Let’s face it: We live in a world built upon capitalism and free markets. Succeeding to build wealth in our society is dependent upon learning how to make money work for you – and this means understanding just how investing can passively grow your wealth over time.

Moreover, this implies that depending on working more for money — that is, finding a better job, improving skills, climbing up the corporate ladder, etc. — is not the only thing you must do to help you optimise the building of wealth.

Unfortunately, what you can earn from your job is limited to the time you put into it.

However, money is not limited by health, age, or time. Money can work overtime and benefit from compounding effects — your capital earns interest, and the interest that money makes also earns interest.

So, if money can potentially do the job better than you anyway, why not just allow it?

This is why learning how to make money work for you is necessary to anyone who wants to build a healthy, wealthy future. In part, the goal is to follow proven investment strategies, like those from Kevin O’Leary, chairman of O’Leary Funds Inc., who said, “Money is my military, each dollar a soldier. I never send my money into battle unprepared and undefended. I send it to conquer and take currency prisoner and bring it back to me.”

It’s this mindset of seeing money as something that we can take command of that is key to building wealth. It’s also key to avoid working for money until you die.

As Warren Buffett famously said: “if you don’t find a way to make money while you sleep, you will work until you die.”

In this article, we will consider the best way to make your money work for you. To do this, we’ll look at 10 practical steps you can take right away to do this:

- Create concrete financial goals

- Invest in your financial education

- Create a budget and stick to it

- Pay off your debt and avoid new ones

- Set up an emergency fund

- Embrace passive investing

- Build a diversified portfolio

- Make passive income

- Stick to your financial plan

- Use an online financial planner

At the end of this article, you should be more relaxed about your finances, watching them work for you rather than them working you up.

[Do you want to make your money work for you when it comes to achieving your financial goals? Schedule a free call with a Sarwa Wealth Advisor, and we’ll help you create a solid financial plan to start investing in your future self.]

1. Create concrete financial goals

Success in any sphere of life requires clearly defined goals and ambitions, and the financial sphere is not an exception. It is not enough to desire wealth; you need to articulate, in clear terms, why you desire it. Therefore, the first step in learning how to make money work for you is creating concrete financial goals.

“It takes as much energy to wish as it does to plan,” said Eleanor Roosevelt, former First Lady of the US. So, instead of wishing to have more money or build wealth for the future, start planning. And the first step is identifying your financial goals.

Your goal or ambition must be SMART — that is, specific, measurable, achievable, realistic, and time-bound. The SMARTer your goals, the easier it is for you to create clear action plans to achieve them.

Source: Crunchbase

In addition, your financial goals must be broad enough: short term (save enough money for downpayment on a house within two years), medium term (pay for your children’s college education in five years), and long term goals (retire at age 50).

And, more importantly, you must learn to prioritise: rank your goals in the order of importance. If paying for college in five years is more important than going for vacation in six years, then the former must take priority in the allocation of resources.

It doesn’t matter what your goals are; the important thing is to be clear about what you are working for (turn them into SMART goals) so you can create action plans to reach them.

2. Invest in your financial education

You have probably heard the popular saying that “knowledge is power.”

While knowledge in itself (without action) is ineffectual, success begins with knowledge.

Investing in education gives you an unfair advantage over others.

Therefore, to achieve your clearly defined wealth-building goals, you need to invest in your financial education.

One of the most popular advocates of financial education is Robert Kiyosaki, an accomplished entrepreneur and author, Rich Dad, Poor Dad. Comparing the power of money with that of financial education, he said:

“Money is one form of power. But what is more powerful is financial education. Money comes and goes, but if you have the education about how money works, you gain power over it and can begin building wealth. The reason positive thinking alone does not work is because most people went to school and never learned how money works, so they spend their lives working for money.”

“If you understand how money can work for and against you, you can make better decisions,” said Mellody Hobson, President of Ariel Investments. “Financial literacy is not about wealth but about understanding money regardless of the amount. It’s about how you treat it and how you maximise opportunities.”

To let your money work for you, you must build the habit of consistently learning how money works.

If you are unsure where to start, begin by reading the Sarwa blog. There you will find informative, educational, entertaining and well-researched articles that will help you master money.

3. Create a budget and stick to it

The best way to make your money work for you is to begin with budgeting. A good budget helps you clearly understand where your money is coming from and where it is going.

Budgeting is important because the first step to making your money work for you is having control over your money.

“The simplest definition of a budget is ‘telling your money where to go,’” said Tsh Oxenreider, author of Organized Simplicity: The Clutter-Free Approach to Intentional Living.

