“Don’t put all your eggs in one basket.” This is advice you have probably heard in various circumstances. But when it comes to investing, this simple saying is the bedrock of understanding how the market can best work for you.

When all your eggs are in a basket, the loss of that basket can signal financial catastrophe. But if you have ten baskets (for example), then the loss of that one basket does not seem as fatal.

Knowing how to invest in the S&P 500 is one way to follow this advice. Instead of investing in only one company (one basket), what if you could invest in 500 of them such that the failure or poor performance of one does not spell doom for your entire investment?

This is called diversification – and that is exactly what the S&P 500 excels at offering.

In this article, we will explain what the S&P 500 is all about, why you should invest in it, and how you can do so. We’ll cover:

- What is the S&P 500?

- How to invest in the S&P 500

- Why should you invest in the S&P 500?

- Why not only invest in the S&P 500?

- Start investing in the S&P 500 in the UAE

[Do you want to know more about how to build wealth by investing in the US stock market? Subscribe to Sarwa’s newsletter today for crucial resources and the latest market updates.]

1. What is the S&P 500?

The S&P 500 is a stock market index that tracks the performance of the stocks of 500 of the largest US companies. These stocks are traded on the New York Stock Exchange (NYSE), Nasdaq, and the Chicago Board Options Exchange (CBOE).

It includes popular companies like Alphabet (Google), Amazon, Apple, NVIDIA, Berkshire Hathaway, and less-popular ones like Eli Lilly and Co., UnitedHealth Group incorporated, and Merck and Co.

Given that the S&P 500 covers about 80% of the total market cap of US equities, it is often used as the measure of the performance of the entire American stock market (a role also played by the older Dow Jones Industrial Average).

Consequently, mutual funds, whose aim is to outperform the market, use the S&P 500 index as the benchmark for market performance, against which they measure their performance.

S&P 500 historical performance

Data collected and analyzed by Trade That Swing, a financial education website, shows that the average annual return of the index between 1924 and 2024 is 6.59% without dividends and 10.57% with dividends.

If we focus on the last 20 years (2004-2024), the index has produced an average annual return of 8.39% without dividends, and 10.48% with dividends.

