The year is 2011, and someone from 2021 came to tell you that they’ve turned $1,000 into $69,000 by buying a digital coin with a Shiba Inu dog as its face. You would either think he’s lying or crazy.

But you would be wrong. Anyone who bought $1,000 worth of Dogecoin in January 2011 (when its price was $0.008255) and held it until May 2021 would have earned a whopping 6,800% return. That’s the kind of return that even the best stock investors could only dream of.

Yet, that was the story of Dogecoin.

What started as a joke based on a viral meme became a money-making machine backed by successful people like Elon Musk and an army of miners and social media enthusiasts who have even engaged in many charitable endeavors.

By learning how to invest in Dogecoin, you can also become a part of this thriving community and potentially make incredible returns on your investment.

In this article, we introduce you to Dogecoin, examine the main reasons why people invest in the coin, and how you can also invest in it from the UAE. We’ll cover:

- A short history of Dogecoin

- Why should you invest in Dogecoin?

- How to invest in dogecoin in the UAE

(Disclaimer: Past performance is not a guarantee of future performance. Therefore, the information below should not be taken as investment advice.)

Do you want to learn more about the value of cryptocurrencies to your investment plan? Subscribe to Sarwa’s newsletter today for regular expert-backed insights.

1. A short history of Dogecoin

Jackson Palmer, a product manager at Adobe, and Billy Markus, a software developer at IBM, founded Dogecoin on December 6, 2013. They intended to joke about the way people took the whole cryptocurrency market seriously, thereby adding some elements of fun.

Palmer and Markus created Dogecoin with the image of a Shiba Inu dog (named Kabosu) that had previously gone viral on social media as its logo.

Dogecoin logo

Source: New York Magazine

The coin became an instant success on social media with many people on Reddit even using it to tip content creators on the platform.

In two weeks, the coin’s price rose by 300% when China stopped its banks from investing in crypto. Also, the transactions conducted per day on the Dogecoin blockchain exceeded that on the Bitcoin blockchain.

Elon Musk’s endorsement of the coin in 2019 would later prove to be monumental. He began by touting how the coin would become a viable currency for daily transactions.

In keeping with his projection, Tesla, Musk’s company, started accepting Dogecoin as payment for some merchandise. Also, SpaceX, another company owned by Musk, launched a DOGE-1 mission to the moon funded entirely with Dogecoin.

In the same year, Binance, the most popular and liquid cryptocurrency exchange, listed Dogecoin on its platform.

All of these would culminate in a series of Musk’s tweets promoting Dogecoin in 2021. This led to a rapid rise in the coin’s price, moving from $0.008255 on January 27, 2020, to an all-time high (ATH) of $0.5696 on May 10, 2021, a 6,800% increase.

(Disclaimer: This does not constitute investment advice as past performance does not guarantee future performance.)

Dogecoin would suffer from the general cryptocurrency bear market, with its price dropping as low as $0.056.

Elon Musk would again be at the center of another upward run of Dogecoin in 2024. His appointment by the newly elected Donald Trump as a co-leader of the Department of Government Efficiency (DOGE) led to a surge in the price of Dogecoin from a swing low of $0.11 (on October 12) to a swing high of $0.39 (on November 26).

At the time of writing, Dogecoin is the seventh-largest cryptocurrency by both market cap and trading volume. It’s also listed on popular crypto exchanges like Binance, Coinbase, and Kraken.

2. Should you invest in Dogecoin?

The debate about whether cryptocurrency has any investment value started with Bitcoin and it rages still.

Is Bitcoin a good investment?

Those who consider it to possess no investment value will argue that its price is driven only by speculations among market participants. They will also point to regulatory risk and high volatility as other downsides.

On the other hand, Bitcoin enthusiasts have argued that it is a store of value, an inflation hedge (due to its limited supply), a portfolio diversification tool, and provides an opportunity to earn higher risk-adjusted returns.

We can consider the same question as it relates to Dogecoin: is Dogecoin a good investment?

The utility of Dogecoin

Questions about the investment value of crypto assets usually turn on whether they have utility (use cases) or not.

So, does Dogecoin possess any utility?

The code behind Dogecoin was based on Luckycoin, which was derived from Litecoin, a Bitcoin fork.

