be very costly.

Luckily, those who have succeeded with investing as a wealth-building engine for the long run have left us with a ton of valuable information on what has made their specific strategies successful.

All you have to do is educate yourself and apply what you have learned.

Instead of roaming through the internet looking for the latest hot stock, novice investors learning how to invest in stocks for the first time are better served by applying time-tested investment advice and strategies of these long-term successful investors.

In this article, we will do a deep dive to cover all of the key investing basics for beginners based on the time-tested principles that long-term investors live by today.

We will cover:

- Before you invest: The fundamentals of successful financial management

- The principles of successful investing

- What to invest in: The basics of selecting the best investment assets

- How to invest: Practical steps to get started

[Are you ready to start your investment journey? Register with Sarwa to set up a stock portfolio or start trading, or subscribe to the Sarwa newsletter to get weekly investing tips.]

1. Before you invest: The fundamentals of successful financial management

While investing is truly the most powerful engine for wealth building in our capitalistic world, only those who have excess cash are in a position to start investing.

Therefore, a beginner’s guide to investing must start with the fundamentals – how to ensure you consistently save enough extra cash to invest.

The following are fundamentals every new investor needs to know.

a. Prepare a budget

Budgeting is at the very foundation of sound financial management. Basically, a budget is a list of expected income and expected expenses for a defined period of time, usually a month.

According to Dave Ramsey, a financial advisor, “a budget is telling your money where to go instead of wondering where it went.” So, instead of spending your income as circumstances demand, a budget ensures that you are spending it according to a predefined plan.

A popular budgeting system popularised by Elizabeth Warren, a US senator, is called the 50/30/20 rule. This simple budgeting rule instructs that you spend 50% of your income on your needs (housing, clothes, groceries, etc), 30% on your wants (entertainment, travel, etc), and 20% on savings/investment.

As is evident from the 50/30/20 rule, the aim of budgeting is to ensure that you spend less than you earn so that you can have the extra cash to save/invest, a precondition for wealth building.

Importantly, this rule also sets you up so that you pay your future self in the form of savings or investments before you start spending on wants.

“Budgeting only has one rule,” said Leslie Tayne, founder of Tayne Law Group, a debt relief firm. “Do not go over budget.”

So, as a beginner investor, you need to prepare a budget, preferably using the 50/30/20 rule, so that you can ensure that you will have extra cash to save and invest every month.

b. Create a systematic investment plan (SIP)

When it comes to investing, consistency is the key.

Ideally, your experience in the market isn’t going to be just for a few months – real wealth building is thought of in decades.

So, creating wealth will require you to consistently put money in the market for a long period.

A systematic investment plan (SIP) enables you to achieve this consistency. It requires that you set aside and invest a certain amount of money consistently and regularly with a long time frame in mind.

When applied on a monthly basis, a systematic investment plan can also be referred to as a monthly investment plan. For example, if you are using the 50/30/20 rule, a SIP will require that you set aside and invest 20% of your monthly income in the market.

But an SIP goes beyond stable, steady, and uniform investing.

This kind of plan also requires that you highlight and rank the goals that you are seeking to accomplish with your investing. Your financial goals can vary from the short term, medium term and long term, and each can include things such as retirement, purchasing a home, saving for your children’s college tuition, going for a dream vacation, among other goals.

An SIP requires that you highlight and rank these goals in order of preference. By doing this, you will be able to allocate your savings/investment to the goals that are of the highest priority. Below is a sample scale of preference for two hypothetical investors:

While Investor A will devote the savings/investment portion of their budget first to a retirement plan and then to property purchase, and so on, Investor B has decided to prioritise theirs to buying a dream car first and then to planning a vacation, and so on.

There is no right or wrong scale of preference. What matters is that your scale of preference uniquely reflects your current financial situation and overall values. Also, these financial goals must guide all your investment and financial decisions.

c. Use automated investing

One of the ideas that have revolutionised personal finance is George Clason’s instructive admonition that you should pay yourself first. This idea was popularised in his The Richest Man in Babylon, a book that has become a classic.

Clason believes that by saving/investing first before spending, people will be “forced” to develop the restraints they need to spend within their means. That is, he believes that we might need to make the portion for saving/investing inaccessible to help our wealth creation plans.

Digital financial advisors like Sarwa have adopted this idea by providing investors with an option to automate their investing. So, if your payday is the 25th of every month, you can allow Sarwa to automatically deduct a portion for investment on that day (paying yourself first) to avoid spending it on something else.

