Learning how to become rich in Dubai is not a pipe dream. Indeed, 60% of Dubai millionaires are self-made.

There is, however, a certain playbook that these self-mae millionaires follow, which we will cover in this article. And, luckily for you, living in Dubai makes it easier to follow these lessons.

A survey by HCSB, a banking and financial services firm, listed the UAE as one of the top 5 places for expats to grow their wealth. They highlighted tax-free personal income, high salaries (beyond the global average), attractive benefits, and end-of-service gratuity as factors in favour of growing wealth in the UAE.

Add to all these the growing GDP, government commitment to diversification and entrepreneurship, and the boom in the real estate, tourism, and healthcare sectors (to mention but a little) and Dubai is surely a favourable place to find millionaire status.

But knowing how to be a millionaire in Dubai requires knowing the investment opportunities to explore and being consistent in investing in them. “It’s not how much money you make, but how much money you keep, how hard it works for you, and how many generations you keep it for,” said Robert Kiyosaki, investor and financial educator.

In what follows, we consider how to become rich in Dubai by highlighting the various options you can consider.

[Do you want to be a millionaire in the UAE by investing in stocks, ETFs, and cryptos? Sign up for Sarwa Trade to start your journey to wealth and financial freedom.]

1. Invest in yourself

“The most important investment you can make is in yourself,” according to Warren Buffett, one of the 10 richest men in the world.

We begin this list with this idea because “investment in self-development pays the highest dividends,” according to Debasish Mridha, an American physician and poet.

There are two things we have in mind when we talk about investing in yourself.

Increase your income

First is how investing in yourself can help you increase your income.

If you, like most people, are not born with a silver spoon and have not been lucky enough to win the lottery or become the recipient of a large inheritance, then your path to wealth will involve increasing your income.

As an employee, the best way to increase your income is to command a better salary in your current job or get a better-paying job. Any of these will require improving your skills (technical and soft), becoming better at negotiation, and improving your network.

When you increase your income, then it will be easier (if you have learned how to organise your finances, see below) to explore the various opportunities to get rich in Dubai and the UAE in general.

If you are feeling discouraged about building wealth because you did not (and do not) have a silver spoon, then remember that 60.2% of Dubai millionaires are self-made, according to the Khaleej Times. By putting in the work, you can be like them.

Increase your financial knowledge

The second way to invest in yourself is to improve your financial knowledge. This will include reading books on financial management and investment so you can learn from those who have threaded this path.

Life is tough but the interesting thing is that many people have done what we seek to do; tapping into their wealth of knowledge is a good way to gain an advantage.

Also, you need to read investing books because Warren Buffett advised that you should “Never invest in a business you cannot understand.”

2. Organise your finances

Do you remember what Robert Kiyosaki said above? It is not about how much money you make but how much of it you can keep.

After surveying millionaires in the US, Dave Ramsey, a financial advisor, found that 3 out of 4 became millionaires from regular, consistent investing.

To invest consistently, you need to save consistently. But saving requires that you spend less than you earn.

Yes, knowing how to become rich in Dubai is about spotting opportunities. But what if you spot the opportunity but don’t have the money to invest? Like they say, luck is when preparation meets opportunities.

So, before talking about opportunities, let’s consider how you can get prepared.

Stick to a budget

If you want to consistently save money, then you must have a budget. One popular budgeting system that has helped many people turn around their finances is the 50/30/20 rule.

This system requires that you spend 50% of your income on your needs (groceries, rent or mortgage, utilities, etc.) and 30% on your wants (hobbies, dining out, etc.) with the remaining 20% being your savings.

If your wants and needs at first glance exceed 80% of your income, you can explore different ways to save money in Dubai so you can bring them down to target.

You will be surprised that some people have even used these savings hacks to save more than 20% of their income. There are those in the Financial Independence, Retire Early (FIRE) movement who save between 60% to 80% of their income.

Start with 20% of your income and do it consistently every month.

Sticking to your budget will also help you avoid consumer debt (of which credit card debt is a big part), a problem that many people in the UAE struggle with.

Use a savings account

If you are yet to decide on how to invest your money to become wealthy, you need to keep your savings where they can grow without any risk of capital loss.

