After hearing stories of successful investors, it’s easy to become inspired and jump into building an investment portfolio from scratch.

However, for many, investing in the stock market can be anything but inspiring at first.

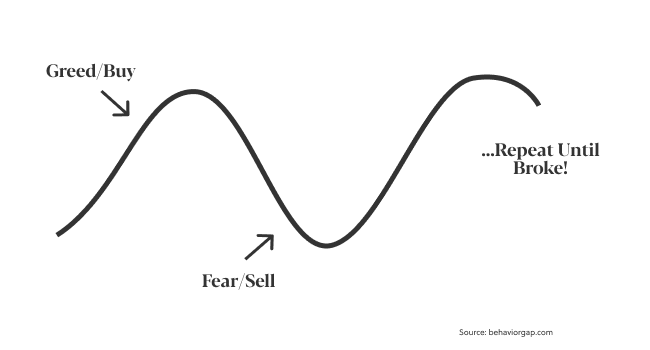

Does this scenario sound familiar?

- Excited to enter the market, you buy an appealing company’s stock.

- It tumbles. A decline of 5%.

- Anxious, you sell quickly, exiting the market.

- It rallies — and you miss the uptrend. Then decide to rebuy.

New retail investors tend to repeat this sad pattern — known as the fear-greed cycle — due to numerous factors. The most common are a lack of discipline and long-term strategy.

Consequently, many feel that growing wealth through the stock market does not work.

That couldn’t be farther from the truth. The main hurdle lies in approach.

Creating a strong investment portfolio that is well-diversified works best for those who have a long-term plan rather than those that try to predict short-term fluctuations. Indeed, this is a gamble that even financial professionals often lose.

There is a kind of ‘zen’ that the art of investment requires, which experts have been preaching long before Warren Buffett was even born.

Paul Samuelson, an American economist widely considered the “Father of Modern Economics,” perhaps put it best:

“Investing should be more like watching paint dry or watching grass grow.”

With this philosophy in mind, we share with you our approach to building an investment portfolio from scratch that will best set you up for gains.

In this guide, we’ll cover the below topics and our approach to portfolio building. You can use this table of contents to review and jump through the sections of the entire guide.

The Ultimate Guide: Building an investment portfolio from scratch

Steps 1-4: Assessing you, as an investor

Steps 5-8: Assessing the market

- Measure your time horizon

- Assess your risk tolerance

- Discover your investor type

- Select THE investment approach

- Find the right ETFs and passively managed index funds

- Identify which investment asset classes are right for you

- Allocate holdings by asset class for each level of risk

- Rebalance your portfolio to constantly optimize

[Need professional guidance? Sarwa is a

So how do we do it?

[Looking to build an investment portfolio but don’t know where to start? Sarwa offers professional financial advisory that makes investing easy and affordable using smart technology. Learn more by subscribing to our newsletter, or schedule a free call with a wealth advisor that can help put your investment goals on track.]

1. First, measure your time horizon on the basis of age, time to retirement, and spending goals

The first step to creating a successful investment portfolio is to understand your time horizon. By calculating this, we will be able to construct a foundation footprint for other important investing factors.

Simply put, time horizon is the period of time you expect to hold an investment before you wish to cash out.

To define your time horizon, we consider these three factors:

- Your age: How old are you at the moment of constructing your investment portfolio?

- Years to Retirement: How far or near are you to retirement?

- Your most significant purchase in the near future: What do you expect to spend a considerable sum of money on in the near future? What are your liquidity needs for example?

These three factors can help define your time horizon, which will in turn affect how we gauge your risk tolerance, as you’ll see below.

2. Assess your risk tolerance

Before selecting your first stock to buy, it’s important to understand that different assets have different risk levels. How you choose which level or risk depends on your personal risk tolerance.

In essence, the higher the risk level of an asset, the higher the probability that you will lose your investment in that asset.

We classify investment assets across a low-risk to high-risk spectrum.

Low-risk assets are government bonds, corporate bonds, certificates of deposits, and savings accounts. These investments are also called fixed-income securities. When you invest in these assets, there is a low probability that you will lose your capital.

