When uncertainties grip the stock market, one asset always shines through: gold. The shiny precious metal continues to serve as a hedge during economic downturns and uncertainties and a long-term store of value, and thus learning how to invest in gold in the UAE should be an important part of your investment journey.

As Trump’s trade policy continues to deepen economic uncertainty in the US and the global economy, investors across the globe have once again turned to the shiny asset.

Gold’s spot price reached a new all-time high (ATH) of $2,900 an ounce on February 10, 2025, crossed the $3,000 mark on March 18, and peaked at $3,163.25 on April 2. It is even more interesting that while the S&P 500 Index has fallen by 3.37% yield-to-date (at the time of writing), gold has produced an 18.53% rate of return already.

Learning how to invest in gold in the UAE can provide the protection that your portfolio requires in these uncertain times. But how can you buy gold in the UAE?

In this article, we will cover how to buy gold in Dubai, identify five options you can pursue, and how to decide between gold trading and gold investment in the UAE. We’ll cover:

- How to invest in gold in the UAE: 5 options to consider

- Gold trading or investing: Which should you explore?

- What moves the price of gold?

- How to start trading or investing in gold in the UAE

Do you want to learn more about how to build wealth through smart and focused investment? Subscribe to Sarwa’s Newsletter for regular investing insights, updates, and guides.

1. How to invest in gold in the UAE: 5 options to consider

If you are interested in protecting your portfolio like all other global investors, buying gold should be one of the options on the table.

Thankfully, there are many options you can explore as an Emirati. We consider five of them below:

1. Gold bullion

Gold bullion is tangible gold “that is officially recognized as being at least 99.5% and 99.9% pure,” according to Investopedia. They are valued mainly for their precious metal content rather than any artistic quality.

Investors and central banks usually purchase gold bullion as a store of value since gold’s price tends to be stable over the long term.

Gold bullion can come in the form of bars or coins.

Gold bars vary in weight, from smaller one-ounce bars to bigger kilo bars. On the other hand, gold coins, which are nationally minted (for example, American Golden Eagle comes from the US Mint), come in smaller denominations and are more liquid (easier to buy and sell).

Below is an example of a gold bar:

Sample gold bar

Source: Money.com

Below is the American Gold Eagle, which is an example of a gold coin:

Source: Wikipedia

Pros of buying gold bullion

- Tangibility: Have you met people who prefer real estate as an asset class to stocks just because the former is tangible (even though the latter provides higher returns)? The same logic applies here. When you purchase gold bullion, you have direct, physical access to your asset.

- Liquidity: There is a global demand for gold so finding a counterparty should not be difficult, especially for small-sized gold bars and gold coins.

Cons of buying gold bullion

- Illiquidity: Liquidity issues can arise with large gold bars (kilo bars). Since these are bigger and require larger storage space, finding a counterparty to trade with can be harder.

- Insecurity: Tangibility is good but it comes with security issues. Physical gold can be stolen if not properly stored.

- Storage fees: While storage in vaults and safes can make the loss of gold bullion less likely, there is a price to pay for that extra security. Storage fees add to the cost of owning gold, which consequently reduces the return on investment (ROI).

- Premiums: Gold bullion has price premiums that represent the extra work that was done to produce, package, and ship them. “Since gold coins and bars must be produced, packaged, and shipped, they can come with high premiums, especially if they’re rare or have historical significance,” according to CBS News.

Price premiums are especially higher for gold coins since they have higher demand, historical significance, and more sophisticated design.

- Transaction costs: Gold trading involves dealers that bring buyers and sellers together. These dealers also charge transaction fees that further add to the cost of owning physical gold.

- Additional stress: The hassle of taking physical delivery of gold and storing it can be inconvenient.

How to invest in gold in the UAE through gold bullion

If you are in Dubai, you can purchase physical gold through the following means:

- Dubai Gold Souk: This is a trading house located in Al Ras.

