There’s a long-standing belief that the best way to earn good returns on your money is to only invest in the S&P 500.

The reasoning goes like this: since the Standard & Poor’s 500 stock index (S&P 500) has a history of outperforming active investors (such as mutual funds), the best investment approach for those who don’t know much about the markets is to invest in a low-cost S&P 500 fund.

But this strategy is not a recipe for success. It might actually lead to unwanted losses. Investors that only invest in the S&P 500 leave themselves exposed to numerous pitfalls:

- Investing only in the S&P 500 does not provide the broad diversification that minimizes risk

- Economic downturns and bear markets can still deliver large losses

- The past performance of the S&P 500 is not a guarantee of future performance (yeap, and we’ll get back to that!)

- You lose the advantages of investing in other developed and emerging markets, other assets classes like REITs, and small-cap companies.

While investing only in the S&P 500 is better than an active investing approach (which includes trying to time the market), for the above reasons it is still a losing strategy.

Before we dive into explaining the rationale behind why not only investing in the S&P 500 is a sound investment strategy, let’s briefly review what is the S&P 500 and why its appeal has grown to the level we are witnessing today.

What is the S&P 500?

The S&P 500 is the weighted index of the market cap of the 500 largest publicly traded companies in the United States. The index includes many companies in the technology and finance industry, as these industries currently lead large-scale economic activity in the US.

For several decades, investors (especially institutional investors) have used the S&P 50 to measure the performance of the US equities market.

Investing in the S&P 500 can include buying an ETF or index fund that tracks the S&P 500.

Because these investments track the whole basket of companies within the S&P 500, the investor does not need to buy shares from the individual companies that constitute the index or pay an expensive mutual fund to manage the investment.

These days, the growing interest in investing only in the S&P 500 can be attributed to the ease with which investors can buy an index fund or ETF that offers this low-cost exposure to the S&P 500.

For example, the Vanguard 500 Index Fund (VFINX) and the Vanguard S&P 500 ETF (VOO) both track the S&P 500 index. Investing in these funds offers an easy, cheap and convenient way for even novice investors to jump into an index with a high historical outperformance.

Sounds too good to be true, right? Well, it is.

Now it’s time to poke some serious holes into this strategy.

The flawed “only invest in S&P 500” approach

Without a doubt, the past decade was a sensational run for investors, with the S&P 500 registering a total return of 256%, or 13.5% annually, through the 2010s, according to Howard Silverblatt, senior index analyst at the S&P Dow Jones Indices.

This means that if you had invested $10,000 in the S&P 500 in 2010 and left it in the market you would have close to $36,000 by the end of the decade.

For obvious reasons, this strategy seems like a no-brainer to many investors.

However, this strategy is not bulletproof.

Simply put, only investing in the S&P 500 is not a wise strategy for the long-term intelligent investor because it ignores some fundamental principles of diversification and historical unpredictability.

Importantly, just because the S&P 500 has delivered phenomenal returns in the past, doesn’t mean that you should only invest in this asset.

Even those who have already benefited from the past 10-year returns could fall into the trap of creating unrealistic expectations about what the future might hold.

Here, investors should also understand the critical importance of making long-term investment decisions with proper diversification.

Let’s look into why that is the case.

Minimizing risk: The other side of the equation

Before American economist and Nobel Prize laureate Harry Markowitz developed the Modern Portfolio Theory, investors tended to focus only on an investment’s returns. The goal was to buy a company with good fundamentals at a low price and watch it grow over the years.

However, Harry Markowitz identified that sound investment decisions must evaluate returns and risk.

He believed that the average investor is risk-averse — for the same level of returns, an investor will choose the investment with the lowest risk.

Consequently, the investor’s goal is not merely to maximize returns but to maximize returns for a given level of risk or minimize risk for a given level of return.

Markowitz discovered that the risk of a portfolio (essentially, your bucket of investment assets) that is not positively correlated is lower than the risk of any individual investment in that portfolio.

For example, stocks and bonds are often negatively correlated — when the stock market is growing, the bond market is falling, and vice versa. This means that when an investor invests in a portfolio of stocks and bonds, the risk is lower than if he chooses only stocks or only bonds. If stocks are down, bonds will not necessarily be influenced, and vice versa.

According to Markowitz, the best way for investors to minimize risk is to have a portfolio of assets that are negatively correlated — meaning that your basket will include a range of assets that will not be influenced by others.

The advantage of this approach is that you are not exposed to all the unsystematic risk of a particular asset. Consequently, a bad ride for one asset won’t cause you to lose all your money.

