With more than 4,685 stocks available in the US market, you might be confused about which one to choose as a swing trader.

Do you just focus on popular stocks like AAPL and AMZN? Or perhaps you follow the ones that have seen the largest recent price increases?

Well, it’s more complicated than that.

As with every other thing related to stock trading and investing, you must learn to be strategic.

In this case, you must know how to screen stocks for swing trading. That is, you must identify what characterises stocks that are good for swing trading and then screen the stock market to select stocks with those factors.

This might sound difficult, but it is not.

In what follows, we will consider how you can select the right stocks for swing trading and how to swing trade stocks. We’ll cover:

- What types of stocks are good for swing trading

- How to screen stocks for swing trading

- How to swing trade stocks

[Do you want to learn more about how to be a better stock trader? Subscribe to our newsletter today to have weekly resources and market news delivered to your inbox.]

1. What types of stocks are good for swing trading

Swing trading depends on profiting from price swings that occur over days and weeks. In terms of time horizon, swing trading is in between day trading (where traders are concerned with intra-day price movements) and position trading (where traders can wait for months before liquidating their position).

Just as investors do fundamental analysis to help them select the right stocks, swing traders must also know what they are looking for in a stock so they can identify the right ones to trade.

So, what types of stocks should you look for as a swing trader? Let’s consider four key features:

Liquidity

When a stock is liquid, it is easy to buy or sell it quickly without significant changes in its price. If you have to wait for hours (or days) before your order can be filled, then the stock is illiquid.

Liquidity is often measured by trading volume.

On most trading platforms, trading volume is measured daily. There is also data for the average daily volume over a period (usually 30 days).

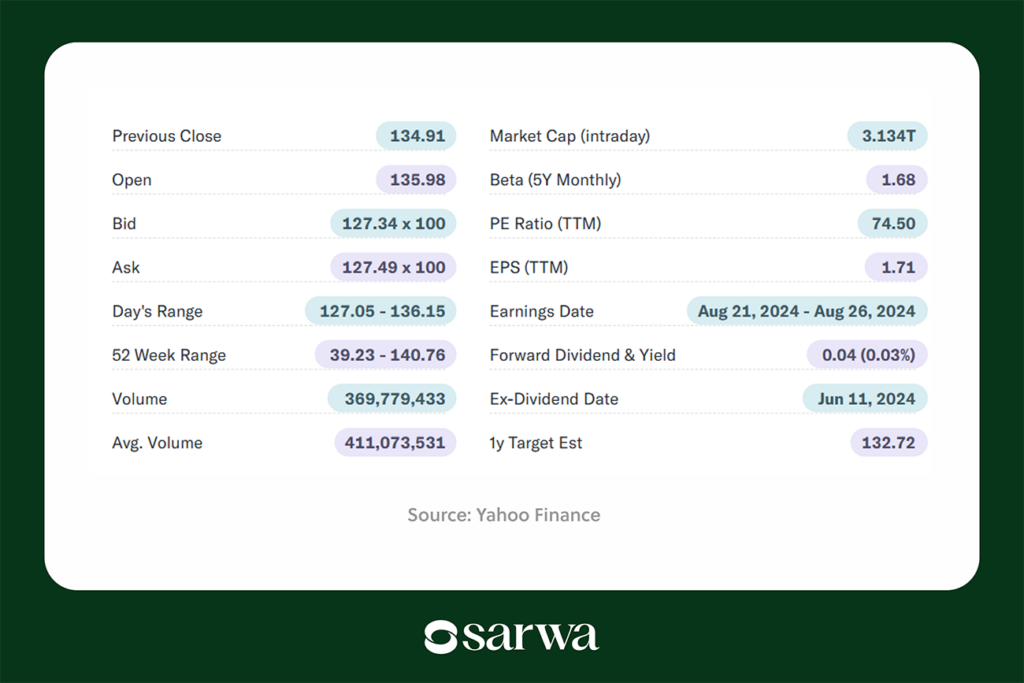

In the chart below, we see that NVDA has a trading volume of 369,779,433 at the time of writing. The average volume – average daily volume over 30 days – is 411,073,531.

Source: Yahoo Finance

Why is liquidity important to swing traders?

Swing traders depend on price swings for profit but prices are determined by demand and supply. When volume is large, prices can easily move up and down and you can profit from those movements.

Secondly, trading volume is important when you want to exit a trade. Suppose a trade goes against you and you want to get out immediately. If trading volume is low, this might be difficult. You might have to wait and watch the trade become even more unfavourable before selling.