In general, government bonds are considered the least risky of these investments since they are backed by the financial power of a government. When we purchase a bond from a government, there is usually high assurance that they will repay. (This, of course, depends on which government. U.S. treasury bonds are considered to have the lowest risk.)

High-risk investments can include individual company stocks, mutual funds, and REITS. Here, you could lose your capital as the prices of the underlying assets tend to be more volatile. Though all these assets qualify as high-risk, company stocks are the riskiest of all.

No risk, no reward

Though low-risk assets can preserve your capital, they have low returns on investment. Meanwhile, high-risk assets can produce higher returns (earning you more money).

To determine how much high-risk assets you should have in your portfolio, we’ll need to figure out your risk tolerance.

In essence, risk tolerance is how willing an individual is to invest in high-risk assets as a percentage of their total holdings.

To better understand risk tolerance, we can observe it in two ways:

- objective risk tolerance

- subjective risk tolerance

Objective risk tolerance is the level of risk you can take because of your unique financial circumstances and time horizon. For example, when you are five years to retirement, your risk tolerance is probably lower than a 25-year old. Furthermore, if you expect to pay for your child’s college education within the next five years, your risk tolerance will probably also be much lower than a single individual.

However, other emotional and psychological factors determine risk tolerance.

Subjective risk tolerance is used to describe a natural predisposition to risk; i.e., those who are inherently averse to risk compared to others that are natural risk takers.

This means that our risk tolerance level can be shaped by our personality and attitude as much as our current stage in life.

3. Discover your investor type: Ranging from conservative to aggressive

We can classify investor portfolios into three main categories based on their risk tolerance level:

- Conservative: Conservative investors tend to allocate a greater portion of their capital in low-return, low-risk assets (LRLR) and a lower portion in high-return, high-risk assets (HRHR).

- Balanced: Moderately aggressive investors will likely keep a 50:50 allocation (or 60:40) between HRHR assets and LRLR assets.

- Growth (aggressive): Aggressive or growth investors are risk-takers. They have a large portion of their capital in HRHR assets and a smaller portion (about 15%) in LRLR assets.

[Note: Sarwa offers 6 conventional portfolios, including ‘very conservative’, ‘moderate conservative’, and ‘moderate growth’ approaches. Moreover, each portfolio is customized to meet the account holder’s specific goals.]

Only after identifying your risk tolerance level and what type of investor you are can you begin to identify the strategy needed to achieve your investment goals.

Our risk tolerance level and investor type directly impact our investment goals.

For example, the primary goal of a conservative investor is to preserve capital. Though the conservative investor wants growth, the overarching drive is the desire to protect his/her investment from depreciation.

The balanced investor is looking for moderate growth. This is a person that is not as concerned with the preservation of capital as the conservative investor. Likewise, he/she is not as concerned with growth as the aggressive investor.

The aggressive investor is after large returns at possibly higher costs. This person invests in a few low LRLR assets to preserve some capital, his commanding drive is the desire to achieve a high growth rate.

Once you know your tolerance level, you can begin to outline the time and strategy needed to achieve your investment goals.

4. Select THE investment approach

Once you have decided how much of each asset class you’d like to invest in, the next step is to choose the specific shares of assets that will be in each of them.

At this point, many new investors decide to constitute each asset class by picking individual stocks and bonds or investing in actively managed mutual funds.

This is called active investing, and there are various problems with this strategy.

Ultimately, this pick-and-choose, short-term approach fails many new investors, setting them sadly apart from those who have chosen a more disciplined long-term strategy.

Sad facts about active investing

When choosing how to pick investments for your portfolio, consider the following fact:

- People who pick individual stocks rarely beat the market

Beating the market is a term that describes earning a higher return than an index, such as the S&P 500. People who choose individual stocks believe they can outperform the market and earn higher returns.

However, this is often not the case.

According to Todd Tressider, President of SYNERGOS Financial Group, “All the evidence supports the disappointing fact that regular investors as a whole underperform the market. As long as they try to ‘beat the market’ they actually underperform.”