“Dubai Gold Souk has over 350 retailers trading tax-free gold of different carats, designs, and weights. There are also precious stones, strings of pearls, platinum, and silver available here,” according to Trip Advisor, a travel advisory platform.

Dubai Gold Souk

Source: Trip Advisor

- Other specialized bullion trading houses: Kanak House Bullion and IBV Gold are other trading houses where you can buy and sell gold in Dubai. The former is located in Business Bay while the latter has offices in Jumeirah Lakes Towers and Al Quoz.

Both trading houses also allow online gold trading in the UAE through their respective websites.

- Jewelry stores: Some gold jewelry stores also sell gold bullion. Some of these stores also have e-commerce websites where you can make online purchases.

2. Gold stocks

Gold stocks are the stocks of companies that mine, produce, deliver, and sell gold. Since these companies deal with gold, their stock prices will be positively correlated to gold’s spot price. Thus, exposure to these stocks is a form of exposure to gold.

In essence, buying gold stocks is similar to buying Real Estate Investment Trusts (REITs), which are the stocks of real estate companies, instead of physical real estate.

Gold companies operating in the UAE are usually privately owned which makes them unavailable to retail investors. In contrast, many US gold companies (Newmont Corporation and Wheaton Precious Metals Corporation, for example) are publicly listed, making it easy for retail investors to own them.

Pros of buying gold stocks

- No security issues: Stocks are financial assets so you don’t have to worry about physically securing your investment.

- Cheaper access: With gold stocks, there are no price premiums or storage fees. Though there are transaction costs, they tend to be lower than what gold dealers charge.

- Passive income: With physical gold, the only way to make money is price appreciation – sell the gold for a higher price. However, with gold stocks, you can earn passive income through dividends even while keeping ownership of your investment.

- Potential for higher returns: Gold companies can produce higher returns than the spot price of gold. For example, Alamos Gold Inc. has a YTD of 43.76% which is greater than the 18.53% YTD of gold.

Source: Google Finance

Cons of buying gold stocks

- No tangibility: To many people, buying gold in the form of gold stocks is a disadvantage. They want a gold investment in Dubai that they can see and touch.

- Market volatility: It is no longer news that stock prices are volatile. This remains a disadvantage that makes many investors cautious about them.