Without this kind of proper diversification, a bad ride in one stock can lead to the loss of your investment. By following the Modern Portfolio Theory, there is a counterbalance that creates a portfolio engineered for optimal performance.

However, most investors tend to oversimplify diversification.

Let’s explain how diversification is done correctly, and where the S&P 500 can play its part.

Modern Portfolio Theory and the S&P 500

Can investors who only invest in the S&P 500 enjoy this minimization of risk?

No.

The S&P 500 provides only one level of diversification — diversification by industry.

Companies in the S&P 500 index operate across various industries – finance, technology, pharmaceutical, etc. If market factors in the finance industry lead to a downturn in that industry, the growth in other industries negatively correlated to the finance industry will counterbalance that downturn, protecting the investors’ funds.

However, only investing in the S&P 500 does not offer any other layers of diversification.

All the companies are in the United States, so a nationwide economic disaster there could create a huge financial loss. Also, all the companies are at the peak of their lifecycle (large-cap companies), which means there are little opportunities for capturing growth compared to small-cap companies in the introduction stage of their business.

Similarly, the index is made up of only stocks. When the stock market is experiencing a general downturn, there are no other asset classes (like bonds and REITs) to counterbalance that loss.

This is why investing only in the S&P 500 does not help the investor minimize risk. A single level of diversification cannot provide the protection you need in today’s market.

What is lacking with the “only invest in the S&P 500” approach is what Harry Markowitz called broad diversification.

“In choosing a portfolio, investors should seek broad diversification. Further, they should understand that equities–and corporate bonds also–involve risk; that markets inevitably fluctuate; and their portfolio should be such that they are willing to ride out the bad as well as the good times,” said Markowitz.

A large misconception is that investing in the S&P 500 index offers a diversified portfolio through its inherent exposure to numerous companies.

Clearly, this is far from the reality.

Whilst having a broad selection of securities is a good starting point, it’s only one of the four ways to diversify effectively.

That being said, while investing only in the S&P 500 is better than trying to beat the market, it is still not good enough to achieve optimal diversification.

This strategy guarantees that the investor will be exposed to undiversified risk that has been proven to lead to substantial financial loss.

[Read The Importance of Diversification to learn more]

20 years of S&P 500 performance: A case in point

Let’s take a trip back to the year 2000.

Anyone looking to enter the S&P 500 at this time would have been excited as over the previous 20 years the index compounded at a rate of nearly 18%, which increased to over 28% during the last half of the ’90s.

But those who jumped on the bandwagon and invested all of their money into the S&P may have quickly regretted it.

Why? Because the 2000s underwent two major bear markets attributed to the dot-com crash in early 2000s and the financial crisis of 2007/08.

Performance from January 2000 through December 2009 did not meet investors’ expectations and even occasionally dipped into the negative. This time period became known to active investors as ‘the lost decade.’

The below chart shows performance over the past two decades.

S&P 500 Total Return: Jan 00 – Jun 19, monthly levels

Achieving broad diversification

To achieve broad diversification, the investor must learn to diversify in different ways: asset class, market/country, industry, market cap, and time.

- Diversification by asset class: Don’t invest all your money in one particular asset class like stocks or bonds. Instead, diversify across stocks, bonds, and REITs. When one asset class is experiencing a downturn, the other counterbalances it, minimizing your risk.

- Diversification by market: We live in a global economy so don’t make the mistake of investing solely in your own country or the US. Instead, ensure you’re investing in different types of stocks, bonds, and REITs across different markets. Invest in developed markets that provide consistent income and emerging markets with high growth potentials.

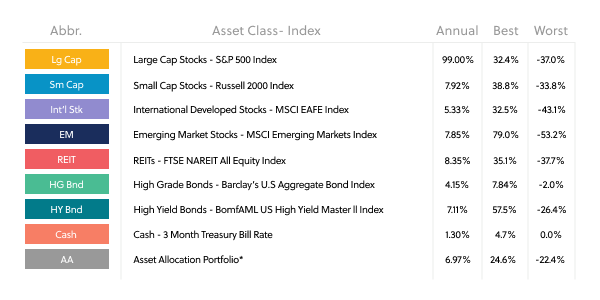

To illustrate this point, the table below highlights the performance of various asset classes each year from 2005 to 2018:

The key takeaway here is that each year’s top performer is different. If you invested only in the S&P 500, you would have missed out on the winning years of the other asset classes.

(See Appendix for details on each asset class.)

- Diversification by industry: When purchasing stocks, you should also diversify by industry. Ensure that all your stocks are not in companies in a single industry. Industrial diversification is what S&P 500 funds provide. Such diversification across your international market exposure is also essential.