Savings accounts are typically good for these purposes since they are insured by the Federal Government.

Now that you have sorted your finances and are consistently saving 20% of your income, let’s consider the investment opportunities that can make you a millionaire.

3. Buy stocks

If you had $1,000 on January 3, 2020, and you bought shares of NVIDIA (a US company producing chips), you would have gotten 16.94 shares at a share price of $59.02.

On March 22, 2024, your $1,000 investment would have been worth $15,976.

Source: Google Finance

We have mentioned Warren Buffett twice now. He is one of the wealthiest people in the world and he made his money investing in stocks.

Buffett identifies and buys companies that are undervalued (their intrinsic value is greater than their share price) and waits for the market to recognise their value.

The stock market has continued to be an avenue for individuals and investment firms to grow wealth. You can make money from the stock market by earning dividends on the stocks you hold or by selling for profit (capital gains).

There are at least two paths to building wealth in the stock market.

Active investing

First, you can buy individual stocks that you believe have good potential and hold them for the short term (to earn short-term profits) or for the long term (to earn dividends and watch their value appreciate over the long run).

If you don’t have the time or competence to evaluate and select individual stocks, you can buy mutual funds instead. These funds are managed by experts who make buy and sell decisions on behalf of investors in exchange for a fee.

Passive investing

Second, you can buy a basket of stocks through ETFs. Why are these important?

We talked about NVIDIA above, but for every NVIDIA (or Apple or Amazon) there is another stock where your $1,000 could have turned into a few cents (Blackberry, for example). But there is no way to know for sure at the time of purchase which one will do well and which one won’t.

Therefore, instead of looking for the needle in a haystack, you can just buy the whole haystack, as John Bogle, the father of passive investing, puts it.

That is, instead of trying to forecast which stocks will do well, you can have a stake in hundreds of them such that even if some don’t do well, others will do well and compensate for them.

Why you should consider the US market

Though the UAE stock market can be lucrative, it remains a fact that the US stock market has made the most money for investors over the years. It is the largest, most liquid, and most diversified. Moreover, most of the top companies in the world operate in the US market.

With Sarwa Trade, you can buy both US stocks and ETFs from the UAE, giving you the best opportunity to build wealth.

4. Purchase cryptocurrencies

If any of your friends was among the early BTC buyers then you don’t need anyone to tell you how much money people have made from cryptocurrencies.

In addition to bitcoin, many have become millionaires from altcoins, including meme coins that were driven by social media popularity.

There are 88,200 crypto millionaires of which 40,500 became millionaires from bitcoin, according to Techopedia, a tech news website.

While buying bitcoin is still what many people reduce cryptocurrency to, the market has advanced with many opportunities to make money (and achieve different financial goals) including yield farming, crypto staking, ICOs, and IDOs, among others.

Though cryptocurrency remains volatile, some of these new opportunities (yield farming, crypto staking, crypto lending) have been adapted to those with lower risk tolerance – lower risk, lower return.

For investors with higher risk tolerance, buying bitcoin, purchasing altcoins, and investing in ICOs and IDOs remain opportunities that can be explored. However, these are high-risk and high-return ventures that require a good knowledge of the crypto market.

If you are looking for how to become rich overnight in Dubai, crypto is one market to consider but remember, again, that the risk is high and you can also lose a significant part of your net worth.

However, you can choose to go the long-term route (less risk, possibly less returns). With this option, you can do fundamental analysis to choose cryptos that have good fundamentals and hold them for the long term where their value would have become evident to other buyers.

With Sarwa Crypto, available via the Sarwa Trade app, you can buy and sell bitcoin and other popular altcoins right from the UAE. You can build your portfolio and pursue a short-term or long-term strategy.

5. Invest in real estate

Dubai’s real estate sector is one of the factors turning it into a global wealth nexus, according to the Indian Economic Times.

UAE’s quality of life, strategic location in the Persian Gulf, growing economy, jobs market, massive infrastructure, tourist attractions, safety, business-friendly policies, and various visa types continue to make it a favourite destination for expats and tourists, according to Keyone Realty Group, a Dubai-based real estate firm.