Before you can begin to save and invest, your monthly income must exceed your monthly expenses. Therefore, you need to know your expenses — in detail — relative to your income, whether they are too much (given your financial goals), and how you can reduce them where needed to increase your savings and investing potential.

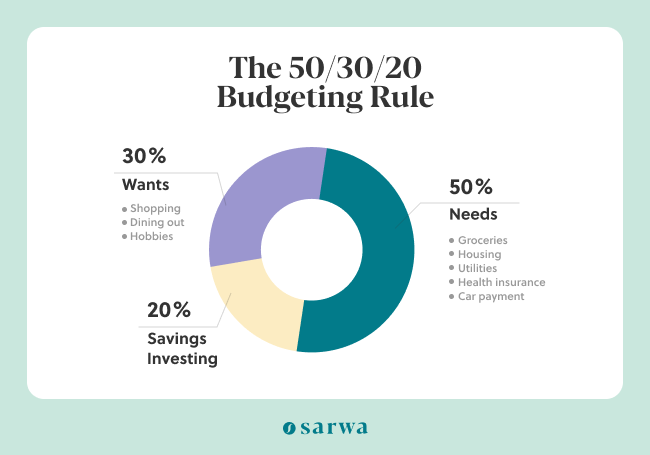

A good budgeting system to start with is the 50:30:20 approach. Here, 50% of your monthly income goes to basic needs (housing, food, clothing, utilities), 30% for wants (vacations, eating out, etc.), and 20% for savings and investments.

Source: Mint Notion

Some people who desire to retire early (the financial independence retire early movement) often use an approach where their savings and investments represent between 40% and 70% of total monthly income (but this is considered “extreme savings”).

If your financial goals don’t require such extreme measures, stick to the 50:30:20 approach.

Nonetheless, remember that letting your money work for you requires that you earn more than you spend. Therefore, ensure you are saving enough money to meet your financial goals. “Budgeting your money is the key to having enough,” said Elizabeth Warren, the US Senator who popularised the 50/30/20 rule.

[To learn more about the 50/30/20 budgeting approach, read, “The 50/30/20 Rule: A Practical Budget That Works]

Once you have created a budget and decided on the portion of your income you will be saving, ensure you build the discipline to stick with it. There are certain hacks that can help you.

First, track your spending and keep comparing the amount spent with the amount budgeted. In this way, you will know when you are about to exhaust the amount you have budgeted for an expense. This is crucial to avoiding overspending.

Second, automate your savings/investing. We’ll talk more about investing in a bit. But in anticipation of that discussion, you can stick to your budget by automating your investing. As George Clason, the author of The Richest Man in Babylon said, “pay yourself first.”

Your expenses involve spending on other things and people; your investment is what you spend on yourself and you must do that first. A good way to do this is to automate your investing.

4. Pay off your debt and avoid new ones

If you have already accumulated debt at this point, you need to focus on paying it off before you can truly let your money work for you. Why is this important?

There are some debts (e.g. car loans, student loans) where your interest repayment is calculated on the debt’s outstanding balance. In that case, the faster you repay the debt, the lower the amount of interest you incur.

In these cases, it’s better to focus on clearing your debt before focusing solely on investing.

One option would be to split your savings into investments and debt payments, depending on projected investment returns and the current interest rates of your debts.

If your projected investment returns are higher, then you can feel confident to begin investing. If the interest rates of your loans are higher than projected investment returns, then adjust accordingly putting a heavier emphasis on paying down the high-interest debts.

When it comes to debt repayment, the debt snowballing method has worked for many people. Here, you start by paying off the smaller debts (while making minimum required payments on the others), gather momentum, and then pay off the larger amounts until you have cleared your debts.

Source: Ramsey Solutions

Again, if the interest on your debts exceeds the return on your investments, focus on using your savings (the 20% in the 50/30/20 rule) to pay off your debts first.

While paying off your debts, don’t acquire new ones. This is one of the reasons why preparing a budget is the best way to make your money work for you. It helps you put your expenses in check to avoid spending beyond your means. Stick to your budget.

“Every time you borrow money, you’re robbing your future self,” said Nathan Morris, author of The Art of Getting Money. The money you will use to repay debt is money you could have invested in your future self.