Litecoin was forked out of Bitcoin in 2011 due to concerns that it was becoming dominated by large-scale mining firms. Litecoin replaced Bitcoin’s SHA-256 technology with a scrypt technology that made it more decentralised – open to individual miners with CPUs and GPUs.

Also, Litecoin processes more transactions per second than Bitcoin (50 to 7) as it takes 2.5 minutes to create a block (it takes 10 minutes on Bitcoin’s blockchain).

Dogecoin also uses scrypt technology and the Proof of Work consensus mechanism. It thus retains some of the advantages that Litecoin has over Bitcoin – faster processing time and cheaper transaction fees.

In essence, the utility of Dogecoin is in its usage as a digital currency with low transaction fees and fast transaction processing time.

Adoption of Dogecoin as a currency

How well has Dogecoin performed as a currency?

We saw that Musk approved it as a payment mechanism for some transactions at Tesla. He also used it to fund a space mission at SpaceX. Dallas Mavericks, a basketball team in the US, also began accepting it in 2021.

Microsoft, Newegg, AMC Theaters, Wrist Aficionado, and AMC, among others, are other companies accepting Dogecoin, according to Techopedia, a technology blog.

Similarly, Reddit users have adopted Dogecoin as a way to tip content creators on the platform.

In comparison to Bitcoin, Dogecoin still has a long way to go in terms of adoption as a payment method.

While Bitcoin has more than a billion unique addresses as of October 5, 2024, according to Glassnode Studio, a crypto data analytics platform, Dogecoin only crossed the 90 million mark on October 4, 2024, according to Cryptoglobe, a cryptocurrency blog.

If Dogecoin’s utility is its adoption as a payment method, it remains to be seen whether more retailers will adopt it in years to come.

Popularity in the crypto community

In recent times, Dogecoin has inspired a Layer 2 network called Dogechain. Though Dogechain is built on the polygon network (rather than on Dogechain’s blockchain), it reinstates the popularity of Dogecoin in the cryptocurrency community.

Like other Layer 2 networks, Dogechain seeks to introduce smart contracts, tokenization, and decentralized apps (dAPPs) to the world of Dogecoin. It will also support non-fungible tokens (NFTs) and gaming.

Another example of Dogecoin’s popularity is the success of the DOGE meme coin that was launched on the Solana chain. This happened after Trump announced his plan to create a Department of Government Efficiency (DOGE) that would be headed by Musk.

The coin, which also has a Shina Inu dog as its logo, reached an all-time high of $9.88 a week after Trump was declared the winner of the 2024 US Presidential election.

Strong community

The strong community behind Dogecoin is another reason for its appeal. A large number of people on Twitter, Reddit, and Discord are committed to the coin.

Some examples of the strength of the community include raising 26.5 million Dogecoin to send the Jamaican bobsled team to the Winter Olympics in 2014, contributing over 40 million Dogecoin to build wells in Kenya in 2014, and collaborating with Mr. Beast and Mark Rober ( popular YouTubers) in 2021 to raise $30 million to remove 30 million pounds of trash from oceans around the world.

Dogecoin’s ability to pull in influential people like Musk, Mark Cuban, Donald Trump (naming the new agency DOGE), and Mr. Beast also speaks to the strength of its communities.

Elon Musk and the Dogecoin logo

But why do popularity in the crypto industry and a strong community matter in the discussion about investment potential?

As long as the demand for an asset increases faster than its supply, its price will rise and it will be a store of value. In the crypto world, digital assets that are household names and have strong communities behind them (Bitcoin being an example) tend to have staying power. Put differently, it is not only utility that drives value (and future performance) in the cryptocurrency world; people buy crypto for various reasons.

Volatility is a concern

Though all cryptocurrencies are considered volatile and high-risk investments, high volatility is especially a big problem with coins that depend on communities, social media, and celebrity endorsements.

After Dogecoin surged to an all-time high of $0.5696 in May 2021, it fell to $0.1868 two months later. It would not cross $0.22 until Trump won the election in November.

However, if you are a long-time investor who believes that its adoption as a currency will continue and its popularity and strong communities will continue to support its long-term value, such volatile movements may not be much of a concern.