It is no wonder then that rental yields are high and property prices are increasing in Dubai and Abu Dhabi, according to the 2023 annual market report by Dubizzle, a property blog.

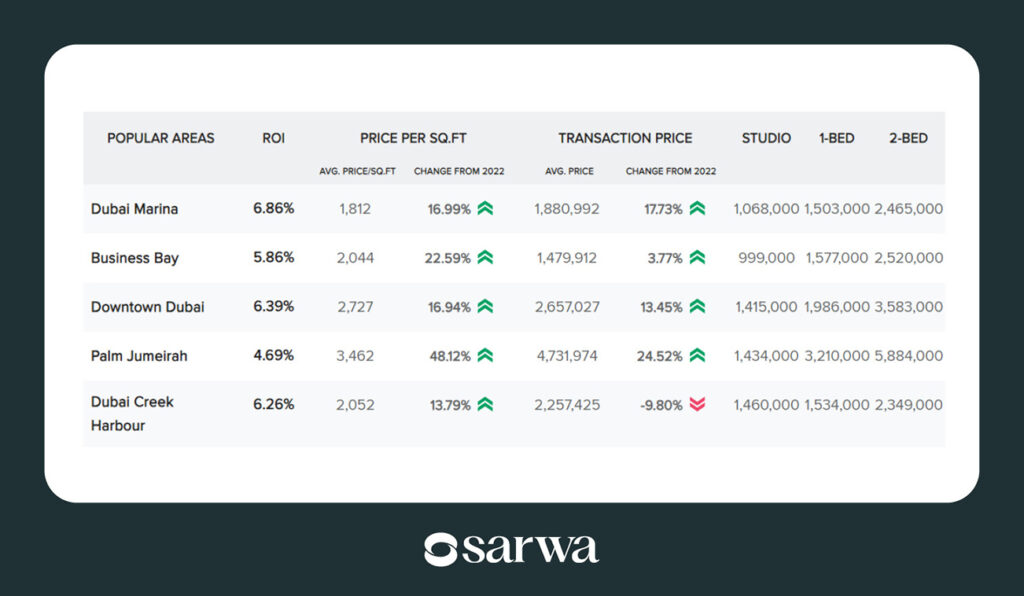

Below is a snapshot of some of the luxury areas in Dubai from the report:

Therefore, if you are seeking how to be a millionaire in Dubai, you should invest in real estate.

You can do this by becoming a flipper – buying Class B properties (properties that are not high quality but are in good locations), improving them, and selling them for a profit – a buy-and-hold investor (earning rental profit) or a developer (buying land and developing new properties on them).

Also, consider prioritising the top real estate locations where you can maximise your ROI. “Every person who invests in well-selected real estate in a growing section of a prosperous community adopts the surest and safest method of becoming independent, for real estate is the basis of wealth,” said Theodore Roosevelt, a former US president.

Real estate investment trusts

The downside with real estate is that you will need significant capital to start as an investor.

If you have not gotten the financial strength to pursue any of the three strategies highlighted above, then you should consider investing in real estate investment trusts (REITs) instead.

REITs are stocks of real estate companies and financial institutions that provide mortgage financing to real estate buyers. By buying the stocks of these companies, you can still make money from the real estate market until you have the financial muscle to buy or develop properties.

Like stocks, you can also buy and sell individual REITs or you can purchase ETFs and diversify your risk.

In addition to purchasing REITs in Dubai, you can also buy REITs in the US through Sarwa Trade.

As of October 2022, the US had the fastest-growing REITs market with the UAE just behind them in second place, according to International Business Magazine. Combining the two markets is a good way to grow your wealth.

6. Start your own business or invest in a startup

The UAE government has created various entities to “create an incubating work environment to support and enhance the performance of small and medium-sized companies and encourage the establishment of innovative projects and start-ups.”

Whether it is education, consulting, funding, or regulatory simplicity, the UAE’s commitment to economic diversification has led it to support entrepreneurial efforts among expats and Emiratis.

If you have good business ideas and have spotted opportunities, then you should consider registering and starting a small business in Dubai and then expanding it as opportunities open up.