5. Set up an emergency fund

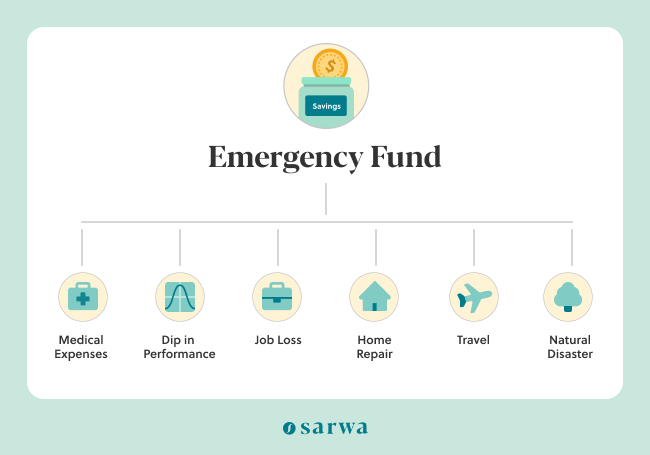

One way to avoid new debts is to have an emergency fund where you can take money to meet unexpected expenses.

An emergency fund is a stash of money put aside to cater to unplanned expenses (a car repair, for example) and unexpected circumstances (job loss, uninsured medical situations).

Most of the debts people incur are the result of some unplanned expenses or circumstances. However, instead of borrowing (at a usually high interest rate) to meet those emergencies, an emergency fund allows you to overcome them with the cash you have saved up — with no interest payments to a lender.

Before you let your money work for you through investing, set up an emergency fund equal to six months of your living expenses (your basic needs or your basic needs plus wants, as per the 50:30:20 budgeting approach). If your monthly living expenses amount to AED 7,000, for example, you’ll need AED 42,000 in your emergency fund.

Why should this take priority over investing?

If an emergency arises, and you don’t have an emergency fund, you may have to sell your investments when the market is on an uptrend (and miss all those gains) or on a downtrend (and take a loss on your investment).

Which should come first, paying off your debt or setting up an emergency fund?

It’s best to set up your emergency fund in part (maybe three months of your living expenses) before cutting down your debts (you will still have to make minimum required payments on all debts). This is because if you focus solely on paying off debt and an emergency arises, you will still have to take on more debt.

Once you have some money in your emergency fund, focus on paying off your debt (with the debt snowballing approach) and come back to complete your emergency fund.

[For everything you need to know about emergency funds, read “How To Start An Emergency Fund That Is Right For You”]

6. Embrace passive investing

Once you have saved enough in your emergency funds, it’s time to start investing. Every step that has come before is so that you can get here. Investing is the difference between making money (your money doing the work) and earning money (from your own labour).

Remember that the advantage of learning how to make money work for you is its ability to generate compound returns over time. The way money does that is through investing.

There are two broad approaches to investing: passive investing and active investing.

While the latter focuses on beating the market (earning more returns than the market), the former focuses on tracking the market’s performance (matching the returns of a given index).

To beat the market, active investors incur more fees and pay more taxes. Moreover, they have historically proven to fail to beat indexes — even underperforming the market in many cases.

In contrast, passive investors aim to match the market’s performance while enjoying lower fees, lower taxes, more diversification (risk is minimised and return maximised), and greater transparency.

Another plus is that passive investing helps you overcome that great enemy of investors — your emotions. Instead of constantly monitoring the market and making rash decisions (which is common in active investing), you focus on the long-term as your portfolio tracks the market’s performance.

Warren Buffett was so confident that passive investing is better than active investing that he placed a bet of $1 million in 2007 that the S&P Index 500 will outperform Protege Partners’ collection of hedge funds over a decade. And he won the bet in a grand style (7.1% returns compared to 2.2%).

The friendly spectacle has come to symbolise that patience and passive investing pay off.

For the passive investor, ETFs (exchange-traded funds) are the assets of choice. In essence, ETFs are low-cost, very liquid (they sell like stocks on the stock exchange market), and provide better opportunities for broad diversification, which is our next step.

[For more on the differences between active and passive investment, read “Active and Passive Investment: Which Strategy is Best For You?”]

So, instead of incurring high fees in an attempt to make high returns (and failing), it’s better to automate your investments by committing 20% of your monthly income (or more) into a passive-managed diversified portfolio.

Sarwa, a digital financial advisor, will create a diversified portfolio (that matches your risk tolerance and time horizon), that is best suited to achieve your financial goals using the Modern Portfolio Theory. You can then automate your investment into this portfolio every month to avoid spending your savings/investment on something else.

In addition, to benefit from passive investing, you must invest for the long term. “It’s not how much money you make, but how much money you keep, how hard it works for you, and how many generations you keep it for,” said Robert Kiyosaki, author of Rich Dad, Poor Dad.