- Actively managed funds underperform over the long term

Actively managed funds have increasingly shown that they cannot beat the market. Indeed, for nine consecutive years, actively managed funds have trailed the S&P 500 index.

These funds spend a lot of money hiring financial and industry analysts who conduct endless quantitative analyses in the hope of beating the market and taking advantage of short-term fluctuations in prices.

Despite huge investments, they still fail to achieve higher returns than passively managed indexes.

- Active investing is subject to a short-term approach

When you purchase individual stocks directly, there is a risk you will approach investing with a short-term approach.

You will buy or sell shares in response to short term fluctuations in the market, which unfortunately often leads to substantial financial loss.

This Waffen Buffet quote (one of the writer’s favorite), sums up the situation best:

“Calling someone who trades actively in the market an investor is like calling someone who repeatedly engages in one-night stands a romantic.”

- Data suggests that passive investing is the way to go

Even if we can not predict the future, there are many lessons we can take from the past.

A ‘Mind the Gap’ study by Morningstar looked into ‘investors returns’ and behavioral finance. They calculated fund returns using the asset-weighted calculation of a fund. What the study showed is that over a 10 year period ending 2017 ( Including the 2008 crash where equity markets dropped 50% from their peak) average fund investors underperformed the funds they owned. In one example of a real fund, the fund itself returned 3.9% over that time period while investors experienced -15.4% of annualized returns!

An active retail investor does not trade well. Effectiveness of active trading is controversial at best. Theoretically, to do this well, you have to “know more than the market”. Academic research has a lot to say about this. Retail investors trade badly in several ways:

- Typically trade too much and accrue substantial transaction costs.

- The stocks they sell outperform those they buy – referred to as the “disposition effect”

- They also trade on the basis of stale news

Choosing the best–performing stocks is nearly impossible. Wrong and multiple trades harm the performance of your portfolio and investors are actually 1.5 times more likely to sell their winning stocks rather than their losing stocks.

There is a fundamental difference between diversification and speculation. The benefits and importance of diversification is a finding that is agreed on in the academic circles: it adds value to the investors. Passive investing is rooted in long term properly diversified investment strategy.

5. Find the right ETFs and passively managed funds that provide low-cost exposure

Instead of actively trading individual stocks, focus on index funds and use a passive investment approach.

Exchange-traded funds (ETFs) are index funds that contain a basket of securities (stocks, bonds, REITs) and track the performance of an underlying index.

ETFs are like mutual funds, but they are traded on the stock exchange. The goal of an ETF is to match the performance of a market index such as the S&P 500.

Passively managed index funds track the performance of a market index. The main difference between ETFs and passively managed index funds is that the former are always traded on the stock exchange.

[Want to learn more about the differences and advantages of ETFs? R

From high-return, high-risk assets to high-return, low-risk assets

From the beginning, we have classified stocks, mutual funds, and REITs as HRHR assets.

However, stocks, mutual funds, and REITs are only HRHR under active investing (buying individual stocks, purchasing actively managed funds).

Considered from a passive investing approach, ETFs and passively managed index funds with holdings of stocks, mutual funds, and REITs are today seen as high-return, low-risk assets — if they are held for the long term.

By focusing on the long-term, employing an hands-off approach, and diversifying your portfolio, ETFs and passively managed funds can reduce the risk of the stock market dramatically.

Here is a new way to think about the investment asset classes we previously describe above:

- High-Return, High-Risk Assets: Stocks, mutual funds, and REITs purchased by individual investors or actively managed mutual funds.

- Low-Return, Low-Risk Assets: Fixed-Income securities like government bonds and corporate bonds.

- High-Return, Low-Risk Assets: Stocks, mutual funds, and REITs purchased as exchange-traded funds (ETFs) and passively managed index funds and held over the long term.

It is important to Understand the returns of these ETFs by assessing the expected return, risk and correlations of these assets. Ideally, this involves the use of statistical techniques.

Once we have defined your asset classes by allocation and investment approach, this is when the investment portfolio building starts.