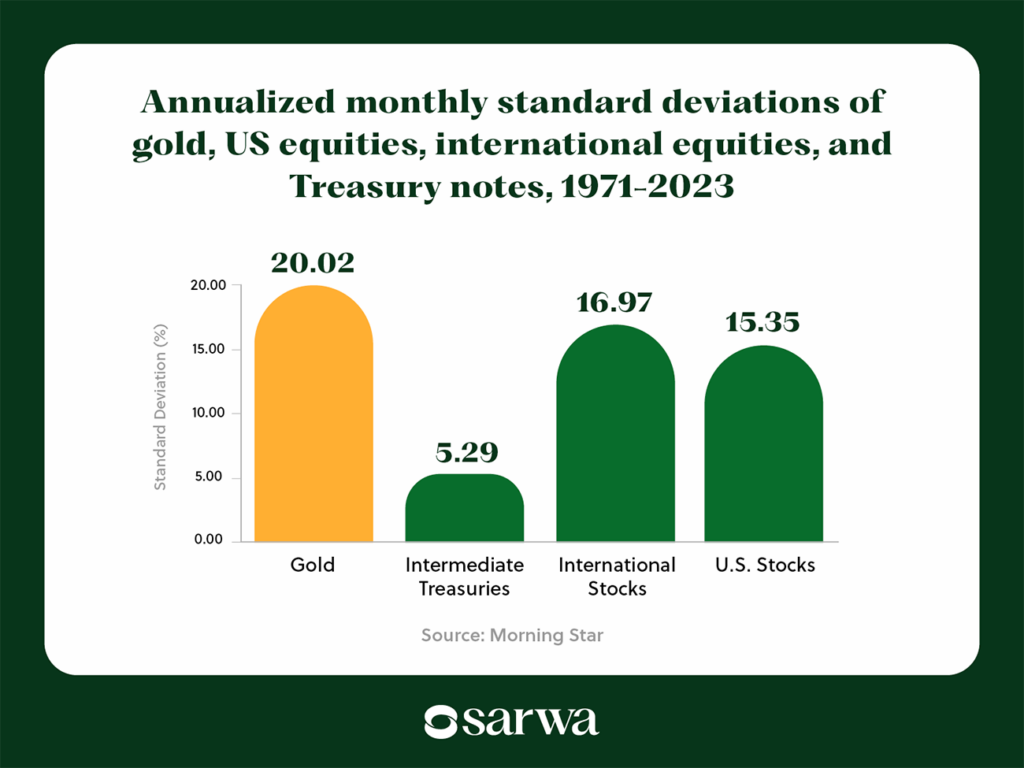

However, over the long term (between 1971 and 2023), gold showed more volatility than US equities, according to a study by Morning Star, a financial services firm. As the chart below shows, the annualized monthly standard deviations of gold exceed that of US equities, international equities, and intermediate-term Treasury notes.

Source: Morning Star

The point is that though stocks are volatile, they don’t, as a whole, seem to be more volatile than gold.

- Industry risks: Certain risks are peculiar to gold companies: environmental concerns, geopolitical tensions, high operational costs, regulatory issues, production disruption, etc. Any of these can result in unstable earnings which may cause stock prices to plummet.

- Difficult to diversify: The importance of diversification is how it helps minimize investment risks. However, diversification is more difficult with individual stocks. The transaction costs of purchasing 15 different stocks, for example, can be significant. Also, not all retail investors have enough cash to purchase a reasonable amount of shares in 15 companies.

How to invest in gold in the UAE through gold stocks

Since most of the publicly traded gold stocks are in the US, you will need a UAE broker that can provide access to international markets, especially the US.

Sarwa is such a company. By registering an account with them, you can purchase individual gold stocks in various US stock exchanges.

3. Gold mutual funds

Mutual funds can solve the problem of diversification associated with individual stocks.

Retail investors can own shares in a gold mutual fund which will have investments in many gold stocks and even in gold bullion.

Consequently, a single share of a mutual fund will represent exposure to tens or hundreds of gold stocks and will be correlated with the value of gold.

Pros of buying gold mutual funds

- Easier and more cost-effective diversification: With a single share of a mutual fund, you can gain access to hundreds of gold stocks. Though mutual funds charge high expense ratios, they may still be cheaper than the transaction fees needed to buy 15 stocks, for example.

- Professional management: Mutual funds are managed by experts, who can make decisions that will provide great value to investors.

- Potential for higher returns: The whole point of a mutual fund is the possibility that it can provide higher returns to investors than they could achieve by buying passive funds or managing their portfolios themselves.

Cons of buying gold mutual funds

- Underperformance: Mutual funds measure their success by comparing their returns to a relevant market index. If they outperform the index, they have succeeded.

Interestingly, various studies have shown that most mutual funds underperform their chosen indices. “The latest tally shows that 65% of actively managed U.S. large-capitalization mutual funds fell short of the benchmark Standard & Poor’s 500 stock index in 2024,” according to the Los Angeles Times, a US newspaper. “That’s worse than the 60% of funds that underperformed the benchmark in 2023, and a hair worse than the average rate over the last quarter-century.”

- Minimum investment requirement: Most mutual funds will require investors to have a minimum capital level before they can buy shares in the fund. This can be an entry barrier for many retail investors.

- High cost: Mutual funds are actively managed funds that try to outperform the market. In doing so, they buy and sell stocks regularly, leading to high operating expenses. These operating expenses are then passed on to fund owners in the form of high management fees.

- Illiquidity: Mutual funds, unlike stocks, cannot be traded during trading hours. Investors must wait till the end of a trading day before they can buy or sell new shares in the fund.

