Whether your goal is to enjoy many of the luxuries scattered across the country (desert safaris, yacht cruises, private air charters, luxurious resorts, and shopping) or to attain financial independence as soon as possible, you will find that learning how to make money online in the UAE is a helpful skill.

While personal finance professionals tend to focus on cutting down your expenses to save money, there is also a need to emphasise the other side of the equation – increasing your income.

Perhaps you have tried all you can to cut down expenses but still can’t afford the life you want or enjoy the freedom you desire. In that case, it’s time to focus on increasing your income.

Of course, you can increase your income by changing jobs, requesting a bigger salary at work, improving your skills, or expanding your business.

However, in this article, we’ll focus on how to make extra money in the UAE in addition to your salary or business income.

A higher salary is good but as Warren Buffett has famously said, “Never depend on a single income. Make investments to create a second source.”

Multiple streams of income do not just help increase your total income, they also help to diversify your risk. If someone with three sources of income loses their job, the other two can support them in the meantime.

In this article, we will highlight how to make money online in the UAE in 9 simple and effective ways.

[Do you want to better manage your money and build wealth from the stock market? Subscribe to Sarwa’s Newsletter today for expert personal finance and investing strategies.]

1. Freelancing

Freelancing allows you to earn extra cash from the comfort of your home using your professional skills.

Unlike a salaried job, freelancing typically operates on a contract-by-contract basis, which allows you to work with multiple clients and choose the projects you are interested in. This feature also makes it easy for you to keep your day job while freelancing as a side hustle.

Some of the most sought skills by employers of freelancers (or gig workers) include website development, AI services, video editing, social media content and management, and mobile app development, according to Forbes.

Other popular skills include digital marketing, virtual assistance, UX design, and data analytics.

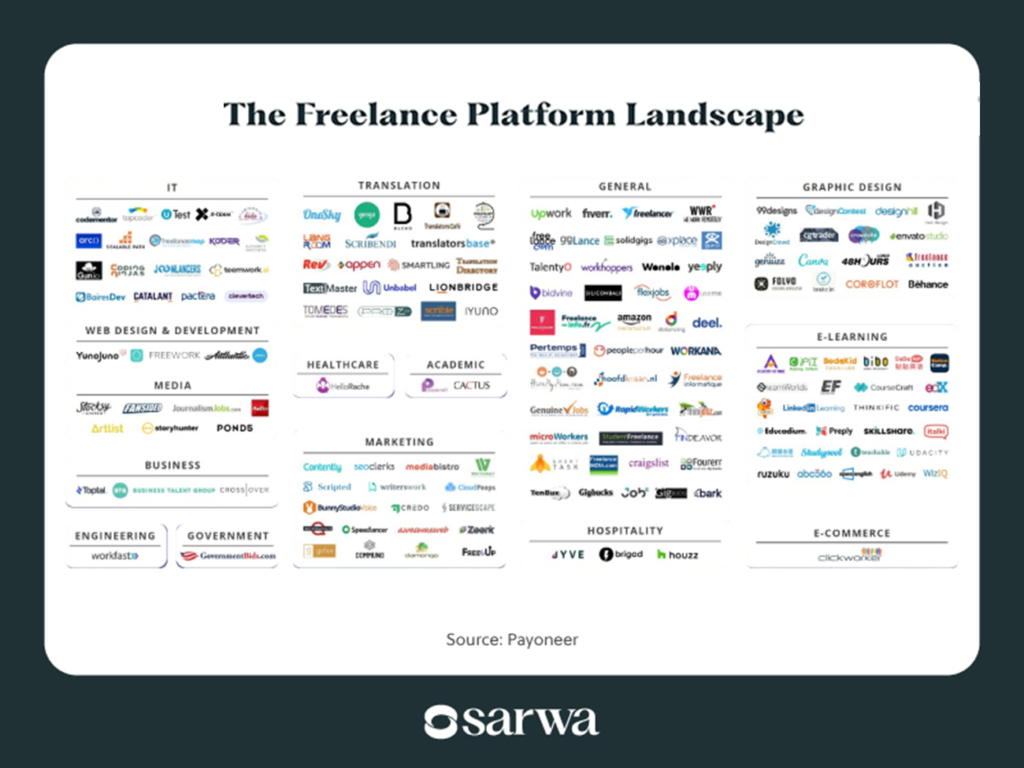

Freelancers and their employers can easily connect on freelance platforms, of which Upwork, Fiverr, PeoplePerHour, Toptal, Guru, and Freelancer.com are some of the most popular.

In addition, there are freelance platforms that focus on one category of freelancers. For example, CloudDevs focuses on developers and designers while ProBlogger specialises in freelance writing gigs.