- Diversification by market cap: Large-cap companies have limited growth potentials, but they provide consistent income, while small-cap companies have huge growth potential. Diversifying across large-cap, mid-cap, and small-cap companies can help to maximize returns and minimize risk.

- Diversification across time: Make time your ally and invest as early in your career as you can to give yourself more time to compound your returns. Too many people suffer from decision paralysis where they become caught up in trying to invest at the ‘perfect time.’ Instead, they actually end up not investing at all and miss out on valuable time in the market.

Once you invest now to enjoy compound returns, you can also choose to keep adding to your investments through dollar-cost averaging (DCA). By using this strategy, instead of waiting for the “perfect time” to add to your investments, you can do it at regular intervals through your robo advisor.

Using the broad diversification techniques summarized above will help you minimize your risk and maximize your returns come rain or shine.

Remember, your portfolio encomposes a world much bigger than a single country or single index fund.

In this way, being properly diversified will also help you to limit volatility and curb your emotions — perhaps the most dangerous threat to investors.

“You don’t need to have a high IQ in the investment business, but you do need emotional control,” said legendary investor Warren Buffet.

Measuring the performance of broad diversification

In investing, there is no such thing as a sure thing.

This maxim reinforces a timeless market lesson: Returns can swing from one period to another. Even though we should not base future investment decisions in retrospect, we can learn some lessons from the past.

Academic research and data strongly suggest that diversification is key for long-term investment success.

Holding a broadly diversified portfolio can help smooth out the swings because if one company or market performs badly during a given period you will have other areas of growth elsewhere to protect you, to some extent, from losses. Having a sound strategy built on this core principle — and sticking to it through good times and bad — can be a rewarding investment approach.

The ‘lost decade’ could have actually been a good decade for those who diversified their portfolio globally and included other parts of the market such as bonds, real estate, and emerging markets instead of limiting their exposure to a single country and asset class like the US stocks.

To demonstrate this powerful tool, we analyzed the performance of three different portfolios over the 10-year period from 2000 to 2009:

- A portfolio 100% invested in the S&P 500.

- A portfolio with a 40% allocation to US stocks, 30% to global stocks, and 30% high-quality bonds. (Mod Risk)

- A portfolio globally diversified across multiple asset classes including stocks, bonds, real estate, and commodities. (Thun Mod Risk)

The chart above shows that investors who held a well-diversified portfolio (inclusive of US stocks) outperformed both those holding all US stocks and those holding stock and bond portfolios, delivering a respectable annualized return of 7% versus the S&P’s -0.95% during the same period.

Part of the reason why the well-diversified portfolio performed so well is because of its exposure to real estate (via REITs) which have a low correlation to stocks. This means that they don’t move in the same direction at the same time. As a result, the investor benefits from reduced volatility and risk.

The bottom line is that the S&P 500 should be a good friend, not your only friend.

Building a diversified portfolio

When building an investment portfolio from scratch, broad diversification should be the central goal.

Instead of following the “only invest in the S&P 500” approach, diversify your portfolio across asset class, market, industry, market cap, and time.

The best way to build such a portfolio is through a robo advisor that invests in ETFs across asset classes, markets, industries, and market cap while providing you with an opportunity to diversify across time through dollar-cost averaging and automatic rebalancing.

For example, a typical portfolio constructed by Sarwa includes ETFs of:

- US Stocks

- Developed Markets

- Real Estate Investment Funds

- Emerging Markets

- US Bonds

- Global Bonds

Here, there is diversification by asset classes — stocks, bonds, and REITs. There is also diversification by market — developed and emerging.

A common ETF used to add exposure to the US stock market is Vanguard Total Stock Market ETF (VTI), which comprises large-cap, small-cap, and mid-cap companies across different industries- diversification by industry and market cap.

Furthermore, Sarwa allows investors to make periodic investments with regular rebalancing, providing diversification across time.

[Wondering why ETFs are so popular and effective? Read “Why Invest in ETFs: Explaining the Popularity of The Go-To Fund”]

Takeaways

- If you only invest in the S&P 500 (through an index fund or ETF), you will be better off than trying to beat the market.

- However, investing only in the S&P 500 will not provide you with the broad diversification you need to minimize your risk and maximize your returns.

- To achieve broad diversification, you need to diversify by asset classes, markets, industry, market-cap, and time.

- Investing in a basket of ETFs through a robo advisor is a low-cost way to achieve broad diversification, minimize your risk exposure, and maximize your returns.