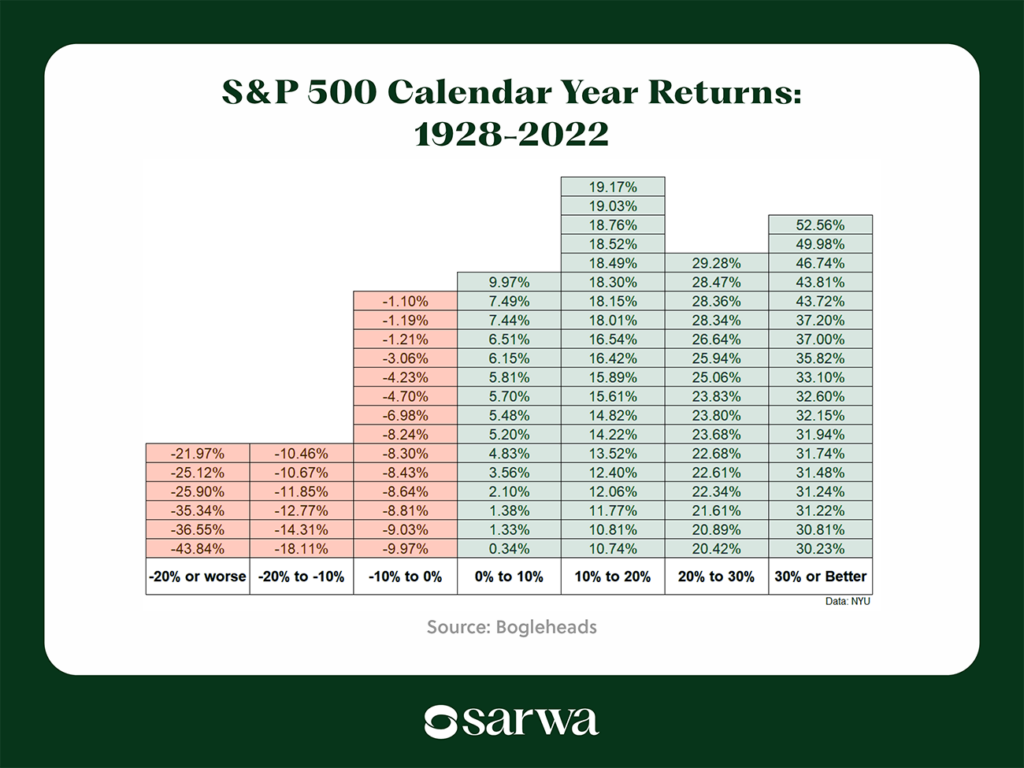

More interestingly, the S&P 500 index has more positive return years than negative return years, according to a survey by Bogleheads, an investment education website. As the chart below shows, there are 69 positive return years between 1928 and 2022 while there are only 26 negative return years.

In essence, the S&P 500 rises (72.6%) more than it falls (27.4%).

S&P 500 Calendar Year Returns: 1928-2022

Source: Bogleheads

(Disclaimer: Past performance is not a guarantee of future performance)

S&P 500 composition

The S&P 500 Index tends to contain stocks from all sectors of the economy. In order of their weight in the S&P 500, these are IT, financials, healthcare, consumer discretionary, communication services, industrials, consumer staples, energy, utilities, real estate, and materials.

Given that market capitalization changes as price and the number of outstanding shares change, the constituent of the S&P 500 index may change. The effort to reflect this change is called rebalancing and it is done every quarter (March June, September, and December).

Also, since the weight attached to each constituent depends on its market cap, rebalancing can cause the weight attached to a stock in the index to change.

For example, Microsoft was once the largest company in the world, which means it had the largest weight in the index. When Apple took Microsoft’s place, the former’s weight would increase while the latter’s would reduce.

2. How to invest in the S&P 500

Investing in the S&P 500 means getting exposure to the stocks that the S&P 500 holds. By investing in the S&P 500 index, you are tracking the performance of the index, which means your returns will mirror that of the index.

If you want to learn how to invest in the S&P 500 index, there are three options:

Buying individual stocks

You can choose to buy the S&P 500 stocks individually. That is, you can list out all the stocks that are in the index and start buying them one after the other.

While this option is viable, it is not efficient.

First, except your brokerage firm charges zero commission, buying 500 stocks can ramp up your brokerage fees.

Second, creating 500 buy orders is in itself a stressful and time-consuming exercise.

Third, unless your brokerage firm allows you to buy fractional shares (where you can buy a fraction of a share if you can’t afford a whole share), then you need a large capital outlay to invest in 500 of the largest US stocks.

Nevertheless, even with fractional trading, you have to go through the stress of calculating the weight you should assign to each of the 500 stocks to truly mirror the S&P 500 index.

Fourth, we have mentioned the importance of rebalancing the S&P 500 index every quarter. If you are buying individual stocks, you have to create buy and sell orders to rebalance your portfolio every quarter, a time-consuming, expensive, and stressful exercise.

Given the inefficiency of this option, it is better to consider deploying an index fund strategy or an ETF strategy.

Buying an S&P 500 Index Fund

An index fund is a basket of securities that mirrors the composition and tracks the performance of a stock market index.

The S&P 500 index is one popular index that many index funds mirror and track.

Fidelity 500 Index (FXAIX) is an example of an index fund that mirrors and tracks the performance of the S&P 500 index.

How does an index fund strategy differ from buying individual stocks?

First, when you buy a single share of an S&P 500 index fund, you already have exposure to all the stocks that constitute the S&P 500 index. The fund already mirrors the index so all you have to do is buy a share in the fund.

Second, since you only have to create one order to get exposure to the index, transaction costs are lower.

Third, you don’t have to worry about rebalancing; the fund handles everything.

Though you will pay management fees (in the form of expense ratio), the benefits of an index fund strategy (compared to buying individual stocks) far outweigh the cost (which is very low).

Index funds are also known as passive mutual funds. Thus, they operate like the typical mutual fund. You cannot buy and sell shares of an index fund during normal trading hours. Instead, you will wait until the close of the trading day and then buy or sell based on the fund’s net asset value (NAV).