Such discipline is needed for successful investing.

According to Benjamin Graham, the father of value investing and mentor to Warren Buffett, a financial plan and behavioural discipline are the two key ingredients of successful investing. With an SIP, you’ll have a financial plan and with automated investing you’ll enable behavioural discipline.

d. Invest in your financial education

For Warren Buffett, “the most important investment you can make is in yourself.”

And, according to Benjamin Franklin, one of the founding fathers of the US, “an investment in knowledge pays the best interest.”

So, as someone looking for help on how to start investing in stocks, you must explore valuable and trustworthy resources that will help you understand the fundamentals of both personal finance management and investing.

The Sarwa Blog is one place to start. You can and should also explore other investing for beginners PDFs created by successful investors, as well as other resources like videos and podcasts.

2. The principles of successful investing

With the fundamentals above, you’ll have the basics that you’ll need to start spending below your income, steadily and consistently invest your extra cash, and discipline yourself.

Now, we will consider the principles of smrat investing that successful investors like Warren Buffett, Benjamin Graham, Peter Lynch, and Ray Dalio, among others, have highlighted over the years.

These include rules and time-honoured pieces of wisdom from those who have seen the ups and down of the market over many decades and come out of it with the creation of great wealth through investing.

Beginners looking for help investing in stocks must take note.

a. Invest in the stock market

The stock market is the world’s most powerful wealth-creation machine, and you must only look at the Forbes list of the richest people in the world to see that. All of their wealth is connected to the market.

“How many millionaires do you know who have become wealthy by investing in savings accounts?” This was a probing question asked by Robert Allen, a personal finance advisor, to emphasise that while stocks are riskier than savings accounts, they are the best instruments for creating wealth.

Savings accounts do have their own use – they are good avenues to save money you will need soon and to build an emergency fund. However, they pay paltry interest rates – an average of 0.20% in the UAE.

In contrast, since 2010, the S&P 500 (an index of the stocks of the 500 biggest public companies in the US), has returned an average of 12.41% per year. Even 10-year bonds in the US, which yield more interest than savings accounts, only have a yield of 2.90% at the time of writing.

[For more on the differences between saving and investing, read “Saving vs Investing: How Much Should You Allocate to Each?”]

It is then obvious why Robert Allen prefers the stock market for wealth building.

Warren Buffet agrees with him: “Today people who hold cash equivalents feel comfortable. They shouldn’t. They have opted for a terrible long-term asset, one that pays virtually nothing and is certain to depreciate in value.” Cash equivalents here include treasury bills, certificates of deposit, bankers’ acceptances, among others.

b. Diversify your investment portfolio

People like Robert and Warren don’t deny that stocks are riskier than savings accounts and bonds.

However, they also know through decades of experience that they are the best wealth-generating assets. So, instead of avoiding them, new investors should embrace them and then seek to minimise risk. How do you do this?

Investors minimise risk through portfolio diversification. Simply put, diversification means you don’t put all your eggs in one basket. Instead of investing in a single stock or multiple stocks that are positively correlated (that is, likely to move in the same direction), you invest in multiple stocks that are negatively correlated (that is, unrelated and likely move in opposite directions) or uncorrelated (not affecting one another).

When two stocks are positively correlated, a drop in the share price of one will lead to a fall in the price of the other. Meaning, one loss will bring another loss with it.

However, if they are negatively correlated, a fall in the share price of one will lead to a rise in the price of the other; meaning, one loss will be compensated for by another gain. Also, if they are uncorrelated, a drop in the share price of one will not directly affect the other; consequently, one loss will not necessarily turn into two.

According to the Modern Portfolio Theory, a Nobel-prize winning investment strategy, by investing in such negatively correlated, uncorrelated, or less-positively correlated assets, you can minimise your overall portfolio risk.

There are different ways to reduce risk by diversification.

First, there is diversification by asset class. Here, investors will include other assets apart from stocks in their portfolio to reduce the overall risk. For example, most investors should include bonds and REITs (real estate investment trusts) in their portfolio. These asset classes are less risky and less-positively correlated to stocks, so they can reduce overall portfolio risk.

[For more on the relationship between stocks and bonds, read, “What are Stocks and Bonds? An Investor’s Guide”]

Second, there is diversification by industry. Here, investors invest in stocks across different industries that are negatively correlated, uncorrelated or less-positively correlated to one another.