If you have any of the skills in demand on these platforms, you can create an account, showcase your skills through a portfolio of previous works, and then bid for freelance work. You can do all of these on the weekend or after work hours on workdays.

Some have found permanent online jobs or remote work while working with clients on these platforms and some have created their own businesses offering their skills outside freelance websites.

2. Blogging

Blogging is one of the oldest means of making money online. It involves consistently writing about a subject matter or related subject matters, drawing in an audience of loyal readers, and then profiting from the traffic and loyalty generated.

You can make money through Google advertising, sponsorships (companies reaching out to you directly), paid memberships, the sale of digital courses, affiliate marketing (selling other people’s products through an affiliate program), and guest blogging (businesses and other bloggers paying to write on your blog), among others.

The major challenge with blogging is getting traffic and converting that traffic to loyal readers.

Doing this requires consistent publishing but you must also choose the right niche. Blogging about everything might sound nice but it makes it difficult for you to be seen.

“A niche focus is crucial for success in blogging because it allows you to build a loyal following, establish yourself as an expert in your field, and monetise your blog,” said AIContentfy, a search engine optimisation (SEO) platform.

Health and fitness, personal finance, fashion, lifestyle, business and marketing, technology and gaming, and travel are the most popular blogging niches, according to WPBeginner, a WordPress training website.

However, don’t underestimate the power of operating in a less popular niche (people have been successful blogging about pets, parenting, marriage, bodybuilding, etc.) if you can consistently produce (and market) quality content.

3. Selling digital products

If you are unsure you can be consistent enough to be a blogger, Youtuber, or influencer, you can create digital products instead.

Though it requires significant time investment initially, once created, the digital product will continue to make money for you even while you are not doing anything.

Digital products include ebooks, video tutorials, online courses, audiobooks, and stock photos.

If you don’t have the time to create your audience and sell products to them, you can sell them on third-party online platforms that will charge a little commission on sales. For example, you can sell ebooks on Amazon KDP, online courses on Coursera or Udemy, audiobooks on Audible, and stock photos on Canva.

Finding digital product ideas should not be difficult. Just ask yourself what skills you currently have that someone out there will pay to learn. It can be something as formal as how to create an e-commerce website or as informal as how to take care of your dogs.

4. Paid online surveys

If you want to learn how to make money online in Dubai without investment, you should consider completing paid online surveys.

Businesses, academic institutions, market research agencies, NGOs, and government agencies need people’s opinions for various reasons. Nowadays, they have realised that paying people to give their opinions and complete surveys is a good way to improve completion rates.

You can make money by completing surveys that apply to you on any of the legit survey websites.

Swagbucks, KashKick, SurveyJunkie, SurveySavvy, OpinionOutpost, FocusGroups.com, and InboxDollars are the top 7 paid survey platforms, according to Time Magazine. (Some of these websites also pay for ad views, data entry, app reviews, etc.)

You can get paid through PayPal, gift cards, and local bank transfers. In most cases, there is a minimum amount you must earn before you can request a payout.

5. Online tutoring

If you have a good grasp of any of the popular academic subjects (Maths, English, Physics, Economics, etc.), you can earn extra cash online teaching others. You will be surprised at how difficult some people find what is simple and easy for you.

Tutor.com, TutorOcean, Wyzant, Varsity Tutors, and Preply are among the popular global tutoring platforms.

In addition, you can join UAE-based platforms like Time Tutors, Concept Tutors, and Instaclass.

With a strong internet connection, a good camera, and a microphone (and a whiteboard if needed), you should be ready to tutor students online and earn money doing it.

6. Dividends from long-term investing

Now let’s focus on how you can earn extra money online through the financial market.

The first is earning dividends (passive income) from your investment portfolio.

Dividends are the portion of a company’s income that they distribute to their shareholders. While it is not compulsory to pay them, many companies do. They are usually paid every quarter (once in three months, 4 times in a year) though some companies prefer to pay them monthly or annually.

Source: Kenyan WallStreet

If you have dividend-paying companies in your portfolio, then you can earn consistent income at least every quarter.

Investors who place great value on passive income from investing follow a dividend investing strategy where they prioritise companies with a good history of dividend payments when constructing their portfolios.

In addition to dividend stocks, you can also invest in fixed-income securities like government and corporate bonds that pay interest twice a year.

If you are a passive investor and want to earn passive income from your investment in the UAE, you can sign up for Sarwa Invest. During the sign-up process, you will have the option to choose to withdraw your dividends or have them reinvested.

If you choose the latter, you allow your interest to gain interest via compounding without any additional effort since Sarwa will automatically reinvest all your dividends.