Also, index funds are not required to disclose their holdings so you may not know what the fund holds at every point in time.

Finally, some index funds (like the typical mutual fund) have minimum investment requirements. That is, you must have a minimum investment capital before you can get started.

Buying an S&P 500 ETF

There is another way to invest in the S&P 500: buying an S&P 500 ETF.

Though there are passively managed (about 80% of all ETFs) and actively managed exchange-traded funds, we focus on the former (for reasons we will soon identify).

A passively managed exchange-traded fund is also a basket of securities like the index fund. When you purchase a share of an ETF, you have broad exposure to all the stocks that constitute that index.

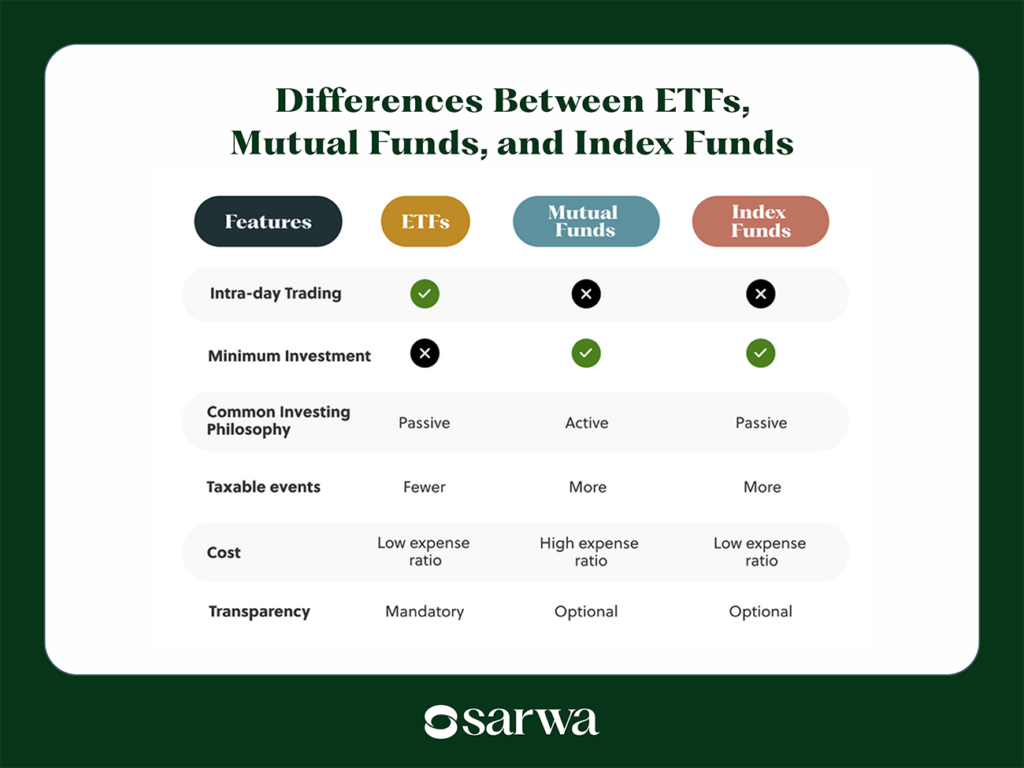

However, there are at least four key differences between the two:

- Intra-day trading: ETFs trade like individual stocks – you can buy and sell them during trading hours instead of waiting till the end of the trading day.

Consequently, the share price of an ETF changes with the market and you don’t have to wait till the end of the trading day for NAV adjustments.

The presence of intra-day trading means ETFs have more liquidity than index funds. That is, they are easier to buy and sell without significant changes in prices.

- Transparency: ETFs are required to be transparent about their holdings at every point in time. Index funds don’t have the same requirement.

- Account minimum: ETFs don’t usually have minimum investment requirements which makes them appropriate for beginner investors.

- Cost: Though it is possible to find index funds that are cheaper than some ETFs, in general, ETFs are the cost-effective option.

Differences between ETFs, mutual funds, and index funds

Vanguard S&P 500 ETF (VOO) is an example of an S&P 500 ETF.