Third is diversification by market cap. Investors who do this include large-cap, mid-cap, and small cap stocks in their portfolio since all three have different risk-return profiles.

Fourth is diversification by market. Here, investors include US stocks as well as stocks from other developed countries outside of the US as well as emerging markets. Like market cap, these different regions have different risk-return profiles and they can be negatively correlated, uncorrelated, or less-positively correlated to one another.

In addition to reducing risk, a highly globally diversified portfolio also has the potential to increase returns. A study by Sarwa has shown a positive correlation between diversification and investment returns.

As seen below, investing $10,000 in a Thun Mod Risk portfolio (“a portfolio globally diversified across multiple asset classes including stocks, bonds, real estate, and commodities”) is more profitable than investing in a Mod Risk portfolio (40% US Stocks, 30% Global Stocks, and 30% high-quality bonds), which is more profitable than just investing in the S&P 500.

c. Invest for the long term

“Invest for the long haul. Don’t get too greedy and don’t get too scared,” said Shelby M.C. Davis, founder of Shelby Cullom Davis and Co, an investment firm. Or as Warren Buffett puts it, “If you aren’t willing to own a stock for 10 years, don’t even think about owning it for 10 minutes.”

Said another way: The search for quick returns is the worst way to build wealth in the stock market.

As Paul Samuelson, a Nobel Laureate in Economics, puts it, “Investing should be more like watching paint dry or watching grass grow.”

With long-term investing, your money will benefit from the beauty of compounding interest, which Albert Einstein called the eighth wonder of the world. The more you leave your money to gain compound interest in the market, the more it is likely to grow.

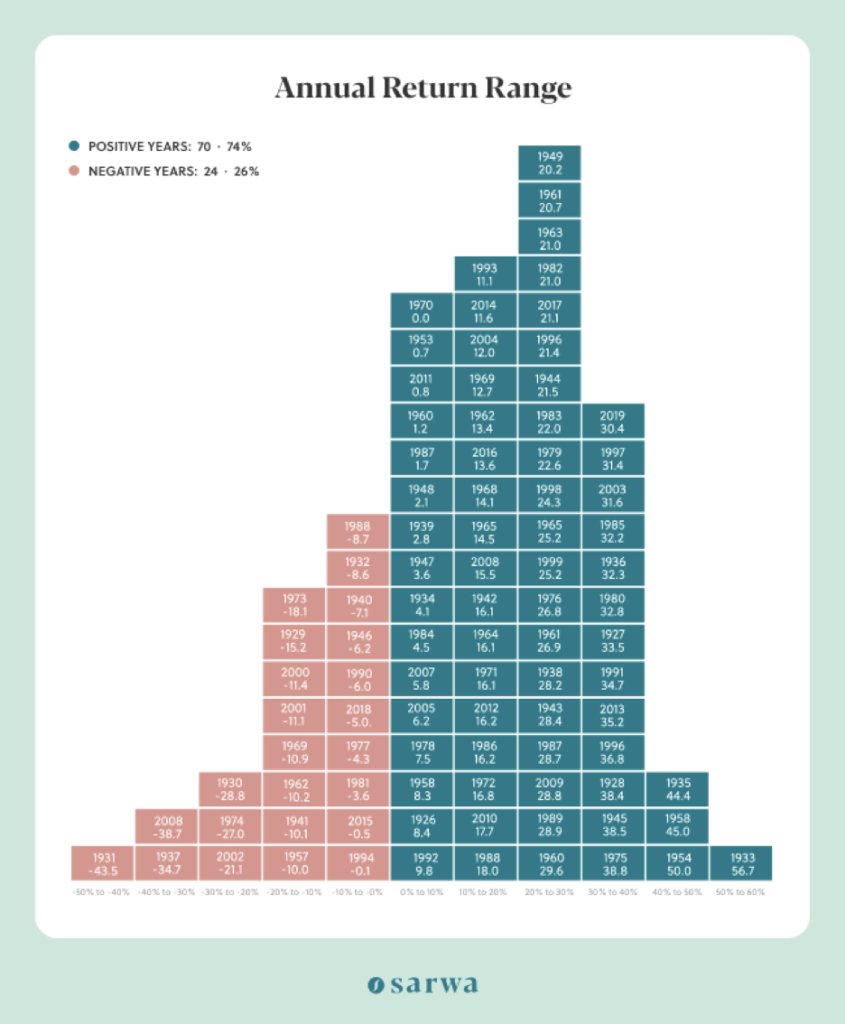

Therefore, instead of being driven by the short-term fluctuations and drops in stock prices, successful investors should train themselves to stay the course and focus on the long-term prospects. A research of stock movements between 1926 and 2019 by the Center for Research in Security Prices has shown that the stock market rises more than it falls (74%-26%), which makes long-term investing a clearly proven strategy.

d. Use passive investing

The debate over active and passive investment has been going on for a while.