Active investors who are either short or long-term investors can sign up for Sarwa Trade and create their portfolios by buying stocks, ETFs, crypto, and REITs. If you belong to this category, you will also have the option to withdraw your dividends as soon as they are paid.

7. Social media influencing and marketing

There was a time when only celebrities were influencers. Social media has now democratised influencing such that you don’t need to be popular in real life before you can become an influencer on a social media platform.

We now have mega (more than 1 million followers), macro (between 100,000 and 1 million followers), micro (1,000 – 100,000 followers), and nano (less than 1,000) influencers.

Influencers make money advertising the products and services of businesses, either implicitly (indirectly) or explicitly (directly). They are either paid for every post about the business or a fixed amount every month (or year).

Like blogging and “YouTubing,” social media influencing also thrives on niching. Some focus on Instagram and TikTok (especially lifestyle, food, and travel influencers) while others prefer Twitter (crypto enthusiasts, for example).

In addition to niching by platform, you can also niche by topic – relationships, crypto, Forex, lifestyle, food, travel, etc.).

Social media influencing requires consistently producing content, engaging with content, and relating with other people in the niche.

There is another way to create an income stream on social media: marketing. If you understand social media very well, you can help businesses who are just opening up their accounts or those who have not had any success.

Navigating social media is not very easy for older business persons. With your skills (content creation, graphic designing, advertising, marketing, public relations management, etc.), you can help them get greater brand visibility, engage with current customers, and gain new customers.

If you are up for this, you can start a social media management business. Send pitches to businesses around you who are not on social media and those who are there with no results.

Once you can produce good results for one company, getting more companies on board will become easier.

You can then expand to be a digital marketer by including email marketing, Google and Facebook advertising, analytics and reporting, among others, in your service offerings.

8. Starting a YouTube channel

Perhaps you are not the text or article kind of person and you prefer talking to writing. Well, you can still learn how to earn money online in Dubai by starting a YouTube channel.

Many people across the globe have changed their fortunes and that of their families through YouTube. They have created successful channels reviewing gadgets, tutoring academic subjects, teaching about cryptocurrency, reviewing books or movies, and creating comedy skits. With YouTube, the potential is endless.

Though “YouTubing” might be more expensive to start than blogging, you can always start small and then grow from there. Remember that every expert was once a beginner.

Again, the key is selecting a niche (something you are passionate about enough to do consistently), producing quality video content in that niche, and marketing your channel. You might also invest in getting a shoutout from a bigger channel.

YouTube like blogging also requires consistency. Moreover, the goal should also be to create loyal subscribers who will consume and share your content.

9. Trading financial assets

The last on our list of how to make money online in the UAE is trading financial assets like stocks, ETFs, REITs, and cryptocurrencies.

While long-term investors can only earn income when a dividend is paid, usually once every 3 months, traders can make money hourly, daily, and weekly, depending on their trading strategy.

Also, the income you can make relying on dividends is determined by how much dividend the stocks you hold are paying in a particular quarter or year. Your income in a year might be 6% of your total investment.

In contrast, your online earning from trading is determined by your trading strategy. Some traders can do a 200% return in a year and some can do a 500% return. It’s all up to your expertise.

The US stock market has the highest market cap, liquidity, transaction volume, and listed companies. It has provided and still provides the biggest opportunity for people across the globe to make money.

If you are in the UAE, you can make money trading US stocks, ETFs, and REITs (in addition to cryptocurrency) on the Sarwa Trade platform.

Sarwa Trade is easy to use, intuitive, regulated (by ADGM Financial Service Regulatory Authority), and safe (secured with 256-bit bank-level encryption).

Transfers from and to your local bank accounts are free and your deposits are completed immediately. We only charge the lower of $1 or 0.25% of the value of your trade, which is lower than the average brokerage fee charged by stock brokers.

You can start trading on Sarwa Trade with just $1 and you can buy and sell fractions of all the investment assets available on the platform.

[Do you want to create an alternative source of income by trading financial assets? Sign up for Sarwa Trade for cost-effective, accessible, secure, and seamless trading of stocks, REITs, ETFs, and crypto.]

Takeaways

- In addition to saving money by reducing your expenses, you also need to increase your income.

- By creating multiple sources of income through online business, you can increase your income and also diversify your income risk.

- The ways to make money in the United Arab Emirates (Dubai, Abu Dhabi, or any of the other emirates) include selling your skills on freelance platforms or through digital products, building an audience via blogging, “Youtubing,” social media influencing, teaching academic subjects online, and completing paid surveys.

- You can also earn passive income from your long-term investment portfolios or “active” income from trading financial assets.