Remember, it is important to achieve greater diversification, so choosing multiple ETFs or passively managed funds that are properly correlated will result in a superior strategy (high-return, low-risk).

Keep in mind that there are ETFs and passively managed funds of US stocks, emerging market stocks, developed market stocks, US bonds, global bonds, REITs and more. Indeed, the ETF industry continues to innovate their offerings.

6. Identify which investment asset classes are right for you

While the three types of investors are different, they typically invest in two types of assets in varying degrees: HRHR assets (for growth) and LRLR assets (for capital preservation).

[Note: There is also a third type of asset that produces high-,long-term returns with relatively lower risk. We’ll get into that more later on below.]

The next step in building an investment portfolio from scratch is to choose the asset classes that will constitute the HRHR assets category and the LRLR assets category.

High-Return, High-Risk Assets

Assets typically belonging to this category include:

- US Stocks: These are stocks of companies in the United States.

- Developed Market Stocks: Developed market stocks are stocks of companies in highly industrialized, first-world countries like Japan, the United Kingdom, Germany, etc.

- Emerging Market Stocks: These are stocks of companies in countries with a high-potential developing and growing economy, such as China, India, and Brazil.

- REITs: These are stocks of companies that own or finance income-producing real estate. It’s a middle way between stock investing and real estate investing, and a popular way to continue investing in

property while getting into the market.

Low-Return, Low-Risk Assets

Assets typically belonging to this category include:

- US Bonds: These are treasury and corporate bonds of the US government and corporations

- Global Bonds: These are treasury and corporate bonds on governments and corporations outside of the United States.

- Other Fixed-Income Securities: This can include investments in certificates of deposits and savings accounts.

7. Allocate holdings by asset class

Doing this “optimally” is a technical exercise that extends and modernizes Nobel prize-winning research of the Modern Portfolio Theory. In addition to that, the investor type will influence this calculation. The next step is to choose an asset allocation formula that divides up your capital into the right asset classes. For examples:

- Conservative investors tend to have a higher percentage in LRLR assets (say 60-70%) and a lower portion in HRHR assets (say 30%-40%).

- Balanced investors will drift towards a 50:50 allocation or 60% in HRHR assets and 40% in LRHR assets.

- Growth investors tend to have an upward of 70% in HRHR assets and a downward of 30% in LRLR investors.

Depending on your risk tolerance and investment goals, you need to choose an asset allocation formula that works for you.

The Importance of Diversifying Your Assets

Diversification is an investment strategy that aims to reduce risks and maximize returns. This is done by limiting your exposure to any particular asset class by spreading your capital throughout a variety of asset classes.

The purpose of diversification is to avoid putting all your eggs in one basket. By placing your capital across many different asset classes and industries, you’ll reduce any downturns that may occur to a particular asset.

How do you diversify your investments?

- Diversification by Industry: Instead of investing in the stocks (or bonds) of companies in one industry, you can invest in multiple industries. In this way, when one industry underperforms, it will not affect your entire portfolio

- Diversification by Geography: When you diversify your investments in different countries, the performance of one country’s economy does not affect the whole portfolio.

- Diversification by Capitalization: You can invest in a mix of companies defined by their size; they are classified by small-cap, middle cap, and large-cap holdings. This will enable you to enjoy the possible high growth of small-cap companies and the security of large-cap companies.

After deciding which of the asset classes you should invest in, it’s important to determine how much to assign to each based on historical data and statistics. When doing this, we ask ourselves questions like these:

How much of your capital should be allocated to US stocks, emerging market stocks, or developing market stocks?

Within each of those markets, how much should be assigned to small-cap, mid-cap, and large-cap companies?

How much should be allocated to US bonds and/or global bonds?

It is also important to do it properly.

However, proper diversification requires taking into account different complex factors in a unified approach and tracking:

- The best risk-return combinations available in financial markets: You do this by using principles from modern financial economics along with statistics and mathematical optimization to determine which portfolios offer the best combinations.

- Your risk-bearing capacity: This is a function of your natural level of risk tolerance, your short- and medium-term liquidity needs, and your investment horizon, as mentioned above.