Technological improvements

Community members and developers have worked to improve Dogecoin’s blockchain through bug fixes, upgrades, performance enhancements, security improvements, and the introduction of new features.

Though there is no official roadmap for dogecoin, the community’s active involvement guarantees that there will continue to be discussions around how to improve it.

However, whether any improvement or update will increase its adoption as a major currency (its utility) remains to be seen.

Unlimited supply is another concern

Previously, we mentioned how demand exceeding supply is key to an asset being a store of value.

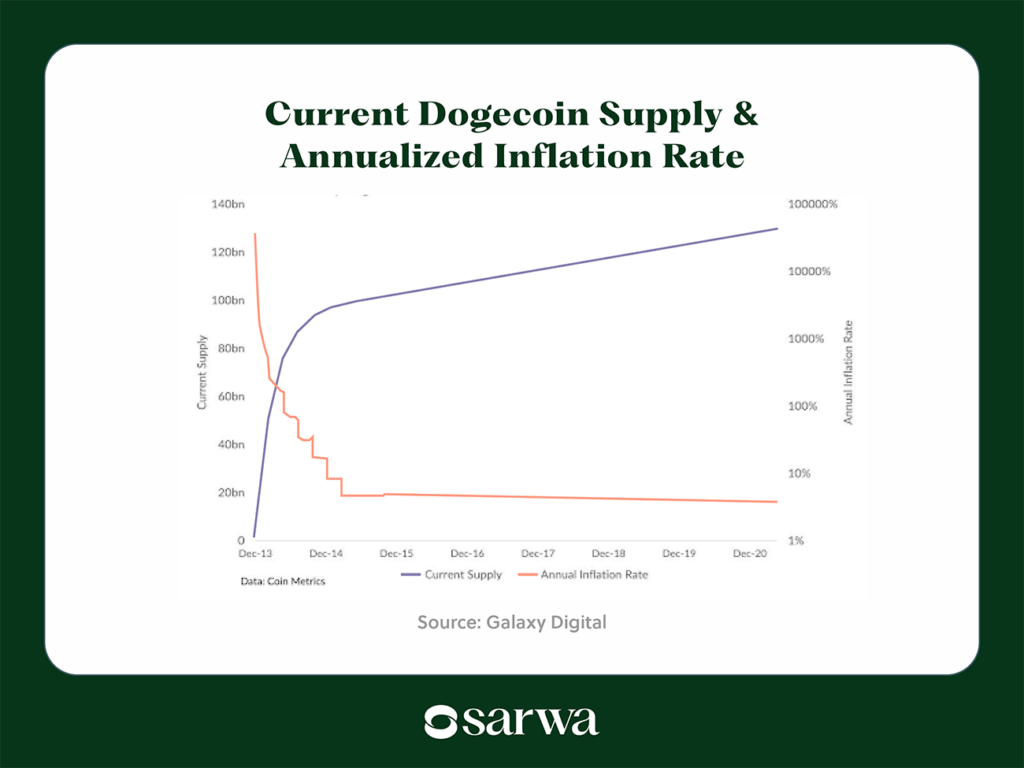

What makes Bitcoin a good store of value is its limited supply (cannot exceed 21 million). In contrast, Dogecoin has an unlimited supply – about 5 billion new coins enter circulation each year. In other words, while Bitcoin is a deflationary asset, Dogecoin (like fiat currencies) is an inflationary asset.

“Inflationary cryptocurrencies have declining purchasing power over time due to increases in supply; deflationary cryptocurrencies increase in intrinsic value over time as total supply remains constant or decreases,” according to the Corporate Finance Institute, a financial education platform.

Though inflation can reduce the transaction costs of a currency, it threatens its use as a store of value (unless a rise in demand is strong enough to undermine the rise in supply).

However, there is one slight advantage with Dogecoin – limiting additional supply to 5 billion every year reduces its inflation rate.

“Dogecoin has a diminished inflation rate because it has a fixed yearly issuance of 5 billion coins,” according to its official website. “This means that each year, the rate of inflation decreases comparative to the total supply, and in a very predictable way, making Dogecoin the perfect candidate to be used as a currency.”