Active investing is an investment strategy where investors or mutual funds managers are constantly buying and selling in a bid to outperform a particular stock market index. On the other hand, passive investment is a strategy where investors or passive fund managers imitate the holdings in an index and seek to track its performance.

Passive investment has become popular because it is a low-cost alternative (lower management fees and lower taxes), less risky (no need to risk trying to outperform an index), more transparent (passive fund managers disclose their holdings), and more diversified (it naturally benefits from the exponential diversification of numerous indices).

Moreover, over the years, active investors (such as mutual funds managers) have failed to achieve their main goal: outperforming their target indices.

So, many investors have decided not to settle for higher risk, tax, and management fees when the promised higher gains for these costs does not materialise. This has contributed to the increased interest in passive investing.

Furthermore, passive investing has shown that it can also earn better returns than active investing while also providing its benefits.

For example, Warren Buffet placed a bet with Protege Partners in 2007 that the S&P 500 index would outperform a collection of hedge funds managed by the latter over the next 10 years. In 2017, Buffett won – the S&P had returned an annual return of 7.1% compared to the 2.2% of the hedge funds.

Successful investors have also recommended passive investing because it helps investors focus on the long term rather than constantly buying and selling and subjecting themselves to the short-term fluctuations of the stock market.

So, if you are just learning how to invest in stocks for the first time, consider taking the advice of David Swensen, the former chief investment officer of Yale University: “Unless an investor has access to ‘incredibly high-qualified professionals,’ they should be 100 percent passive — that includes almost all individual investors and most institutional investors.”

e. Prioritise lump-sum investing

Lump-sum investing is an investment strategy where you invest all your investable cash at once. It applies both to Mr. A who has AED 100,000 of disposable income to invest and invests it all at once (instead of say investing just 10,000 in 10 batches) and Mrs. B who invests AED 10,000 at the end of every month and invests it all when the month ends (instead of spreading it over the next four weeks, for example).

There are two alternatives to lump-sum investing: timing the market and dollar-cost averaging (DCA).

The former involves waiting for the most opportune time to invest – often when the market is in a dip. And DCA involves spreading your investable cash (money that is currently available) into batches (say AED 100,000 spread out into 10 batches of AED 10,000).

Successful investors have discouraged market timing as a poor investment strategy. “For most of us, trying to beat the market leads to disastrous results,” said Jeremy Siegel, professor of finance at Wharton School of the University of Pennsylvania.

However, between the two responsible strategies – lump-sum and DCA – the former has been shown to be superior. For example, a study by Vanguard has shown that with a portfolio consisting of 60% stocks and 40% bonds, lump-sum investing outperformed DCA 67% of the time over six months and 92% of the time over 12 months.

As we have mentioned, the market rises more than it falls. Therefore, staying longer in the market with more funds has been proven to be more profitable than staying for a shorter period with less funds.

f. Use dollar cost averaging to manage your emotions

While not the ideal strategy, successful investors have recommended DCA for new investors who are still afraid of putting their feet into the market all at once.

For example, commenting on DCA, Dee Lee, a financial advisor, said “some people get frightened when the market drops after they put money in, so the client feels good doing dollar-cost averaging spread over the year.”

DCA is still better than market timing. Moreover, it can help investors to build discipline, take away emotional investing, and it also offers opportunities to lower investment cost when the market is going down.

3. What to invest in: The basics of selecting the best investment assets

Now that we have explained the investing basics for beginners with fundamental principles, let’s consider another important topic: investment options and how to select the right types of investments.

Here, there are two broad categories to consider: buying individual assets and buying passive funds.

However, while it is not recommended for beginners to start buying individual stocks and assets on their own, it is nonetheless important to have a basic understanding of how this process works.

Buying individual assets

If you have decided that you want to try buying individual assets (stocks, bonds, REITs) to include in your investment portfolio, there are certain things that must be considered to select the right investments:

- Do fundamental analysis: “Know what you own, and know why you own it,” advised Peter Lynch, a former fund manager at Fidelity Investments. Or, as Warren Buffett puts it, “it’s far better to buy a wonderful company at a fair price, than a fair company at a wonderful price.”