- Transparency: Mutual funds are not mandated to publish their holdings. Investors might therefore be unaware of the assets underlying their shares in the fund.

How to invest in gold in the UAE through gold mutual funds

There are no local gold mutual funds in the UAE.

However, investors who prefer to have gold investment in the UAE through mutual funds can do so by registering on platforms that provide access to US gold mutual funds like Franklin Gold and Precious Metals Fund and Invesco Gold & Special Minerals Fund.

Some of these platforms include Abu Dhabi Commercial Bank (ADCB) and Hong Kong and Shanghai Banking Corporation (HSBC), UAE.

Emirates NBD also has a gold investment account through which users can purchase gold without delivery of physical gold.

4. Gold exchange-traded products

There are two gold exchange-traded products: exchange-traded funds (ETFs) and exchange-traded commodities (ETCs).

Gold exchange-traded funds invest in gold stocks and derivatives (futures and options) rather than directly in physical gold. A share in a gold ETF reflects exposure to many gold stocks and derivatives but not to physical gold itself.

On the other hand, gold exchange-traded commodities invest in physical gold. Thus, a share in a gold ETC reflects exposure to physical gold itself. The gold ETC will be responsible for storage and shareholders can trade their shares for cash instead of for physical gold.

(Note: In popular usage, both gold ETFs and ETCs are referred to as gold ETFs)

Gold ETCs have become popular as an easy and cost-effective way to gain exposure to gold.

“In recent years, Gold ETCs are what investors have been flocking to,” said Akshay Iyer, Private Wealth Advisor at Sarwa. “They are simple, cost-effective, and very easy to access through global markets. And because the UAE doesn’t apply capital gains tax, there’s no tax event for when you sell which has made them especially popular here.

Unlike gold mutual funds, gold ETFs and ETCs are traded like stocks during trading hours so you can buy gold at market price. Also, their passive approach to investing leads to lower trading frequency which contributes to their cost-effectiveness.

Learning how to invest in gold ETFs and ETCs in the UAE is a good way to gain exposure to gold.

Pros of buying gold ETFs and ETCs

- Accessibility: Most ETFs and ETCs can be traded fractionally. That is, if you can’t afford to buy a single share, you can buy a fraction of a share (for example, 0.1 of a share). Retail investors with little capital can also invest in gold in this way.

- No minimum investment: ETFs and ETCs don’t require a minimum capital level for access. This fact also increases accessibility for retail investors.

- Low cost: Low trading frequency leads to low management fees.

- Liquidity: ETFs and ETCs are liquid as they can be traded during normal trading hours.

- Transparency: Exchange-traded products are mandated to publish their holdings. Investors can readily know what underlying assets they are exposed to.

- Diversification: ETFs make diversification easier and cheaper through lower expense ratios, access to more assets, and a wider range of diversification methods.

Cons of buying gold ETFs or ETCs

- Intangibility: Gold ETFs may not be attractive for investors who want tangible assets. Though ETCs solve this problem to some extent, by giving exposure to physical gold, investors still cannot see or touch the physical gold since they only own a share of it and it is stored with the ETC.

- Tracking errors: Though ETFs seek to mirror an index’s performance, they don’t do it perfectly. The difference between the ETF’s return and the index’s is known as tracking error. For some ETFs, the deviation may be high.

ETCs are also not free from tracking errors as the product’s return can deviate from that of gold.

How to invest in gold in the UAE through gold ETFs

In addition to gold stocks, Sarwa provides access to popular US gold ETCs like SPDR Gold Shares (GLD), iShares Gold Trust (IAU), and Goldman Sachs Physical Gold ETF (AAAU), among others.

5. Gold futures and options

Gold futures are contracts that allow you to buy or sell gold at a future date at predetermined prices. Futures are standardized contracts that can be bought or sold on exchanges.

The availability of leverage means that gold traders can control a large amount of gold with a relatively small initial investment. Upon expiration, these contracts can be settled in cash or physical gold.