Some of the most thriving sectors (in addition to real estate) in Dubai’s economy include tourism, trade, healthcare, financial services, and technology, according to Reuters and Indian Economic Times (quoted above).

However, there is a caveat.

We have all seen those statistics about the percentage of startups that fail in the first five years. Whatever the actual number, the fact remains.

Therefore, before starting, ensure you have a solid business plan (which includes solid financial projections, market research, and demand analysis, among others).

Investing in startups

If you are not the entrepreneur type, you can also consider investing in startups.

The good thing about this is that if the startup goes on to become a big company, your returns will be very high (more than what stocks will even give you).

However, the startup failure rate is high. Said differently, investing in startups (like starting one) is a high-risk and high-return venture.

7. Partner with foreign investors

Dubai is not just a tourist destination. The low tax rates for businesses and zero rates for individuals are attracting “people who have high net worth and people who are business owners or entrepreneurs,” according to The Indian Times.

In 2022 alone, over 5,200 high-net-worth individuals (HNWIs) migrated to the UAE in 2022, making the country the top destination for migrating millionaires. India, the UK, Russia, Lebanon, and Pakistan are some of the top sources of these HNWIs.

The influx of wealthy businessmen (billionaires and millionaires) means higher foreign investment in the UAE economy (especially in Dubai and the free zone).

Foreign investors are often in need of residents who understand the business dynamics of the country and can make it easier for them to succeed.

By forming partnerships with foreign investors, you can combine resources to create successful businesses.

8. Multiply your income sources

You can also use your savings to create multiple streams of income.

If you are not tired of hearing from Buffett, here is another important saying of his:

“Never depend on a single income. Make an investment to create a second source.”

Multiple income sources are important for two reasons.

First, they reduce the risk of going broke. Even if one loses their job, the other sources of income can save the day while they look for another.

Second, multiple sources of income means more income and if you have organised your finances well, that means more savings and investments. With more savings and investments, you can grow your wealth further through the other means above or by turning your passive income source into a full-blown business.

Passive income here does not mean you won’t do anything. Rather, it means you will continue to earn income from an initial investment of time and resources. Even if continuous efforts are required, it is minimal.

Below are some passive income ideas to earn money online:

- Selling digital products: If you have expertise in a field, you can create an ebook, a video course, or an audiobook on some aspects of it. You can sell these digital products on platforms like Amazon KDP (ebooks), Udemy (video courses), and Audible (audiobooks).

- Dropshipping: With dropshipping, you can market and advertise the products of others, receive orders, and send those orders to the business that holds the stock. Your profit is the difference between the price you quote to customers and the price the stock owner charges you.

- Blogging: Instead of putting your expertise in the form of books, video courses, or audiobooks, you can write regular articles on a blog and build an audience of readers.

Once you have put in the initial efforts to grow an audience, you can drive consistent traffic and earn money through affiliate marketing, guest blogging, sponsorship, and advertising.

- YouTubing: If you can put in the effort to build a YouTube channel, you can also make money from monetising your channel. Though creating videos takes effort, once created, they continue to bring in advertising revenue.

While they are not passive, you can also consider earning money by spending a few hours on these side hustles:

- Online tutoring: If you are good at subjects like Maths, Chemistry, Physics, English, and Economics, among others, you can earn some extra income tutoring students virtually. There are global tutoring platforms (Tutor.com, Varsity Tutors) as well as UAE-based ones (Concept Tutors, Time Tutors).

- Freelancing: You can also earn money from high-demand digital skills like digital marketing, video editing, app and website development, and data analysis, among others.

Popular freelance platforms include Fiverr, Upwork, and Freelancer.

- Social media marketing: With many businesses now seeking to go digital, you can help them set up their social media channels, advertise on those platforms, and create an audience.

[Are you ready to build wealth through stocks, ETFs, and cryptocurrencies? Sign up for Sarwa Trade and start your journey to becoming rich in the UAE.]

Takeaways

- You don’t need to be born with a silver spoon to build wealth in the United Arab Emirates

- To build wealth, you must increase your income by investing in yourself and organising your finances.

- Investment opportunities for wealth building include stocks, cryptocurrencies, real estate, and starting a business.

- You can also increase your income and build wealth by creating multiple income sources.