Consequently, your priority should be selecting stocks of wonderful companies who have long-term growth prospects and durable competitive advantage. According to Buffett’s investing principles, this means choosing companies that have economic moat, increasing profit margins, growing return on equity, low debt-to-equity ratio, and a history of good performance (for at least the past 10 years).

The research process by which you identify such stocks is called fundamental analysis. It involves looking into a company’s quantitative and qualitative factors and determining whether they have good prospects over the long term. This concern about fundamentals also applies to other investment assets.

- Diversify as much as possible: As we said in the previous section, diversification helps to reduce risk. Don’t put all your eggs into one basket.

- Focus on the long term: Select investments that have long-term potential and hold them for the long term so you can maximise your returns and ride short-term fluctuations.

- Avoid groupthink or the fear and greed cycle: Many people lose money in the financial markets because they do what others are doing instead of doing fundamental analysis and stockings to their plan. When everyone is buying, they buy (by this time, the price is already high and more than the intrinsic value of the stock). And when the asset is overbought and begins to fall, they sell out of fear of more losses (typically at a price that is below what they bought it for). This fear-greed cycle results from group think and can lead to considerable losses.

Jim Crammer, host of Mad Money on CNBC, pulled no punches when he said that “people who are buying stocks because they’re going up and they don’t know what they do, deserve to lose money.”

To avoid being amongst such people, ensure your investment decisions are driven by proper research. Similarly, ensure you are not taking financial advice from everyone who offers them. Stick to time-honoured principles.

- Choose a good brokerage app/digital investment platform: There are now many online brokers and investment apps in the finance space. If you decide to buy stocks yourself, you will need a brokerage app or digital investment platform that is cost-effective, safe, allows fractional trading (the ability to buy less than 1 share), and has a low minimum trading account requirement.

Sarwa Trade is such a digital investment platform. With it, you can buy stocks and exchange-traded funds (ETFs) (more on this later) on stock exchanges in the US. You can also transfer funds from your local bank account to your brokerage account for free. Moreover, your funds are secured with SSL encryption and you will have access to market reports and stock information you need to make smart decisions.

Also, as someone learning how to invest in stocks for the first time, you can buy only a fraction of a share.

Buying passive funds

However, for reasons we have covered in the previous section, buying passive funds might be a better alternative when it comes to investing for beginners.

By passive funds, we refer to passive index funds and passive ETFs. These are baskets of securities (stocks, bonds, REITs) that imitate the holdings in an index and track the performance of that index.

While index funds and ETFs are similar, there are certain differences that make ETFs a better option.

First, you can trade ETFs throughout the trading day, unlike index funds that can only be traded at the end of the trading day. Also, ETFs don’t require minimum investment, which means you can invest in ETFs even if you have little funds as a beginner looking to start investing in stocks for the first time. Third, ETFs are more transparent since transparency is mandated for them while it is optional for index funds.

Since ETFs have these advantages, let’s focus on why buying passive ETFs can be more advantageous than buying individual stocks, especially when it comes to investing for beginners:

- Diversification: A single ETF can contain hundreds or thousands of stocks diversified by industry. However, as an individual, it will be difficult (or near impossible) to have the cash needed to purchase hundreds or thousands of stocks. Consequently, the diversification you will get with 5 ETFs is exponentially multiplied compared to what you would get by buying 5 stocks.

- Cost: Second, if you have to buy hundreds of stocks, you will need to think about expensive transaction fees that will add up to a significant amount (except if you are using an affordable digital platform like Sarwa Trade). However, you will pay only a single commission to buy one ETF that contains hundreds and thousands of stocks.

- Returns: As we have seen, even professional investors have been unable to match the returns of passive funds. Warren Buffett’s bet has shown that passive funds do outperform active ones. Now, if professional fund managers cannot outperform passive funds, how will you, a beginner investor, do it?

- Long-term investing: While you can easily buy and sell stocks individually, with a passive ETF, you are “forced” to stick with the constituents of an ETF. This helps you to take the emotion out of investing as you focus on the long-term returns of your fund rather than the short-term fluctuations of the individual stocks in that fund.

Now that we have established why passive funds can be superior to buying stocks individually, let’s consider some important points that will help you maximise the benefits of passive ETFs:

- Diversify: Even when you choose ETFs, it is not enough to just buy a single ETF. A single ETF may give you diversification by industry and market cap. But with multiple ETFs, you can also get diversification by market and asset class, among others.