On a final note, although index funds and ETFs try to mirror and track the performance of the index, they don’t always do this perfectly.

We mentioned above that the S&P 500 index has a YTD of 12.09%. In contrast, both FXAIX (S&P 500 index fund) and VOO (S&P 500 ETF) have returned 12.97% on their NAV.

This difference is often known as tracking error and it can be positive (as in this present case) or negative. This can result from various factors including management fees, how fast the fund mirrors changes in the index (or whether it does so at all), how dividend payment is managed, whether the fund has the same weight as the index, and drag (the time difference between receiving cash and reinvesting it), among others.

3. Why should you invest in the S&P 500?

Now that we have covered how to invest in the S&P 500, let’s spend some time considering why this makes sense.

The best way to approach this section is to listen to what some top investors have said about this matter.

Let’s start with one of Warren Buffett’s quotes. “In my view, for most people, the best thing to do is own the S&P 500 index fund,” he said. “The trick is not to pick the right company. The trick is to essentially buy all the big companies through the S&P 500 and to do it consistently and to do it in a very, very low-cost way.”

John Bogle, the founder of Vanguard Group, the second-largest provider of ETFs, agrees. In one of the popular investment quotes, he said: “Don’t look for the needle in the haystack. Just buy the haystack!” The haystack here refers to indices like the S&P 500 index.

Elie Irani, an information technology professional and founder of Wise Investor Middle East, also recommends passive index funds, in his interview with Sarwa. According to him, “An ‘average Joe’ has the ability to surpass over 90% of money professionals by investing in index funds.”

Why are investment experts recommending passive funds like the S&P 500 index? There are at least three reasons:

Poor performance of actively managed funds

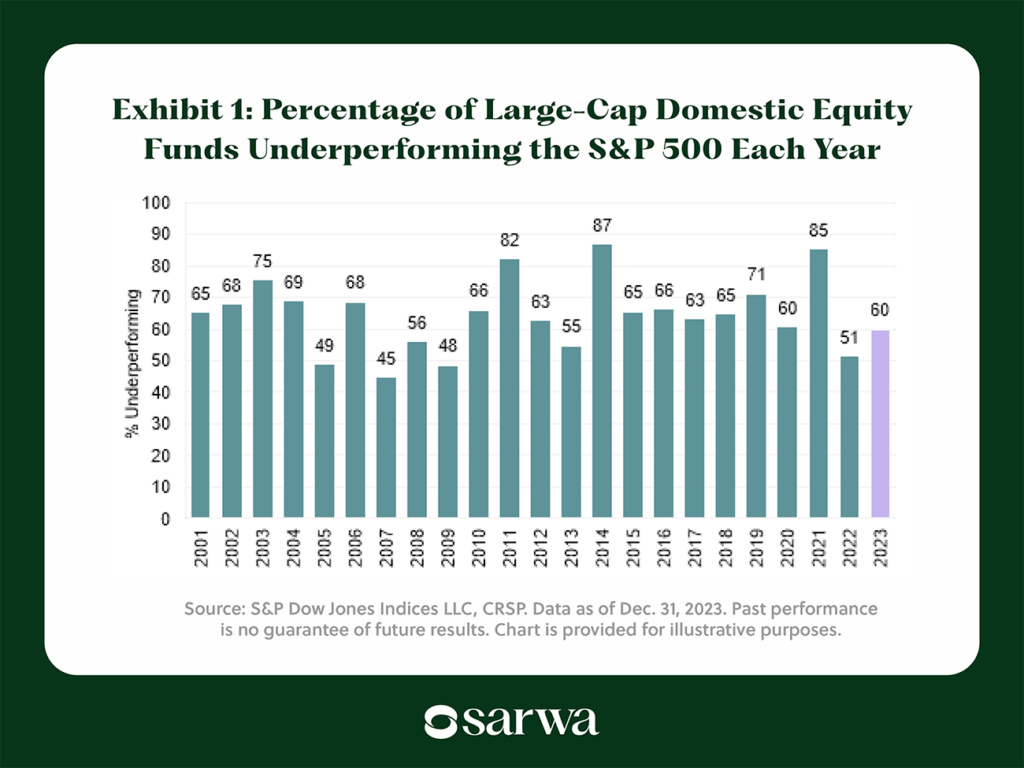

About 60% of large-cap domestic equity funds in the US underperformed the S&P 500 in 2023, according to the 2023 SPIVA report by S&P Global.