Volatility

Volatility is often considered as a risk factor (especially for investors) but for swing traders, it is a profit determinant.

If a stock barely moves over days and weeks, the chance of profiting from it is low. However, if a stock moves up and down regularly, there is a better chance of profiting from upward and downward price swings.

As Investopedia puts it, “The stocks that have the highest volatility may be the most ideal for swing trading as there are the most opportunities for profit.”

Unlike day traders, however, swing traders focus more on volatility over days and weeks rather than intra-day volatility.

The bollinger band is one of the top technical indicators that measures volatility. The middle band (see below) is the moving average, the upper band is the moving average plus a standard deviation, and the lower band is the moving average minus a standard deviation.

The gap between the upper and lower bands and the moving average shows how volatile the stock is – how much it varies from its average price.

You can also measure volatility by comparing the standard deviation of stocks. Below is the 2 standard deviations of NVDA over the past 28 days:

Source: Yahoo Finance

The average true range (ATR) is another measure of volatility. It shows the daily trading range of a stock over a defined period. The higher the ATR, the more volatile the stock.

Diversification

If all your stocks are in the same industry or sector, any event or development that affects the entire industry or sector can lead to unfavourable market conditions, causing significant losses.

To minimise this risk, you need to select stocks across different industries and sectors. Also, you need to ensure that the industries and sectors are not positively correlated.

If industry A is positively correlated with B, then any event that turns the market against you in A may turn it against you in B as well. On the other hand, if they are uncorrelated, A will not affect B and if they are negatively correlated, B will move in the opposite direction.

The importance of portfolio diversification to risk minimisation is not unique to investors.

Response to events

Many swing traders trade on news events including announcements of earnings reports, a new CEO, the exit of an executive, innovative products, and mergers and acquisitions, among others.

If you trade on events, then you want a stock that tends to respond to events (positive or negative).

2. How to screen stocks for swing trading

Now that we know the types of stocks we are considering, let’s consider how to screen stocks for swing trading.

Screening for liquidity

Most stock screeners will have a section dedicated to liquidity. Below is the liquidity section on Yahoo Finance’s screener:

Source: Yahoo Finance

Once you have ticked these liquidity indicators, you can then input a minimum trading volume that a stock must have before you consider it.

Screening for volatility

While Yahoo Finance has served us well thus far, Trading View is better for this section.

It allows us to include bollinger bands as part of the screening criteria (as seen below).

However, traders seldom use this particular criterion, so it might not be very useful.

Traders have typically used % change in prices as a benchmark. The chart below shows where you can do this on Yahoo Finance:

You can select the intraday % change and the 52-week % change. For example, you might decide that for you to trade a stock, its price must change by at least 5% (positive or negative) every day.

The disadvantage with this is that daily % change is more appropriate for day traders while 52-week % change is more appropriate for position traders; there is nothing specific for swing traders.

But you can solve this problem by using Trading View. With this stock screener, you can set weekly and monthly % price changes (as seen below), which are more appropriate for swing traders.

The only disadvantage is that the price changes are not in absolute percentages. If you set it to 0%-5%, it only selects stocks whose prices have increased by that percentage. For those whose prices have fallen, you have to select “-5%-0%.”

That meas you have to run the screener twice – for the positive and negative percentage changes– keeping every other item constant.

Beta is another option. A beta of 1 means that a stock moves at the same rate as the general market. If beta is greater than 1, then the stock is more volatile than the general stock market. All you need to do is decide on a minimum beta and put it in the screener.

Focusing on large-cap stocks

“While a swing trader can enjoy success in any number of securities, the best candidates tend to be large-cap stocks, which are among the most actively traded stocks on the major exchanges,” according to Investopedia.

“In particular, large-cap stocks are among the best candidates for swing trades, as they typically are the most actively traded securities on the major exchanges,” according to Vantage Markets, a forex broker in the Asia Pacific.

Given that large-cap stocks are universally agreed to be the most suitable for swing trading, you can limit your search to such stocks.

To do this on Yahoo Finance, you can select market cap under the popular filters and set it to be equal to or greater than $10 billion.

Screening for diversification

By now, you should have a list of stocks that are appropriate for swing trading.

Using market cap, beta, average volume, volume, and % change in monthly prices (as seen below), the Trading View screener returned 18 stocks.

If I edit the % price change to “-5%-0%,” I get 9 more stocks.