However, while there was a rapid fall in the inflation rate in 2013 and 2014, it has steadied since 2015, according to data analyzed by Galaxy Digital, a crypto and blockchain firm.

Source: Galaxy Digital

This shows that not too much value can be attached to Dogecoin’s fixed yearly issuance.

Should you invest in Dogecoin?

So, should you invest in Dogecoin?

There does not seem to be a straightforward answer.

On the positive side are its use as a currency (especially its transaction speed and costs compared to Bitcoin), strong community, and popularity in the crypto world.

On the negative side are unlimited supply, slow adoption as a currency, and its volatility (though this is not too significant for investors).

Whether you choose to buy or not will depend on which of these factors you think will be more significant. It boils down to whether you believe that the future adoption pace and the strength of its community and popularity will be enough to dampen its inflationary nature and cause long-term growth.

You will also need to consider your financial situation, investment objectives, and risk tolerance before investing in Dogecoin, or any other cryptocurrency for that matter.

3. How to invest in dogecoin in the UAE

If you are confident in its value as an investment asset, the next step is to learn how to invest in Dogecoin from the UAE.

Sarwa Crypto is a product available on the Sarwa Trade app that provides 24/7 access to the top cryptocurrencies, including Bitcoin (BTC) and altcoins like Dogecoin (DOGE), Polkadot (DOT), Ethereum (ETH), Chainlink (LINK), Bitcoin Cash (BCH), Tezos (XTZ), Litecoin (LTC), The Graph (GRT), among others.

You can start your cryptocurrency investment journey on Sarwa Crypto with just $5. If you don’t have much capital, you can buy fractions of a coin and if you have a lot of money to invest, you can buy coins in bulk.

Sarwa does not charge trading fees or commissions and we offer very low and competitive spreads of 0.75%. For now, we don’t support trading pairs on Sarwa Trade (e.g., you can’t buy Bitcoin with DOGE, and vice versa). You have to buy every crypto with USD and not with another crypto.

Transfers from your local UAE bank account to the trading app are free. And we ensure that your deposits are processed quickly so you don’t miss your target prices.

The Sarwa Trade app uses 256-bit encryption to protect your data and money and our customer support team is always ready and available to provide any needed help.

How to buy Dogecoin on the Sarwa Trade app

To start buying Dogecoin on the Sarwa Trade app, take the following steps:

- Register on Sarwa Trade: Sarwa Trade is available on Google and Apple stores. You can sign up on the website or app.

You will be required to complete a Know Your Customer (KYC) process as part of the regulatory requirements.

You will need a valid copy of your passport (or Emirates ID), a valid proof of address document (utility bill, bank statement, tenancy contract, national address, etc), and a live selfie of yourself.

- Fund your account: You can do this through a bank transfer (free), wire transfer, debit card, and credit card. Depositing through local cards costs 2.99% + 1 AED per transaction; for international cards, the cost is 3.99% + 1 AED per transaction.

- Select Dogecoin from the “Crypto” section: You can find the Sarwa Crypto section on the homepage of the Sarwa Trade app (as seen below).

Click on “View all” and then select Dogecoin from the list of available cryptos.

- Create a buy order: After clicking on Dogecoin, you will land on the coin’s page. There you will find 4 tabs: summary, news, orders, and transactions (as seen below).

To purchase the coin, click on the “Buy” button just below the coin’s chart. You can create a market (buy at the current price), limit (buy at a maximum price or below), or stop order (buy only at a specific price).

What are you waiting for? Sign up today for the Sarwa Trade app to buy DOGE and other cryptocurrencies of your choice.

Takeaways

- Starting as a joke, Dogecoin demonstrated how strong community backing, celebrity endorsements, and viral momentum can lead to astonishing financial returns, such as a 6,800% increase in early 2021

- Its low transaction fees, fast processing times, and adoption for payments (e.g., Tesla, Dallas Mavericks) make Dogecoin more than a speculative asset. However, it still lags significantly behind Bitcoin in widespread adoption.

- Dogecoin’s unlimited supply and price volatility pose significant risks.

- How to invest in Dogecoin: For UAE investors, Sarwa Trade provides an accessible and secure platform for buying Dogecoin and other cryptocurrencies.