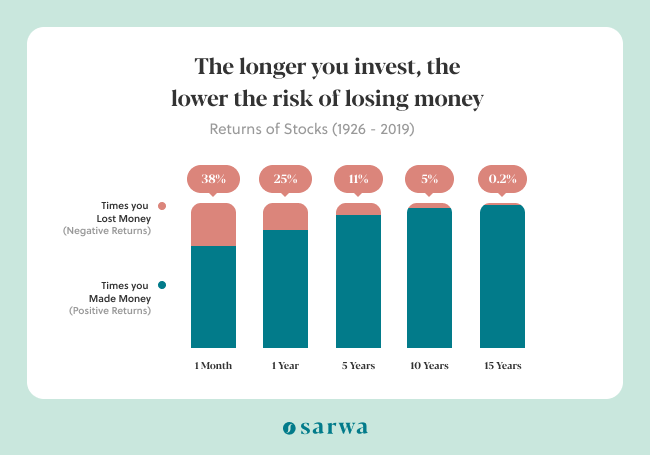

In other words, if you want to let your money work for you, you must give it time to grow, enjoying compound returns over the years. The longer your money stays in the market, the more money you make and the less the risk of losing your money.

S&P 500 data collected by Morningstar, a financial education and empowerment website, between 1926 and 2019 shows that the longer you stay in the market, the more returns you earn and the less the risk of losing your money.

This is why Buffett said that “if you aren’t willing to own a stock for 10 years, don’t even think about owning it for 10 minutes.”

Let’s take an example to illustrate his point. Suppose you invested AED 10,000 in the S&P 500 Index, an index that covers the 500 largest US companies ten years ago, is now worth AED 32,008 (at the time of writing). That’s extra AED 20,008 made just by leaving your money alone in a passive fund for the long term.

The best way to make your money work for you is to accumulate it in a passively-managed diversified portfolio for the long term.

7. Build a diversified portfolio

To let your money work for you, it’s good to invest in a passively-managed fund (ETFs) for the long term. However, in addition to keeping a long-term focus, it’s also important to ensure the portfolio is well diversified.

Why is diversification important?

When you put all your eggs in one basket, the loss of that basket means the loss of all your eggs. However, if you spread your eggs in multiple baskets, the loss of a basket is not as tragic.

It’s the same with investing.

If all your money is in one asset, the loss of that asset will be tragic. However, if your money is in multiple assets, the loss of one won’t be as tragic.

To minimise your risk, ensure you are investing in a diversified portfolio that includes various assets that don’t move in the same direction (assets that are not positively correlated). You can invest in different asset classes (stocks, bonds, REITs, bitcoin), markets (US, developed, emerging), market cap (large, mid, low), industries (finance, health, consumer discretionary, etc).

“You must be diversified enough to survive bad times or bad luck so that skill and good process can have the chance to pay off over the long term,” said Joel Greenblatt, co-founder, Gotham Funds, commenting on how diversification reduces your risk. In fact, without diversifying, you are “literally throwing out money,” according to Jeff Yass, co-founder, Susquehanna International Group, a trading and technology firm.

In addition to minimising risk, diversification can also maximise your returns. We studied three types of portfolios based on their level of diversification and found that the most diversified also provided the most returns.

The first is the S&P 500 which contains the 500 largest US stocks; the second is the Mod Risk portfolio which includes US stocks (40%), global stocks (30%), and high-quality global bonds (30%); the third is a Thurn Mod Risk portfolio, “a portfolio globally diversified across multiple asset classes including stocks, bonds, real estate, and commodities.”

As the chart below shows, the third (the most diversified) outperformed the second and the second outperformed the first.

So, if the S&P 500 can give you extra AED 20,008 over 10 years, imagine what a broadly diversified portfolio can do to minimise risk and maximise returns. In learning how to make money work for you, you must invest in such a broadly diversified portfolio for the long term.

