As a Dubai resident or expat, you may have considered how to best expand your investment portfolio.

While there are a handful of ways to grow your money, two traditional ways of investing come to mind: real estate and stocks. Deciding how to allocate your hard-earned cash into either or both could pose a quandary.

Both real estate and stocks have similarities, advantages, and downsides, so you might not be clear on who the stronger performer might be.

To help you decide, let’s take a deeper dive at which option might be a better investment for you: real estate or stocks?

Income

You can earn income from both real estate and stocks over time. And, the value of both real estate and stocks can rise and fall.

But with stocks, there’s dividend income, or distributions you’d receive from a company’s earnings by being a shareholder.

In real estate, you can enjoy income returns when you sell your property, based on the amount of equity accrued from property appreciation. You can also earn rental income if you lend it out to a tenant.

Bubbles

Both real estate and stocks are subject to bubbles. Stock market bubbles happen when investors create such a demand for an asset that it pushes its value beyond its true worth. This might be because a stock is hot or trending. However, the actual worth of a stock is determined by its performance, not how popular it is.

Real estate or housing bubbles begin with a spike in demand coupled with a limited supply. Those who believe the housing market is on the upswing further drive the demand. But when demand for real estate declines, prices plummet which can result in a crash.

Ownership

When you own stocks, they aren’t backed by physical, tangible property. Instead, you own shares of stock in a company, and how well that company performs impacts the value of your shares.

With real estate, you own property. Your investment is tied to a parcel of land and any physical objects on the land — for instance, an apartment or flat, house, or investment property that you own.

Liquidity

Stocks are far more liquid than real estate. During trading hours, you can buy or sell stocks multiple times in a given day.

With real estate, months may pass after a property is listed on the housing market before it is sold or rented.

Diversification

It’s generally easy to diversify with stocks. Through an investment tool such as ETFs, you can invest in funds that serve different demographics, indices, and risk tolerances. This helps ensure that during volatile economic times, your investments will not all act in the same way.

When owning real estate, your investment is locked into a single asset.

Costs

Now, let’s talk about what we are really looking for: the costs.

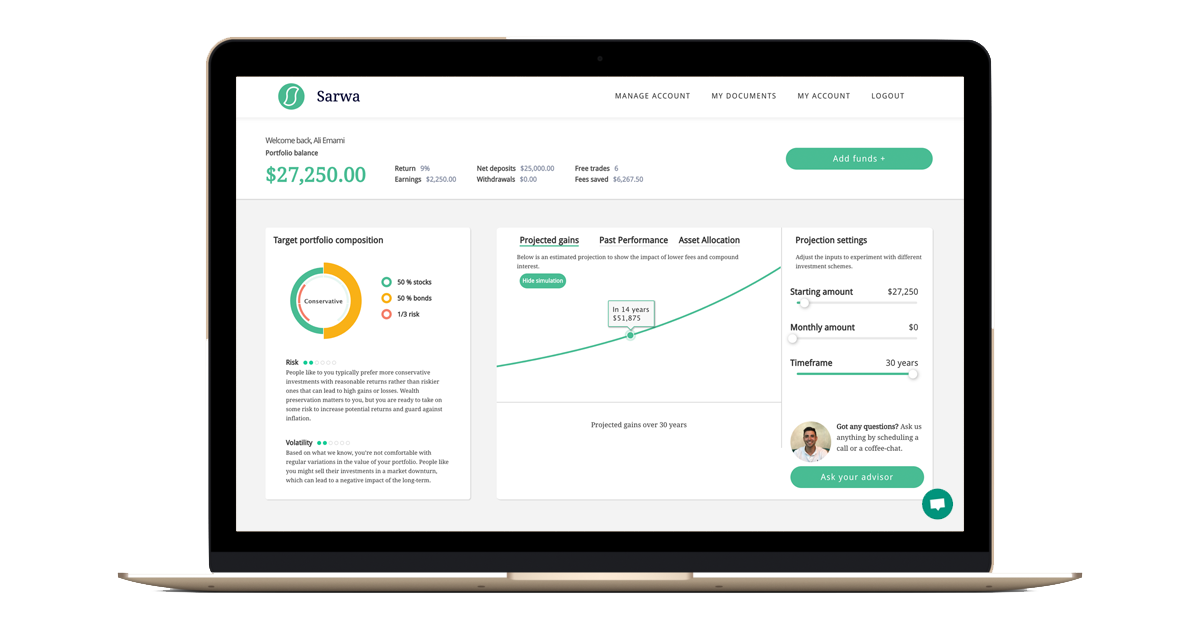

Initial investment costs for stocks are far lower than real estate. There are a number of brokerage options to start trading direct stocks right away, and with low fees per trade. If you’d like to invest in funds that track stock indexes, such as ETFs, you can start investing in Sarwa ETFs with just $2,500.

Compare that to the upfront costs of real estate: The average home price in Dubai is AED 2.78 million and the average apartment cost is AED 1.9 million, so in most cases, you’d need enough money for at least a down payment to purchase your home. In the UAE, the down payment requirement for an investment property is typically 40% of the purchase price, plus there is a mortgage registration fee of 0.25% of the loan amount.

The costs of homeownership can also be quite steep — there’s maintenance, repairs, and insurance. While there are technically no property taxes on home sales in Dubai, there are still other services and communities fees as well as indirect taxes to consider. And if you’re buying an investment property to rent out, you’ll be losing money any time your unit goes unoccupied.

The time it takes to acquire a home loan in Dubai is also a lengthier process than purchasing stocks. This is because you’ll need to gather the required documentation, such as your passport, proof of wages, and bank statements, and wait for approval by a lender.

On the Dubai real estate front, there’s some bad news: It’s predicted that real estate prices could drop by 10 to 15% percent in the next two years, according to S&P Global Ratings analysts.

What’s causing the slump? Looks like geopolitical risks, a new supply, and the introduction of a value-added tax in the UAE.

So what should I do?

Now that we covered the traditional ways to look into real estate and stocks, this is not the only approach to invest into them.

You have already heard, or know about ETFs. A Sarwa portfolio gives you access to different ETFs, including the Real Estate Asset Class ETF that allows you to achieve diversification within this industry and lower your exposure risk.

Surely you want to choose an investment that helps you build wealth. But ultimately it’s a matter of choice, investing style, upfront cashflow, and goals.

Three Main Take-aways From This Article

1. Diversify your assets

2. Keep your cost low

3. Invest in ETFs

Ready to invest in your future?