As seen below, this is not a recent phenomenon. As far back as 2001, 65% of these funds underperformed the index. Things were especially ugly in 2011, 2014, and 2021 when more than 80% of actively managed large-cap funds underperformed the S&P 500 index.

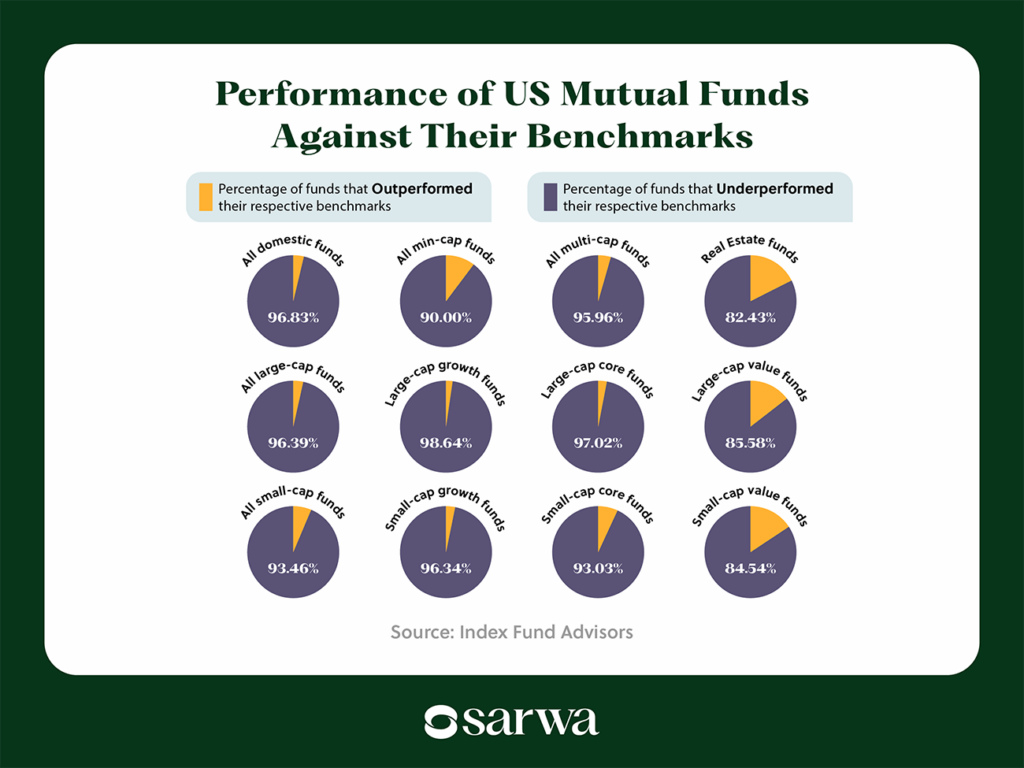

If you think the above is bad enough, consider that between 2004 and 2023, 96.83% of all actively managed funds in the US failed to outperform their benchmarks.

Performance of US Mutual Funds Against Their Benchmarks

Source: Index Fund Advisors

Yet, these funds charge higher expense ratios than index funds on the premise that they will outperform the market. For example, the average expense ratio of equity ETFs in 2023 was 0.15% while that of active funds was 0.42%, according to Investment Company Institute.

Why pay these higher fees when they can’t deliver on the premise that necessitated them?

As Buffett said, “When trillions of dollars are managed by Wall Streeters charging high fees, it will usually be the managers who reap outsized profits, not the clients.”

Given that even seasoned and experienced fund managers struggle to outperform indices like the S&P 500 index, it makes sense for the “average Joe” to stick to the S&P 500 Index. This is why Bogle said you should just buy the haystack instead of looking for the minute needle in it.

Diversification

We mentioned in the beginning that investors are charged to avoid putting all their eggs in one basket and that the S&P 500 index is one way to follow this rule.