Gold options are contracts that give you the right but not the obligation to buy or sell gold at a future date for a predetermined price (known as the strike price). There are two types of gold options: call (confers the right to buy) and put (confers the right to sell).

Both derivatives can be used to open a long or short position on gold prices.

For more on how options work, read “What is Options Trading in the Stock Market? All You Need to Know”

Pros of buying gold futures and options

- Leverage: When you are right, leverage can multiply your return on investment, allowing you to win big even with little capital.

- Liquidity: The derivatives market is very liquid; finding counterparties is not difficult.

- Risk hedging: As we saw above, the volatility of gold is up there with that of stocks. You can hedge against this risk with certain derivatives strategies.

Cons of buying gold futures and options

- Leverage: When you are wrong, leverage can amplify your losses. It is a double-edged sword that cuts both ways.

- Complexity: Investing in derivatives is more complex than investing in underlying assets. It requires specialized knowledge which many don’t possess.

- Volatility: The derivatives market is very volatile. In addition to the volatility of the underlying asset, the market is a hotbed of market speculators.

How to buy gold futures and options in the UAE

Dubai Gold and Commodities Exchange is a derivatives market available in the UAE. International brokerage firms like Interactive Brokers also provide access to US derivatives markets.

2. Gold trading or investing: Which should you explore?

Now that we have covered how to buy gold in Dubai, let’s consider the two types of people that buy gold: investors and traders.

There are at least three differences between gold investors and traders:

First is the time horizon of both.

Gold investors often have a long-time horizon and are more concerned about the value that gold provides for their overall portfolio – inflation hedge, haven, and diversification, among others.

Unlike gold investors, gold traders are more concerned about earning an income from the short-term fluctuations in gold price.

Source: DBS Bank

Second, investors are often concerned about the fundamentals of any gold asset they are evaluating while traders often prioritize technical analysis and short-term price movements.

Third, while investors can buy gold through any of the 5 methods above, traders are often limited to the liquid ones – gold ETFs/ETCs, gold futures and options, and gold stocks.

So, which one should you be? To begin with, there is no reason to choose. You can invest in gold as part of your overall long-term investing strategy, focusing on its hedging, inflation protection, and diversification qualities. But you can also earn regular income from the short-term price movements in the asset.

3. What moves the price of gold?

Both gold investors and traders should be interested in understanding what drives its price. For the former, the focus is on long-term factors that affect the price of gold, while the latter fixates on factors that drive short-term price fluctuations.

The first point to make is that gold’s price is mostly a function of demand rather than supply. This is because supply is relatively constant over time since it is difficult and expensive to mine new gold.

Constancy of supply is the main factor that makes gold a store of value. This is in contrast to fiat money whose supply can be arbitrarily increased by monetary authorities.

So, what drives the long-term demand for gold? There are four sources of demand, according to The Conversation, a global news platform: investment demand, technology demand, jewelry demand, and central bank demand.

Investment demand

There are five reasons why investors demand for gold:

Gold as a store of demand

Gold’s function as a store of value derives from its supply constraints (the supply of gold on earth is limited).

When the supply of an asset is limited and cannot be increased arbitrarily, it will tend to maintain its value over time. Said differently, its value cannot be eroded by increased supply and value will only depend on demand.

Gold’s success as a store of value can be seen in the following chart showing the upward trend in the price of gold since the 1970s:

The price of gold

Source: Economics Observatory

(Disclaimer: Past performance does not guarantee future performance)

Production of new gold from mines has been decreasing since 2000, according to Auctus Metals, a gold investment firm. Also, Provident Metals, an online precious metal dealer, predicts that gold mining will become unsustainable by 2050.

All of these suggest that gold will continue to maintain its function as a store of value.

Gold as a long-term inflation hedge

Assets that have a store of value also tend to provide a hedge against inflation.

Inflation is always and everywhere a monetary problem, said Milton Friedman, the Nobel-prize-winning Economist. His point is that it is only a constant increase in money supply that causes a consistent and high rise in the price level.