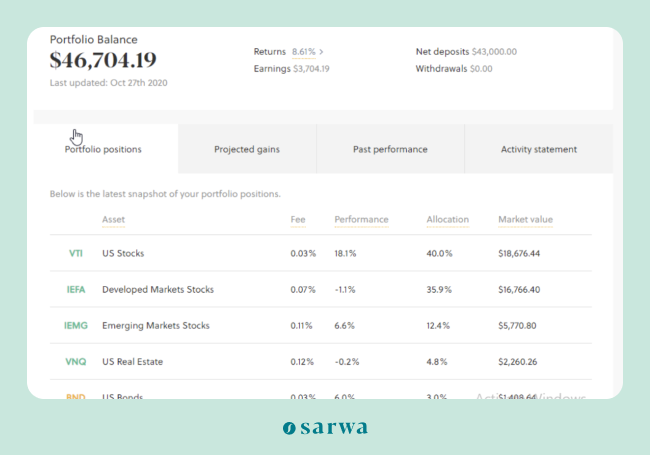

Below is a sample broadly diversified portfolio of ETFs provided by Sarwa:

It is diversified by asset class (stocks, REITS, and bonds), market (developed market, emerging market, US, global market), market cap and industry (within each stock ETF).

[For more on what diversification is all about and its benefits, read, “Learning The Importance of Portfolio Diversification Can Prevent Huge Loss. Here’s Why.”]

8. Make passive income

Another way to let your money work for you is to earn passive income from it. Earning passive income is the best way to see the difference between making money and earning money.

“The key to financial freedom and great wealth is a person’s ability or skill to convert earned income into passive income and/or portfolio income,” said Robert Kiyosaki.

Basically, passive income is income you earn from work that you have done once for all (requiring only little time and attention here and there). As it should be evident, investing in a passive fund is a primary and best way to earn passive income.

However, there are other ways outside of traditional investing to earn passive income: selling digital products (e.g., books, courses, apps), affiliate marketing, dropshipping, content creation (monetising articles or video content).

These passive income sources sure require some initial outlay of work (and some maintenance work here and there), which makes them different from get-rich quick schemes. Nevertheless, their passivity comes from the fact that once they are set up, you can earn money from them even while sleeping. The money you have spent setting them up keeps bringing in more money over many years.

In learning how to make money work for you, also consider these passive income sources.

9. Stick to your financial plan

Just as you require discipline to invest for the long term, you also need it to stick to your financial plan.

“If you have what you want in mind, everything that you invest in should be working to push you further toward your goal,” said Tiffany Welka, financial advisor at VFG Associates.

Once you have set out your goals (step 1) and outlined the plan of action to achieve them (based on the other steps above), ensure you stick to that plan of action.

You will always find someone peddling the latest get-rich quick scheme (dressed up with nice words, of course) or investment scam. These are always tempting because of the returns they promise. But always remember that there is another side to return: risk. Overlooking risk is the reason many people end up losing money to these schemes.

To avoid losing your money, stick to your financial plan and be patient as you walk towards your financial goals. As Charlie Munger said above, “you need to keep raw, irrational emotion under control.”

10. Use an online financial planner

Ask anyone who has invested before and they’ll quickly agree that our emotions are one of the top obstacles to creating wealth.

On one hand, we don’t want to lose money; on the other, we want it to grow as fast as possible. No wonder Warren Buffett has often said that temperament, not intellect, is the most important quality for an investor.

Consequently, we often make poor decisions when our emotions get the best of our intelligence. This is why in learning how to make money work for you, you must master your emotions.

One way you can avoid putting emotions above your intellect is to use a digital financial advisor. While a digital financial advisor cares about your money, they are not subject to the emotional roller coaster that so often leads investors to losing money.

[For more on how a digital financial advisor can help you and how to choose one, read “8 Things To Consider When Choosing a Digital Financial Advisor in Dubai”]

A digital financial advisor will help you create detailed action plans to help you achieve your financial goals. Instead of focusing on what is happening daily in the market, they help you develop a long-term perspective.

They can also help you plan for retirement, create an investment plan, achieve tax efficiency, and plan your estate, among other things.

Furthermore, digital financial advisors, unlike traditional ones, are more cost-effective and accessible, providing personalised solutions that will help your unique situation.

Do you need a digital financial advisor in Dubai that can help you achieve your financial goals? At Sarwa, we’ll work with you to create a diversified portfolio of ETFs that will minimise your risk and minimise your returns and help you achieve your goals.

Schedule a free call with a Sarwa Wealth Advisor and we’ll help you make your money work for you.

Takeaways

If you don’t want to work all your life, you need to start making money while you sleep. To do this, you need to:

- Have concrete goals, educate yourself about money, and create (and stick to) a budget.

- Before investing, pay off your debts and start an emergency fund.

- Embrace passive investing by investing in ETFs

- Create a diversified portfolio where your money grows with maximum returns and minimum risk over the long term.

- Make passive income through non-investment sources like content creation, affiliate marketing, etc.

- Stick to your financial plan, don’t be moved by the latest fad.

- To keep emotions under control and get your finances in order, use a digital financial advisor.