These numerous complex factors are why it is advisable to have a speak with a financial professional.

Once we have constituted each of the asset classes with ETFs and passively managed funds, we now have the outline of an investment portfolio.

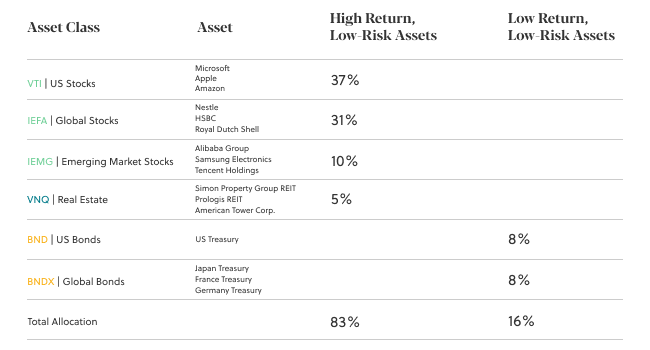

Let’s take a simple example to show what a well-planned investment portfolio could look like.

A sample growth investor portfolio

This example will be for Mr A, a growth investor*.

(*Growth allocation is usually between 80:20 to 85:15.)

[Note: This example is purely for illustrative purposes and should not be taken as financial advice. For personalized financial guidance, contact a Sarwa expert.]

Mr A has an 83:16 allocation between high-return, low-risk investments and low-return, low-risk investments.

To diversify his investments, he has four asset classes for high-return, low-risk investments and two asset classes under LRLR investments.

To constitute the portfolio, he has a mix of ETFs and passively managed index funds.

8. Rebalance your portfolio to make sure your holdings are constantly optimized

As the market rises and falls, your portfolio can become unbalanced.

One asset class may exceed the assigned percentage (due to increase in price) while another may fall below it (due to a decrease in price).

To use the portfolio above as an example, the value of US bonds may increase to 20% of the portfolio while US REITS fall to 10%.

To adjust this, a rebalance of your portfolio is needed.

Rebalancing helps to return your portfolio to its original shape. For example, Mr A can do this by selling some of his stake in BND and using the money to increase his stake in VNQ.

Rebalancing is also required from stocks and funds that pay dividends, an extra earning paid out to shareholders. In this case, the long-term passive investor approach suggests that we reinvest dividends.

9. Implement a plan for regular contributions

Once the investment portfolio is set up, it is important to have

If you have your emergency fund set aside and have cash to invest, statistical probably based on a historical path shows that investing it right away is the best approach. It’s all about Time in the market not timing the market.

If however, you think the emotional rollercoaster is too much for you to handle, then you can split it in smaller sums. This is where Dollar Cost Averaging can benefit you. It prevents procrastination and allows you to not have any regrets about not being in the market.

In essence, dollar-cost averaging (DCA) is an investment strategy whereby you regularly reinvest in an asset at a particular time irrespective of the current price of the asset. By regularly buying the asset over time, you end up purchasing it an averaged price.

DCA is a good way to adopt a long-term approach to investing; it is also the definition of a disciplined investor.

Instead of attempting to time the market – a strategy that does not work – create a plan to regularly invest at a particular period (end of the month, end of the quarter, etc.) and gauge your asset’s value over the long term.

For example, if you choose to invest $1,000 every month, all you need to do is divide the amount in a way that keeps the balance of your portfolio.

10. Automate your approach to investing

Building an investment portfolio from scratch is a challenging exercise.

As detailed in this guide, there are numerous personal, financial

This is where we can help.

Sarwa is a robo advisor that can help you build and automate an investment portfolio that matches your risk tolerance and investment goals.

All you need to do is fill out a questionnaire, and Sarwa will create the right investment portfolio for you.

Sarwa uses a data driven approach to minimize risk and maximize returns, reinvests your dividend earnings, and helps you rebalance your portfolio when needed.

If you are looking for a long-term approach to investing that applies the best practices in the industry to grow your wealth, then Sarwa is the right advisor for you.