However, while the supply of fiat money can be increased by the central bank at any time, increasing the supply of gold is more difficult (mining is hard and expensive). And as we have seen, supply has been decreasing since 2000.

Therefore, when inflation is biting hard and fiat money is losing value, gold can maintain its value.

For example, when the inflation rate averaged 8.8% between 1973 and 1979, gold boasted a 33.5% average annual return.

However, gold was unable to justify its credentials as an inflation hedge during high inflation periods in the 1980s and the 1990s. Also, its return did not keep up with inflation in the aftermath of COVID-19.

So, is gold an inflation hedge or not?

“Some studies have found that gold can be an effective inflation hedge, but only over an extremely long time horizon of more than a century,” concludes Forbes (quoted above).

While gold should theoretically provide a hedge against inflation, empirical evidence seems to conclude that it does this better in the long run.

Gold as a deflation hedge

Investors also like gold because it can function as a hedge against deflation.

“Although it may seem counter-intuitive, gold can be as effective a hedge against deflation as against inflation; in fact, gold’s purchasing power is more likely to increase in deflationary periods than during inflationary eras,” according to Reuters.

During the Great Depression, “gold’s purchasing power increased substantially … as it had in previous deflationary eras.”

Gold as haven

Gold outperformed the S&P 500 in six of the eight recessions between 1973 and 2020, according to Jim Iuorio, managing director of TJM Institutional Services.

Gold during recessions

Source: Forbes

They also note that during the period of the Great Recession, gold prices increased by almost 50%.

Various studies compiled by the Economics Observatory, a platform that makes academic research accessible to policymakers and the general public, show that gold was a good safety net during COVID-19, has been a haven during global crises, and is also a safety net against economic policy uncertainty and unstable market conditions.

This is why “economic downturns” is often the answer to the question “when should I invest in gold?”

Gold and portfolio diversification

Modern Portfolio Theory suggests that when a portfolio contains non-positively correlated assets, its overall risk is reduced. Consequently, investors have embraced portfolio diversification as a good way to reduce risk and even increase returns.

As we have seen, when stocks struggle during economic downturns, gold tends to grow. For example, when stocks fell by 22% in 2022, gold still grew by 0.4%.

This negative correlation during economic downturns makes gold a good option for diversifying a portfolio and thus reducing its overall risk and volatility.

Technology demand

Gold’s malleability (can be shaped into coatings and wires), conductivity (can conduct electricity), and corrosion resistance make it an important raw material in the production of electronics, medical devices, spacecraft, and other high-tech machines.

Rising demand for these products can thus increase the demand for gold. However, there are two points to note. First, demand for some of these products (especially electronics) varies with economic performance, and times of economic downturns can result in lower demand. Second, as technology advances, a cost-effective gold substitute may be discovered, affecting the demand for gold.

Jewelry demand

About half of the demand for gold in 2024 was for the production of gold jewelry, according to the World Gold Council, an organization offering insights into the gold market.

China, the US, and India are the leaders in the global jewelry market. Since they are also global economic powerhouses, one can expect the jewelry demand for gold to be relatively stable.

Central bank demand

Central banks keep gold as part of their external reserves. This is another byproduct of its function as a store of value.

Political uncertainty can also lead central banks to increase their gold holdings.

“Russia’s invasion of Ukraine in February 2022, and the subsequent sanctions on Russia – especially the freeze of Russia’s foreign government bond holdings abroad – has highlighted the risk to governments of losing access to foreign currency holdings,” noted The Conversation. “It appears some governments or central banks reacted to this with increased gold purchases.”

As long as these four factors continue to drive demand upward, gold investors can remain positive that their gold investment in the UAE will produce significant long-term returns.

For gold traders, it is the factors that drive short-term movements that matter. Some of these include:

- Interest rate: When interest rate rises (falls), the demand for gold falls (rises). This is because many investors will prefer to earn the high interest available on fixed-income securities.