Good companies can fail or underperform due to general economic conditions, industry issues, or internal issues. Therefore, putting all your investment capital on one or two companies can be disastrous.

Yes, these companies may turn out huge returns over certain periods. But the uncertainty of the market also means that they can stumble.

Warren Buffett said the first rule of investing is to avoid losing your capital. Therefore, before worrying about how much you can earn from picking one or two solid stocks, consider the risk of losing money that comes with having just two baskets.

Learning the importance of diversification can prevent huge losses. By putting your eggs in many baskets, you reduce your overall portfolio risk, as the Modern Portfolio Theory has shown. That is, the probability of one event wiping your portfolio out reduces.

One way to diversify your portfolio is to invest in stocks across different industries. In this way, an event spelling trouble for the financial sector, for example, will not likely affect your stocks in the utilities sector and may only mildly affect your stocks in other sectors.

If all your stocks were in the financial sector, on the other hand, it could be catastrophic.

The S&P 500 index provides this sector or industry-level diversification. As we have seen, it contains stocks from 11 sectors of the United States which makes it less likely that an industry-level problem will cause you to lose significant amounts.

Low cost of passive funds

Even if active funds narrowly outperform their benchmarks, the spread between their expense ratios and that of passive funds can turn outperformance into net underperformance.

The competition among top passive fund providers like Fidelity, Vanguard, and iShares has led to rapidly falling expense ratios. FXAIX, the index fund we mentioned above, has an expense ratio of 0.015%. Actively-managed funds (mutual funds or ETFs) cannot compete with that.

4. Why not only invest in the S&P 500?

Given what we have said so far about the S&P 500, why not only invest in the S&P 500 and be done with it?

In one word: diversification. “How so? I thought diversification is one of the reasons for investing in the S&P 500 index.”

The S&P 500 provides one type of diversification – by sector or industry – but there are three other types:

- By asset class: An economic event can affect an industry but so can it affect the entire stock market. In periods of economic downturns, investors have found solace in bonds and gold.

Therefore, you can further reduce the risk of your portfolio by including other asset classes aside from stocks.

- By market or geography: Though economic downturns in the US can lead to downturns everywhere else, downturns can also be country-specific. In those cases, investing in other countries outside the US can help reduce risk.

Moreover, developed markets like the US have limited growth potential (they thrive more on stability) while emerging markets like South Africa, Brazil, and China, among others, can offer more significant growth (though with higher volatility).

Investors looking to maximize risk-adjusted returns can combine the stability in developed markets with the high growth of emerging markets.

- By market capitalization: In the same way, large-cap stocks are stable while providing moderate returns (in general). Low-cap stocks are more volatile but they can provide higher-than-average returns. Mid-cap stocks are in between – providing more stability but lower returns than their small-cap counterparts.

It’s obvious that the S&P 500 index only does not provide any of these. It focuses only on large-cap US stocks.

Therefore, while investing in the S&P 500 index can help to reduce risk, seeking broad diversification (by industry, market or geography, market cap, and asset class) can further reduce risk.

“The increasing concentration in the S&P 500 poses significant risks for investors seeking diversification,” said Garth Friesen, former CEO of III Capital Management, a hedge fund. “Investors can reduce risk and enhance their portfolios’ diversification by considering alternatives such as equal-weight S&P 500 ETFs, small-cap ETFs, and diversified large-cap international ETFs. Even Warren Buffett might agree.”

This is why a typical portfolio we provide for our passive investors at Sarwa includes:

- US stocks

- Developed markets stocks

- Real Estate Investment Trusts (REITs)