- Choose the best ETFs or use digital wealth advisors/robo-advisors: There are also different ETFs created by different companies. You will need to evaluate comparative ETFs and choose the one with the best value for money – in terms of returns, expense ratio, transparency and quality of the provider, growth or dividend potential.

However, instead of trying to build a diversified portfolio of ETFs yourself, you can choose to invest with a digital wealth advisor (through their investment apps and platforms), which will apply time-tested and long-standing portfolio management theories to help you create a diversified portfolio personalised to meet your needs.

For example, with Sarwa Invest, investors get a diversified portfolio that aligns with their time horizon, financial goals, and risk tolerance, and it’s created through the Nobel Prize-winning Modern Portfolio Theory.

Digital wealth advisors/robo-advisors will also take away the need for you to start researching the best ETFs yourself. And since they will probably do a better job than you (with the tools and knowledge available to them), they might be a better and more cost-effective option (especially considering opportunity cost).

- Automate your investment: In addition to the benefit of personalisation that you will get with a digital wealth advisor like Sarwa, you will also be able to automate your investment. Remember George Clason’s concept of paying yourself first? You can do that easily with a digital advisor.

- Rebalance your portfolio: Since digital wealth advisors use tools that help them apply award-winning investment theories, they can rebalance your portfolio to ensure it always maintains an optimal allocation.

For example, let’s consider that they have created a portfolio with 40% of US stocks, 20% of bonds, 10% of REITs, 10% of developed market stocks (ex-US) and 20% of emerging market stocks for you. If the portion of US stocks suddenly becomes 60% while developed market stocks and emerging market stocks are now 5%, there is an imbalance.

Digital wealth advisors have the tools to automatically rebalance your portfolio to the optimal allocation they have created for you (based on your time horizon, financial goals, and risk tolerance).

4. How to invest: Practical steps to get started

So, with all that has been said, what can we conclude about how to invest in stocks for the first time?

First, based on the principles of successful investing we have considered, there are three broad practical options for you as a beginner investor (listed in order following these principles):

- Sign up with a digital wealth advisor

- Create your own portfolio of ETFs

- Create your own portfolio of stocks

Having considered in the above section why these options are ranked the way they are, we will now highlight the practical steps you can take as an investor looking for help investing in stocks.

Sign up with digital wealth advisors/robo-advisors

To start using Sarwa Invest, you will need to sign up for an investment account and then fill in some information about your current financial situation and your financial goals.

Based on this information, Sarwa will create a personalised and diversified portfolio of ETFs that is optimal for you, as per the Modern Portfolio Theory.

With Sarwa Invest, you can either use lump-sum investing or DCA. Furthermore, you can create multiple portfolios for various goals (including retirement accounts).

[For more on how to invest money in the UAE, read, “How to Invest Money In The UAE: All You Need To Know”]

Create your own portfolio of ETFs

With Sarwa Trade, you can register an account for free and buy ETFs with zero transfer fees. You can create your own diversified portfolio of ETFs on our mobile app.

Applying both lump-sum investing and DCA strategies is possible with Sarwa Trade.

Create your own portfolio of stocks

You can also decide to buy individual stocks on Sarwa Trade. Though it is harder to do, you can create a DIY diversified portfolio of stocks. However, since it is easier to fall into the trap of market timing here, you need to be more cautious and be sure that you are consistently sticking to the principle of long-term investing.

[For more on how to trade stocks, read, “How to Buy US Stocks in the UAE (The Easy Way)”]

As this article has shown, understanding investing basics for beginners is crucial to a lifetime of successful investing.

Also, as this article has shown, investing for beginners need not be overly complicated. With all the information above, you can confidently begin your investment journey right now.

[Do you want to start creating wealth through goal-based investing? Register on Sarwa or learn more about how we meet all your investment needs in one platform. Do you have questions about successful investing? Schedule a free call with a Sarwa wealth advisor and we will answer all your questions.]

Takeaways

- Many people who want to imitate successful investors have been unable to do so because of lack of guidance on investing basics.

- The best way to create wealth is to consistently invest a specific amount in the stock market.

- Investors who have created wealth through investing have given us time-tested principles that include investing for the long-term, diversifying, embracing passive investing, among others.

- Investing for beginners requires applying these principles to one’s choice of investments.