- The stock market: When the stock market is in a correction or a bear market, investors move money into gold. This results in a rise in gold’s price and a hedge against market downturns. Many of these investors will also shift back to stocks when the market recovers.

- Political and economic uncertainty: The stock market hates uncertainty; the sell-off that followed Trump’s announcement of tariffs is the latest example. And as we saw above, even central banks react to uncertainty by increasing gold reserves. Also, when uncertainty abates, investors and central banks can move money back into other assets.

- Inflation rate: When inflation rises, the demand for gold increases since investors see it as an inflation hedge. On the other hand, when inflation falls, they move money from gold back to stocks and bonds.

- Short-term fluctuations in long-term demand factors: All four factors that drive long-term demand can experience short-term variation, providing opportunities for traders to go short or long.

- How to start trading or investing in gold in the UAE

Investing in gold ETFs on Sarwa

The accessibility, liquidity, transparency, and cost-effectiveness of gold ETFs/ETCs make them the best way for retail investors to gain exposure to the gold market.

Investors and traders can buy gold in the UAE via gold ETCs/ETFs through the Sarwa mobile app on Google Play Store and Apple Store. The following gold ETCs/ETFs are currently available on the platform:

Investing in gold stocks on Sarwa Trade

The gold ETFs available on Sarwa Trade provide you with an opportunity to invest in gold without necessarily taking physical delivery of the commodity.

But what if you are interested in the stocks of gold companies instead?

We have got you covered as well.

Currently, you can buy the stock of Barrack Gold (Ticker: GOLD), a gold mining company headquartered in Canada. Also, keep an eye out because other gold stocks will be available on the app soon.

Why buy gold ETFs/ETCs and stocks on Sarwa Trade?

At Sarwa, our goal is to make investing and trading as accessible, cost-effective, and simple as possible.

Below are the advantages of investing or trading gold ETFs/ETCs and stocks on Sarwa Trade:

- Fractional trading: We offer fractional trading for both stocks and ETFs/ETCs. If you can’t buy a whole share, buy just a fraction.

- No account minimum: Do you have $1 to invest or trade? Then you are already qualified to buy gold at market price on Sarwa Trade.

- Instant deposits: Do you remember that time you couldn’t buy that stock or ETF/ETC at your target price because, by the time your deposit was completed, the price had increased?

On Sarwa Trade, you will never have that problem. Whether you are crediting your account through bank transfers, debit cards, or credit cards, we ensure that the process is as fast as possible.

- No international transfer fees: Deposit and withdraw your funds at zero cost with free AED transfers (whether savings account or current account) in the UAE.

- Competitive prices: Sarwa only charges the greater of $1 and 0.25% of the traded value of stocks and ETFs, which is less than the average fee charged by brokers.

- Simple and intuitive: If you are like most people, you have probably uninstalled an app because of poor interface. That is why Sarwa created a simple and intuitive dashboard that will help you access all relevant information as well as trade stocks and ETFs/ETCs comfortably.

Are you an investor interested in the hedging and risk-reducing benefits of gold or a trader looking to make short-term profits from the gold market? Sign up for Sarwa to cost-effectively, securely, and conveniently invest in and trade gold ETFs/ETCs and gold stocks.

Takeaways

- Investors in the United Arab Emirates can gain exposure to gold through various options, including physical gold (bullion and coins), gold stocks, mutual funds, ETFs/ETCs, and derivatives like futures and options.

- Gold continues to be a safe-haven asset, as evidenced by its significant price appreciation amid market downturns.

- While long-term investors use gold for portfolio protection, diversification, and inflation hedging, short-term traders focus on profiting from gold’s price fluctuations through liquid instruments like ETFs/ETCs, futures, and stocks.

- Factors like investment demand, technology demand, jewelry demand, and central bank demand drive the long-term value of gold while interest rates, inflation rate, stock market’s performance, and political (and economic) uncertainty drive its short-term fluctuations.