It is very unlikely that you will trade 27 stocks. You can add all of them to a watchlist and then select the ones you like the most.

When doing this, pay attention to diversification. Ensure that all your stocks are not concentrated in the same industry or sector. Spread your wings to reduce your risk.

The 27 stocks that the screener returned in the above example cut across 6 sectors so there is no excuse to focus on only one.

3. How to swing trade stocks

Knowing how to screen stocks for swing trading is one side of the coin. Learning how to swing trade stocks is the other.

So, what do you need to do to succeed as a swing trader?

Learn how to do technical analysis

There is no way you can know how to make money trading stocks without understanding technical analysis.

First, you need to understand how to identify chart patterns (especially candlestick patterns), draw trend lines (uptrend and downtrend), support levels, and resistance levels, and analyse price action so you can discover and predict trends.

As a swing trader, focus on hourly and daily timeframes to identify short-term trends and the weekly chart for the intermediate trend.

Second, you need to master moving averages. There are two main types: simple moving averages and exponential moving averages. Knowing how stock prices have moved on average over a given period can also help you predict future price movements.

Third, support your chart and moving average analysis with technical indicators. You can use indicators to show if a stock is overbought or oversold as well as identify the existence, strength, and direction of momentums.

Some of the best swing trading indicators include bollinger bands, moving average convergence and divergence (MACD), relative strength index (RSI), on-balance volume (OBV), momentum oscillator, and average directional index (ADI).

Finally, you need to do a sentiment analysis. This is a way of gauging general market sentiment – are market participants bullish or bearish and are we in a fear or greed cycle? Sentiment analysis can also help determine if you should enter a market and how.

Create a trading strategy

Once you have mastered technical analysis, you need to create a trading strategy that helps you decide when (how to spot trading opportunities), where (entry and exit points), and how (go long or short) to enter and exit a trade.

Having a personal strategy is better than just buying and selling when others are doing so – making you vulnerable to the fear and greed cycle.

There are many swing trading strategies out there (reversal trading, trend trading, breakout trading, pullback and retracement trading, etc.). You can start by choosing one and then personalising it to fit your needs or you can create your trading style from scratch.

“Top traders … have found, through hard work, diligent study, and perhaps a little luck that their ability to stick with a trading plan is far more important than knowing or worrying about what their neighbour is doing,” according to Michael Covel, an author and entrepreneur.

When working on your strategy, you should stick to paper trading (demo trading). You can switch to trading with real money once you have decided on a profitable strategy.

Pay attention to risk management

If you don’t want to burn your capital, you need to also have a risk management strategy.

This tells you how much you should commit to every trade. You can do this by determining what your total capital is and how much of it you can afford to lose in a single trade. The result will determine how many shares you can buy/sell for every trade.

For example, if your capital is $10,000 and you can’t risk more than 2% in a single trade, then your spending on that trade is capped at $100. If the share price is $50, that means you can’t trade more than 2 shares.

Your risk tolerance will influence what percentage of your capital you can risk on each trade.

Another aspect of risk management is using a stop-loss. When market conditions are against you, a stop-loss can minimise your losses on the trade by liquidating your position.

Where to swing trade stocks in the UAE

If you are learning how to buy US stocks in the UAE, Sarwa Trade is a low-cost, secure, and accessible trading platform you should consider. With Sarwa Trade, you can trade stocks, ETFs, and stock options

We allow you to transfer funds from your local bank account to your brokerage account and back without any transfer fees. The commission we charge on your trades is also lower than the industry average.

With the bank-level SSL security we provide, you won’t have to worry about your data and money. We are regulated by the Financial Services Regulatory Authority in Abu Dhabi Global Markets, so you can trade with us with confidence.

The fractional trading we provide and our low minimum account requirement makes us accessible to beginners and retail investors who don’t have much capital. You can start small and grow your capital with us.

We also support your trading journey by providing you with real-time market news on the platform and trading resources on our blog and through our newsletter.

[Are you ready to start swing trading US stocks from the UAE? Sign up now for Sarwa Trade for accessible, secure, and low-cost trading.]

Takeaways

- Successful swing trading requires you to select stocks that are liquid and volatile. Large-cap stocks remain the most appropriate for swing traders.

- Even as a swing trader, you need to diversify your trading portfolio to minimise risk.

- After selecting the right stocks to swing trade, you need to understand technical analysis and create a trading and risk management strategy before you start trading.

- How to screen stocks for swing trading: With Sarwa Trade, you can trade US stocks from the UAE on our platform or mobile app.