- Emerging markets stocks

- US bonds

- Global bonds

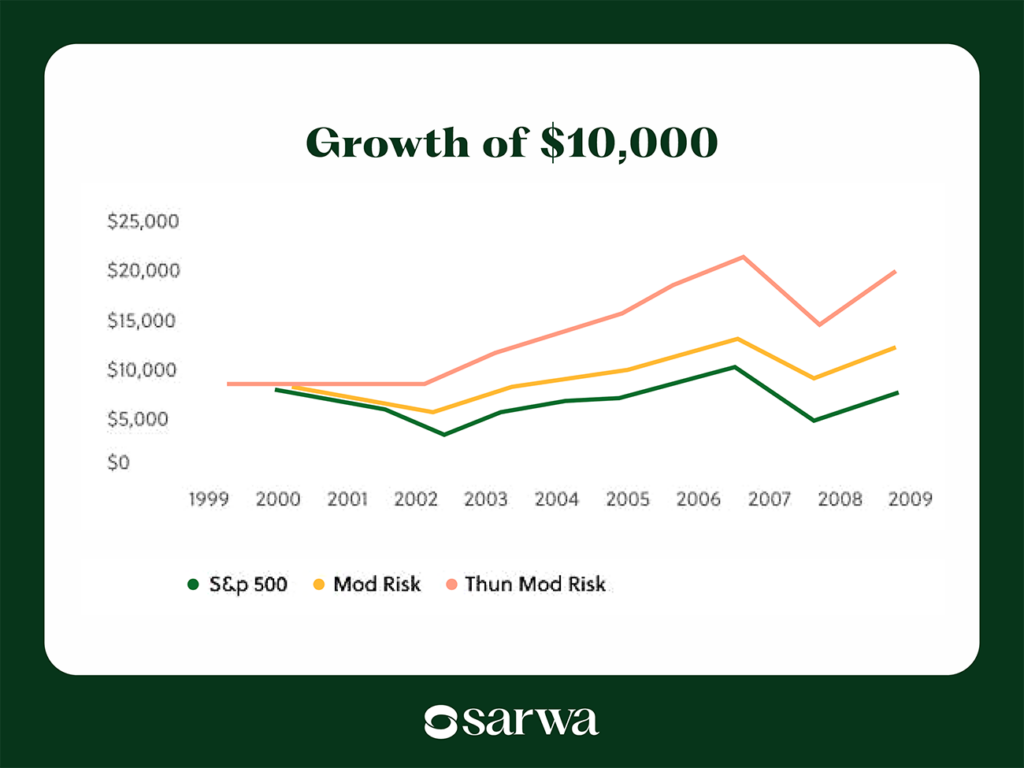

Interestingly when we compared this portfolio (Thun Mod Risk) with one that invests only in the S&P 500 and another portfolio (Mod Risk) that invests in US stocks (40%), global stocks (30%), and high-quality US bonds (30%), we found it to outperform them (based on 2000-2009 data) as shown below.

5. Start investing in the S&P 500 in the UAE

If you are in the UAE and want to enjoy the great riches that are available in the US stock market, the S&P 500 is one good way to start.

At Sarwa, we provide you access to the US stock market so you can build wealth in the largest, most liquid, and most diversified stock market in the world.

If you want to manage your portfolio yourself, you can purchase S&P 500 index ETFs by opening a brokerage account on the Sarwa Trade platform.

And if you prefer to achieve broad diversification, you can also invest in other ETFs that provide diversification by market cap, geography, and asset class.

On the other hand, if you prefer a hands-off approach, you can open an investment account on Sarwa Invest, our robo advisor.

With Sarwa Invest, we use technology and the latest insights in portfolio management to help you create a portfolio that matches your investment goals, time horizon (how far or close you are to your goals), risk tolerance, and risk capacity.

Sarwa Invest is especially useful as a retirement account. With it, you can get your retirement planning underway.

If you are a beginner and you are not sure of the most appropriate way to handle portfolio allocation among different ETFs, Sarwa Invest will help you get started by providing you with a personalized and customized portfolio designed to minimize your risk.

[What are you waiting for? Download the Sarwa App today and start your wealth-building journey with ETFs through Sarwa Trade or Sarwa Invest. ]

Takeaways

- Standard & Poor’s 500 (S&P 500) is a stock index that tracks the performance of 500 of the largest companies in the US stock market.

- You can invest in the S&P 500 index by purchasing individual stocks, buying an S&P 500 index fund, or buying an S&P 500 ETF.

- Investing in the S&P 500 index is a good option because it is inexpensive, provides diversification benefits, and overperforms most actively managed funds.

- Though investing in the S&P 500 alone provides some diversification benefits, broad diversification requires investing in other passive funds.